Share prices for the embattled wind farm developer Ørsted hit a record low on Monday, following the Trump administration’s decision to block a nearly-completed project off the New England coast.

Ørsted is considering suing the administration to reverse the decision, the company said in a statement, and the Democratic governors of Rhode Island and Connecticut said they would also push for a reversal.

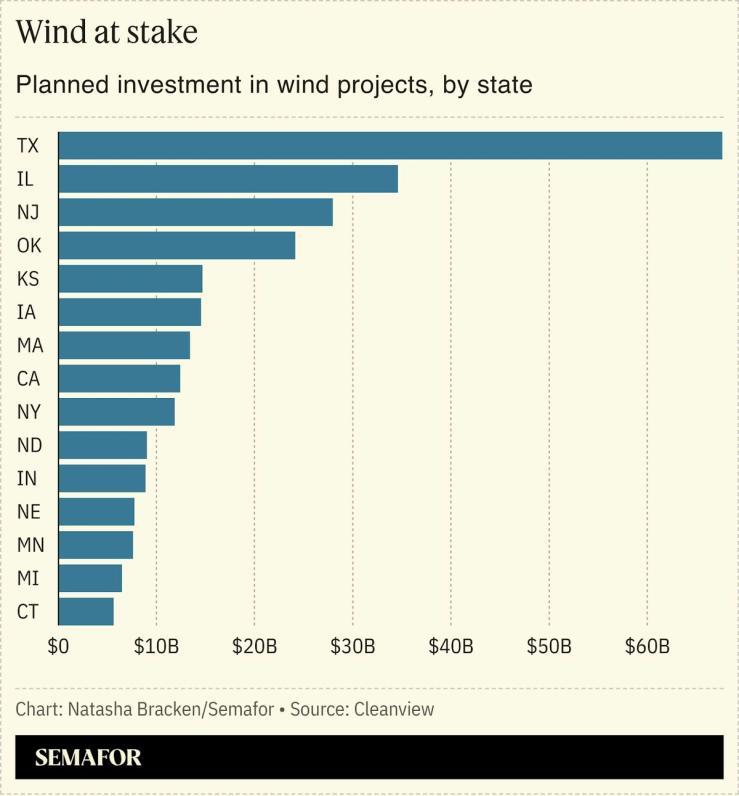

In general, prospects for the US wind industry continue to dim. “The unfortunate message to investors [from the Ørsted cancellation] is clear: the US is no longer a reliable place for long-term energy investments,” American Clean Power Association CEO Jason Grumet said in a statement.

There’s a small silver lining for the industry: Hints that the Federal Reserve may lower interest rates next month gave a boost to share prices for debt-reliant clean energy companies including Sunrun and Bloom Energy. And Ørsted did catch a small break on Tuesday, completing a deal to sell off a portion of a different offshore wind farm in Scotland.