The News

The latest front in Washington’s antitrust crackdown has nothing to do with gouging consumers, monopolizing industries, squeezing vendors, stiffing workers, or any of the other infractions that have caught the eye of the Biden administration’s beefed-up agencies.

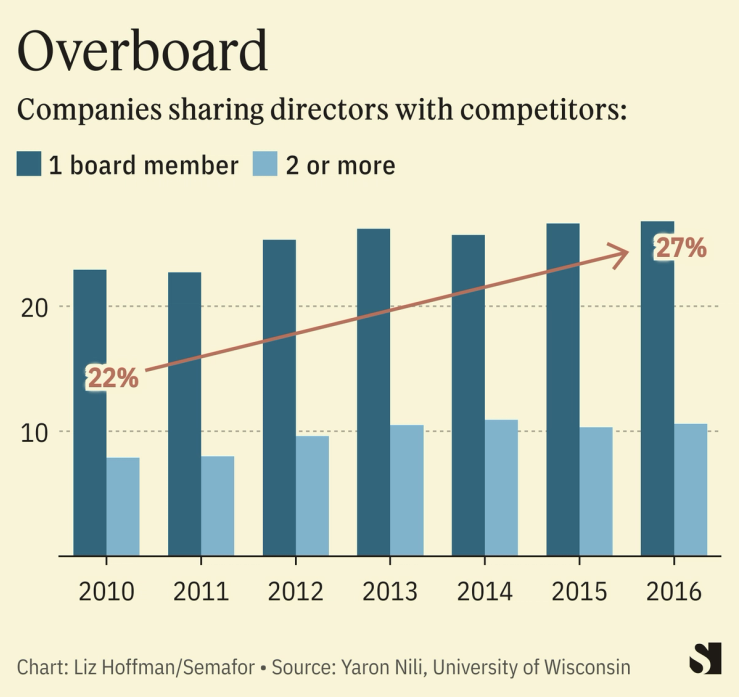

Instead, 15 board members at 11 companies have resigned on the orders of the U.S. Justice Department because they also served on the board of a rival. Many have been private-equity executives who earned their seats through investments.

In an early warning shot, Hollywood superagent Ari Emanuel was forced off the board of concert promoter and ticketer Live Nation in 2021. This week, two directors at Pinterest resigned from the board of Nextdoor, the virtual neighborhood water cooler, under pressure from the DOJ, which deemed both companies to be social networks.

In between, directors at insurers, airlines, and cloud-computing firms have all been forced to choose between their spots in rival boardrooms.

The latest big study found that in 2016, 63% of companies had more than one board member serving at another company in the same industry, and 11% had more than one board member serving at a direct competitor.

Antitrust chief Jonathan Kanter said in March that the DOJ had 17 active investigations into overlapping board postings, which he called “a key driver of concentration for the last forty years.”

“Let me be clear,” he said, “we’re just getting started.”

In this article:

Liz’s view

Board seats are tricky things. You want people who are knowledgeable about the industry but aren’t so cozy that they might, as the DOJ worries, engage in low-grade corporate collusion.

But at what cost? When an activist investor won three seats on Exxon’s board in 2021, its first selling point for its nominees was “energy experience.” Exxon’s boardroom had become a sinecure for former CEOs, including executives from Johnson & Johnson, IBM, and State Street. No sitting director had run an energy company. (Exxon added one in the thick of the fight.)

More recently, the board of Goldman Sachs has been under quiet, grumbling fire for its inaction in the face of growing criticism of CEO David Solomon. The board includes former CEOs of Starbucks, DuPont, and ArcelorMittal, plus a former consultant, U.S. Navy admiral, and mutual-fund executive.

When the bank added a longtime Wall Street executive, Tom Montag, to its board last month, it emphasized his expertise in market risk, a place where Solomon has less experience. Montag’s arrival was delayed while he awaited approval from his former firm, Bank of America, to join a competitor, a person familiar with the matter said.

Room for Disagreement

Consider the overlap in who owns companies, rather than who sits in the boardroom.

Academics have put forward credible arguments that overlapping shareholders create anti-competitive pressures. The shareholder registries of public companies are stacked with the same few names — passive index funds run by BlackRock and Vanguard, and a handful of actively managed mutual funds.

A widely cited 2014 paper blamed common ownership of airlines for between 3% and 5% of rising fares. The concern is that an investor might, in conversations with management, counsel Delta against opening a big hub in Dallas, American Airlines’ home base. (Bloomberg’s Matt Levine asks occasionally, “should mutual funds be illegal?“)

Notable

- “The staggering number of directors” serving on rival boards “could stifle competition and effectively consolidate industries.” — Northwestern University Law Review