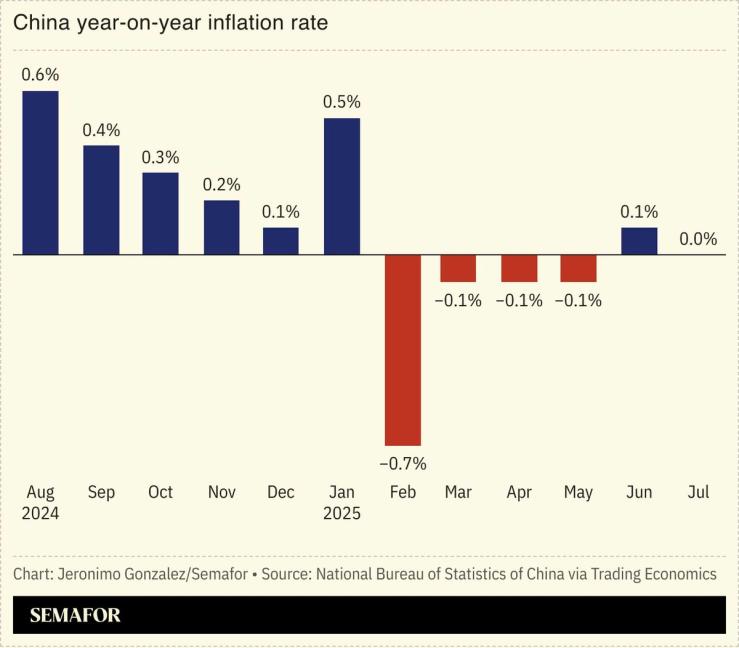

CATL, the world’s biggest battery company, said it would halt production at a mine in China, a move that comes as Beijing vies to crack down on overcapacity in several industries amid deflation fears.

The closure of the eastern Chinese mine — responsible for around 3% of the world’s lithium production — could reshape the market, with prices rising sharply in recent days. Beijing has for decades funneled money into industries it sees as essential for its geopolitical goals, but the debt-fueled spree has led to “involution,” with competitors engaged in a price war that has eroded margins, leaving many struggling. A sudden halt to subsidies could increase already soaring youth unemployment rates, forcing Beijing to keep zombie companies alive.