The Scoop

Big investors including Wisconsin’s state pension fund are banding together to fight Wall Street fees and chip away at the power held by the finance titans that manage their money.

At stake are the billions charged by investors like Ken Griffin and Steve Cohen, whose leverage allows them to set expensive rates. Griffin alone took home more than $4 billion last year thanks in part to the management and performance fees collected by his hedge fund Citadel.

The State of Wisconsin Investment Board overseeing funds of retirees there, a major Texas endowment, and others are founding clients of a new business called Dockside Platforms, which connects them to smaller money managers that charge lower fees and offer more liquidity and transparency.

Dockside’s technology eases the administrative burden of working with more investment partners, creating greater competition for big firms like Citadel. Pension funds and endowments are among the largest investors in hedge funds, funneling nearly $1.5 trillion to them.

Run by former Morgan Stanley executive Michael Jordan, Dockside launched this summer as a unit of Minnesota-based hedge fund Walleye Capital. Dockside declined to comment.

Know More

The largest managers, which oversee dozens of teams investing across different asset classes, have taken over the hedge-fund industry and put up more barriers to pension funds and others looking to invest their money.

At Millennium, Point72, and Citadel, it takes years to get all of your cash out, and fees continue to creep up for the privilege of parking your money there.

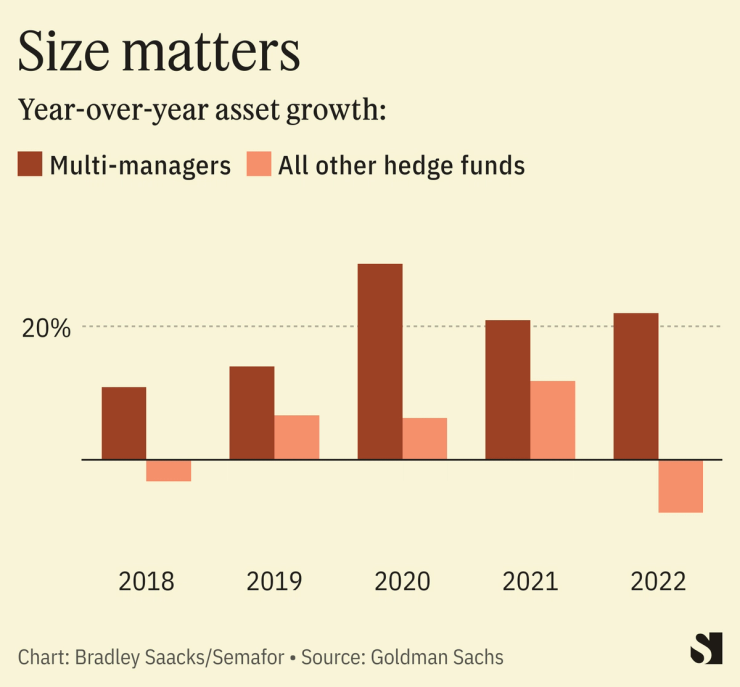

A recent Goldman Sachs review found that these multi-manager funds have grown their assets by roughly 19% annually since 2017. The rest of the hedge fund industry has added just 2.6% by comparison.

Bradley’s view

This is not about replacing Millennium, it’s about pension funds and similar entities having more leverage over the businesses that manage their money. If Dockside makes it that far, it should be considered a success.

Institutions have been fighting with alternative asset managers over fees for decades, but there’s a reason why these mega funds have grown so large.

Replicating them is no small task, even with an unlimited budget. Michael Gelband’s ExodusPoint Capital Management, for example, had all the capital and talent in the world when it launched, but hasn’t yet been able to keep up with the top firms in the hedge fund rat race.

The exorbitant fees pensions and endowments pay Millennium and Citadel make their founders billionaires, but they also pay for the legions of quants and risk analysts that produce steady returns.

Dockside will, in all likelihood, never have the clout of these firms. But it represents a bold move from institutions that don’t want to roll over just because their options are limited.

Room for Disagreement

Smaller hedge funds are more volatile than their larger peers, but perform better on average, research has shown, and managers are often hungrier. As Warren Buffett famously wrote in a 2003 letter to his shareholders, “when one tells you that increased funds won’t hurt his investment performance, step back: his nose is about to grow.”

A nimble portfolio made up of a dozen or more of these firms via Dockside or another managed accounts platform could be a cheaper copy or outperform the biggest funds.

The View From Citadel

The Miami-based asset manager has outperformed peers and the overall market despite its fees, returning more than 38% in its flagship fund last year. A spokesperson for Citadel also pointed out that Griffin and other Citadel employees pay the same fees to invest in their funds.

Notable

- Private market pain has put some institutions in a cash crunch.