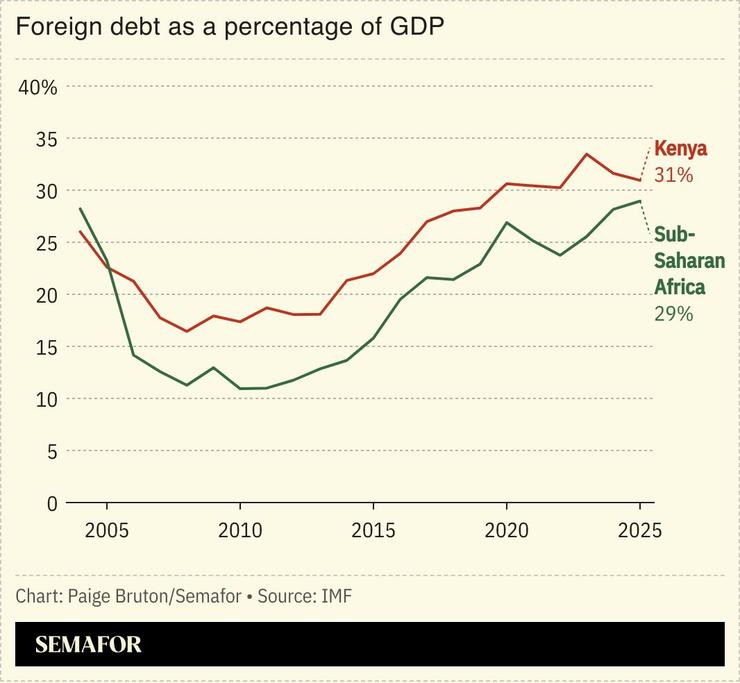

Kenya’s foreign debt burden came under the spotlight in two separate ratings agency reports.

Last week Moody’s said the country’s debt servicing costs would remain stubbornly high as it relies “predominantly on the domestic market to meet its fiscal financing needs.” Approximately two-thirds of Kenya’s financing, just under 4% of its GDP per year, comes from domestic sources, the agency said in a report.

Fitch also flagged the ongoing risks of high public debt, putting Nairobi’s long-term foreign currency issuer default rating at B-. “This higher level of credit risk indicates that the ratings agency believes there is a material default risk for Kenya when it comes to repaying its foreign currency debts,” MarketForces Africa wrote, adding that “a limited margin of safety remains.”

Kenya has so far managed to avoid debt default, but President William Ruto is coming under increasing political pressure with a spate of deadly protests against his administration in recent months.