The News

Investors in large-scale batteries say they dodged a bullet in the budget law signed by US President Donald Trump this month, and are planning for a reinvigorated buildout.

While the One Big Beautiful Bill Act significantly pared back tax incentives for wind, solar, and electric vehicles, energy storage projects can still qualify for Biden-era tax credits as long as they’re under construction before 2034. That’s a positive sign for the stability of an electric grid increasingly swamped by data centers, since batteries are now often the most cost-effective way to get more value out of existing power plants. And it’s a win for the firms investing in new battery projects and manufacturing facilities.

“Storage came out relatively unscathed” from the OBBBA negotiations, said Gabriel Kra, managing director of Prelude Ventures, a climate tech venture capital firm. Prelude was a major backer of two fast-growing battery startups, Form Energy and Redoxblox. A third, Quantumscape, which went public in 2020, has seen its share price triple in the past month after the rollout of a new technology. “We’re very bullish on storage,” Kra said. “It’s a really exciting place to invest right now.”

In this article:

Tim’s view

US power demand is growing at its fastest rate in decades, regardless of any changes in federal policy. So as tax credit cuts make some solutions less palatable, others will have to fill the gap.

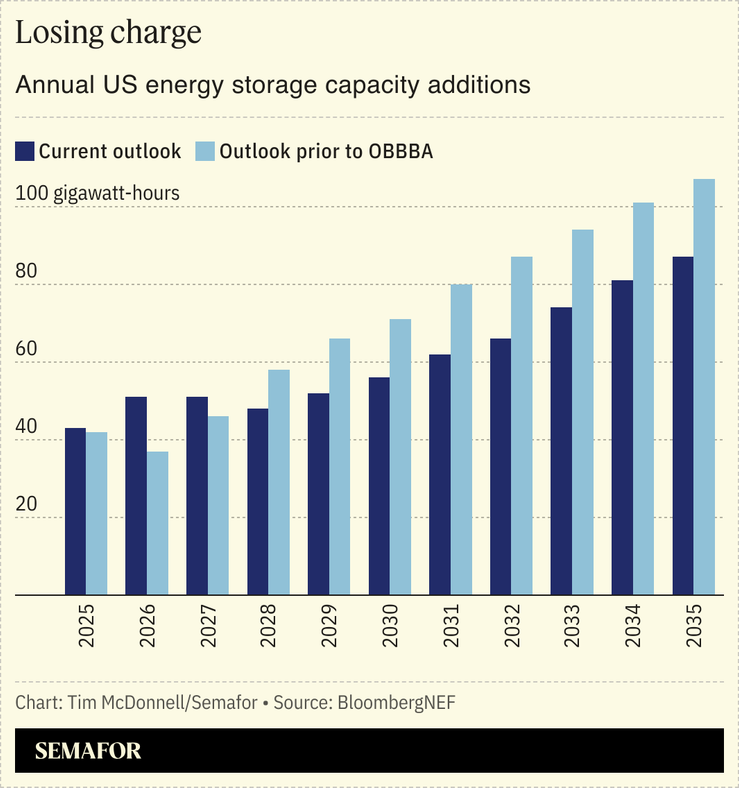

The rapid phaseout of renewable energy tax credits enshrined in the OBBBA is a big setback for that industry: About 23% less solar will be built in the US between now and 2030 than was previously expected, and half as much onshore wind, according to a new BloombergNEF analysis. But that setback works to the advantage of grid-scale batteries: Not only did they keep their tax credits, but if solar becomes less cost-effective, batteries will look all the more attractive to power companies desperate for a way to keep up with demand. A record 15 gigawatts of large-scale energy storage is expected to be installed in the US this year, 25% above 2024 levels, according to Wood Mackenzie.

“At this moment it’s very obvious that if you want to onboard all these big loads, whether it’s data centers or EVs or manufacturing, the fastest and easiest way is batteries,” Jigar Shah, who led the Energy Department’s Loan Programs Office under former US President Joe Biden, told Semafor.

Batteries had a slow start in the US, because in a world with flat growth in power demand, they usually didn’t make economic sense. That calculus changed more in the last two years than in the last twenty, said Pier LaFarge, CEO of Sparkfund, a company that assists utilities in building and accessing batteries and renewables. One reason is the plummeting cost of battery technology, especially as a new generation of domestic manufacturers crops up to compete with China. Another is that growing demand means utilities can’t avoid making major capital investments in new infrastructure; the only question is how to get the most bang for their buck. A billion-dollar investment in storage can do as much to free up more electrons — by making more efficient use of power generation capacity that is usually reserved only for the highest-demand days of the year — as tens of billions invested in a new power plant or major transmission line, LaFarge said.

As for why the battery tax credit survived in the OBBBA, like nuclear and geothermal, which also retained their tax credits, batteries are less of a political lightning rod for Trump and the Republicans than renewables. Batteries also had some important backers in Congress, like Sen. Marsha Blackburn, R-Tenn., whose district has a major new battery factory.

Room for Disagreement

While significantly less affected than renewables and EVs, battery deployment will still take a hit because of the OBBBA, BloombergNEF projects. Even though the main tax credit is preserved, the law imposed tighter restrictions on how much of each battery must be manufactured domestically in order to qualify for a bonus tax reduction. And separately from the OBBBA, the Trump administration’s tariffs and trade antagonism with China are making it harder for US companies to import critical battery minerals, components, and manufacturing equipment.

Notable

- Following a large fire at a grid-scale battery facility in California in January, local activist opposition to new energy storage projects is growing, Heatmap reported.