Ratings agency S&P Global downgraded Senegal over the country’s growing debt burden, as borrowers on the continent increasingly face questions over their creditworthiness.

Senegal’s finance ministry, in its response, said officials were recalculating the country’s GDP using an updated base year, a move that could improve its debt metrics.

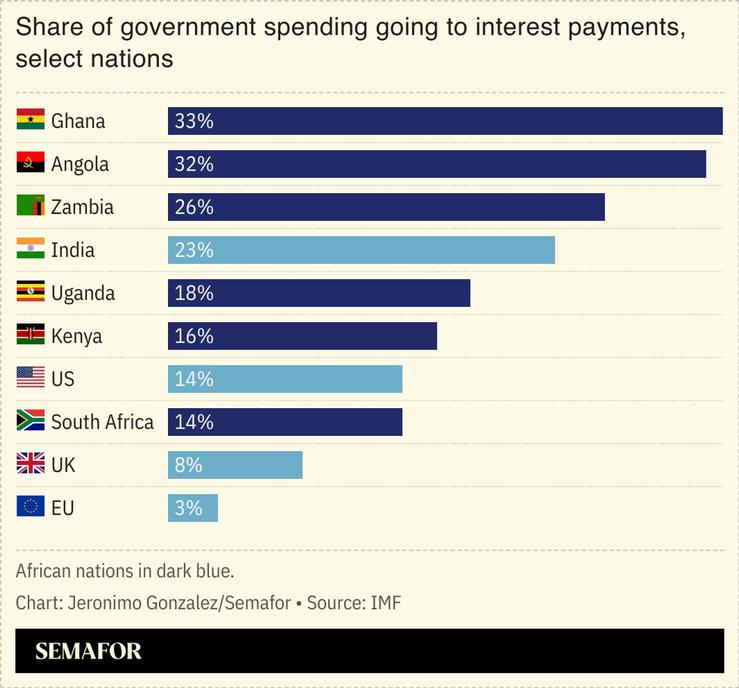

S&P’s decision comes just a month after Fitch downgraded the African Export-Import Bank, a decision that has reverberated across the continent. Debt levels for countries including Mozambique, Senegal, and South Africa have reached a critical level, with debt as a share of GDP approaching that of wealthy nations. Meanwhile interest rates remain persistently high, forcing some African nations to cut spending, fueling social unrest.

Between global uncertainty, tighter financial conditions, and higher borrowing costs, debt concerns across sub-Saharan Africa “are mounting,” the IMF said last week.