The Scene

Rising interest rates and declining office occupancy have been a double whammy for the commercial real estate market. As Liz wrote earlier this year, the crunch is the “big-money version of what happened in 2008,” where landlords can’t find tenants or pay back their lenders.

Cadre, a fintech company bringing real-estate investing to the masses, has seen its once high-flying valuation of $800 million fall to a fraction of that as it tries to raise new funds. It was co-founded in 2016 by Jared Kushner, with the backing of investors including Andreessen Horowitz, Thrive Capital, Founders Fund, Jack Ma, and George Soros.

But Cadre CEO Ryan Williams sees some bright spots amid the distress, including opportunities from regional banking’s “paralysis.” This conversation has been edited for length and clarity.

The View From Ryan Williams

Bradley: Where is real estate as an asset class right now?

Ryan: This is probably going to be one of the best vintages of private real estate in the last 20 years, especially for buyers with discretionary capital. There’s a lot of different stress points in the system, but there’s nothing that I believe will take out the whole industry like you saw in 2009. There’s more money than has ever been on the sidelines keeping things kind of propped up.

Q: It’s not all roses though. Who’s in trouble?

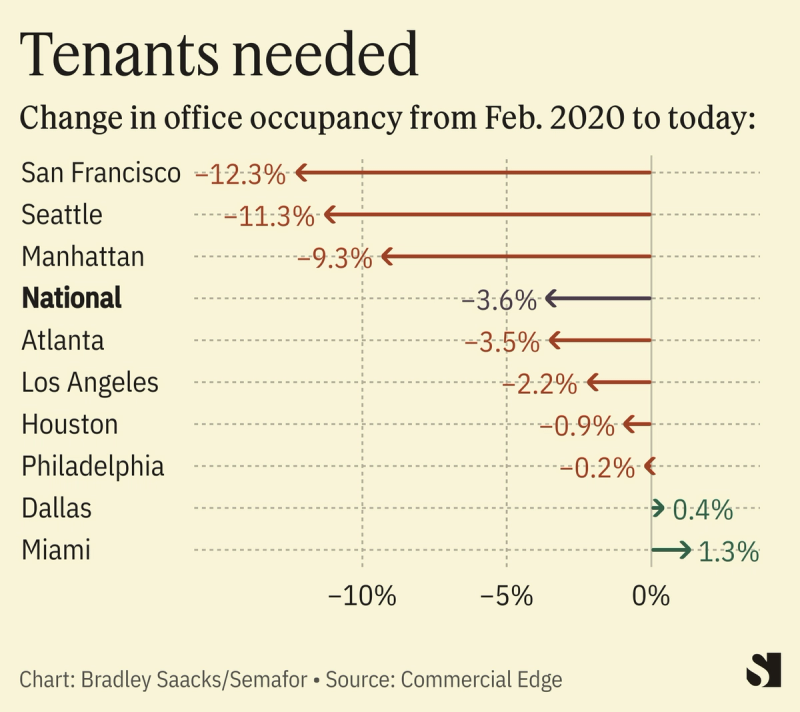

A: The sectors that are the most challenged, and will be the most challenging at least for the next few years, are office — which is no surprise — retail, and then business-oriented hotels. Those are the spaces where there has to be a fundamental repricing. Office would probably be a 40, maybe 50% discount. The top 5% of office buildings will be resilient and still able to select tenants.

For the bottom 95%, people are going to have to figure out how to reposition those buildings. They’re going to have to figure out how to rezone, convert, or they’re just going to have to be willing to sell at a pretty significant loss. The most bleak side of the real estate picture is office.

Q: What about retail?

A: Indoor shopping malls are not the only option for people, so I think that part of the retail market is going to see a lot of distress. But the flip side is one of the most interesting investment opportunities: strip malls. With inflation where it is, people are reverting back to going to grocery centers, and a lot of these retail businesses have some pretty strong in-store sales. You can buy these retail strip centers at really, really attractive prices, like mid-teens cap rates.

Q: You mentioned business hotels as the last area of concern. Do you not see business travel returning to pre-pandemic levels?

A: When push comes to shove, people are choosing to do a Zoom for an introductory meeting versus flying halfway across the world. These hotels that were catered towards those visitors are struggling significantly. Some will have to rezone or reposition, whether it’s to multifamily, more boutique hotel brands. It doesn’t sound great, but when you look at the other side of the spectrum, which is multifamily, industrial, self-storage, student housing, all of those sectors are really strong. It is the tale of two cities in the real estate space.

Q: Lenders that fuel the real estate industry, especially regional ones, are in crisis. Where does that leave the sector?

A: I spoke to hundreds of CEOs of regional banks a couple weeks ago, and it was just so amazing that they were only worried about whether the Fed was going to increase rates or not. Otherwise, they aren’t making a ton of new loans, they’re focusing on managing their existing portfolios, they’re helping people who may have loans coming due soon and need to figure out how to refinance them.

When there’s that sort of paralysis in the banking system, people then tend to look for alternative sources of financing. If you’re an investor today, and you can offer preferred equity, or you can often offer common equity at a higher price, you can make a lot of money and take on relatively limited risk because there’s a gap in the market on the financing side despite some strong fundamentals in some of these sectors.

We like investing in the mid-cap real estate niche, because that’s where, by and large, regional banks tend to lend. That’s why we’re focused on playing offense and still focused on investing, despite some of the hysteria you might hear that overgeneralizes real estate as only commercial real estate.

Q: Surely there are geographies that still make sense for even the most distressed sectors.

A: You can’t get a loan for an office building today. The 5% I mentioned are the people that actually are able to sustain occupancy over 80% consistently, everybody else is struggling — you get to 60%, you’re working miracles. Newer buildings help, but industry makeup of tenants is most important. Financial services, law, and increasingly technology. They’re in the client services business, so they always have to be on, they always have to be available and accessible.

Their buildings tend to be disproportionately represented in that top 5%. Geographically, it’s big cities like New York and increasingly Chicago, but most prevalent in the top 5% is the Sunbelt. The nicest office buildings in Miami are 100% occupied. Nice office buildings in Dallas are 90-plus% occupied, in Nashville, it’s 95%.

Q: And everyone else is going to have to look at their portfolios and pick winners and losers?

A: They’re going to have to start saying ‘I’m not going to help this borrower refinance’ and instead spend time focusing on the top 70, 80% of their portfolio, because they’re in markets they like or have really good tenants. The knock-on effects are that very little new financing will happen. I don’t think you’ll see a new office building that is outside the Sun Belt built in the next five years.

Lenders are so skittish on office that it’s going to take some real time for people to readjust how they think about occupancy and underwriting.

In the next six months, in almost every asset class, there’ll be very little new building and development. For what has been built or is in progress, people are either trying to restructure or, in some cases, sell the land at a fraction of the cost.