Japan’s financial sector faces its biggest shakeup in decades thanks to an end to zero interest rates and an imminent wave of inheritances.

About half of Japan’s household wealth is kept in cash or current accounts, because for years savings have made no money. That is changing as interest rates rise, forcing banks to compete on savings offers.

Meanwhile, about 14% of Japan’s rapidly aging population will die by 2035, creating an “inheritance avalanche,” the Financial Times’ Asia business columnist wrote.

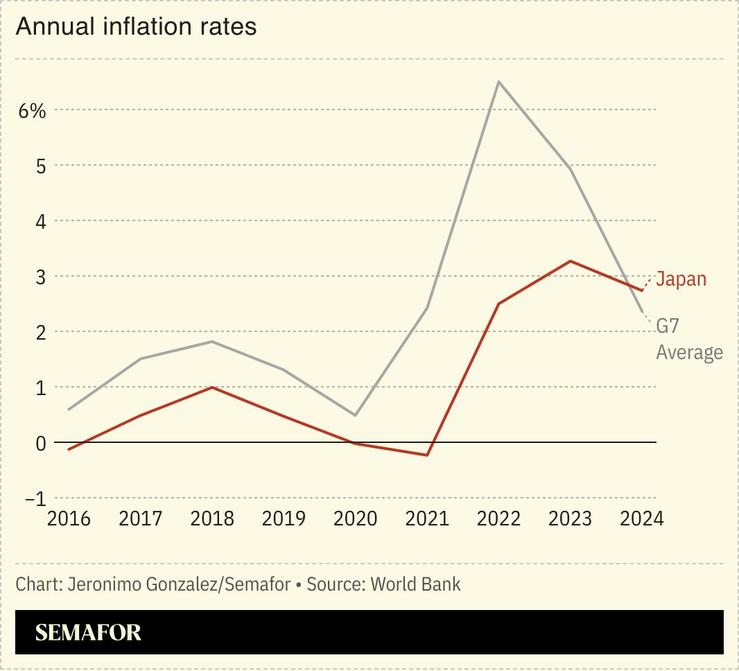

The two factors are forcing an end to decades of inertia in markets, with investors turning to US stocks and bank deposit rates soaring, and persuading ordinary Japanese — “Mrs Watanabe” — to think about returns after decades of not bothering.