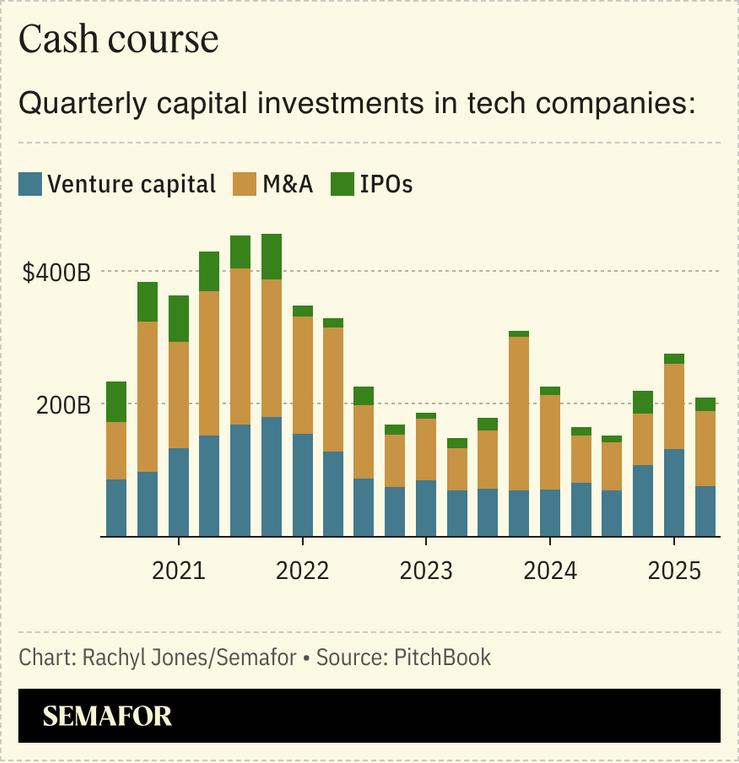

The tech industry is attracting even more investment after it saw an uptick in year-over-year capital infusions in the second quarter, representing 40% of all venture funding, M&A, and IPOs globally, data compiled through PitchBook shows. The $200 billion raised in the second quarter, which follow an increase in the first quarter, is helping the industry recover from a two-year slump driven by high borrowing costs, macroeconomic uncertainty, and a sharp correction from inflated COVID-era valuations and hiring practices.

Demand for AI and supporting infrastructure is fueling this renewed dealmaking, but investors remain concerned about ongoing inflation pressures and geopolitical risks.

Capital One led the investments with its $35 billion acquisition of Discover (included because of its fintech business), followed by Meta’s $14 billion investment in Scale AI, Salesforce’s $8 billion acquisition of Informatica, and the $6.5 billion OpenAI spent on Jony Ive and his io devices company. Crypto firm Circle boasted the largest IPO of the quarter, raising more than $1 billion.