The US Federal Reserve held interest rates steady today as it weighs the broader fallout from Washington’s trade war and a burgeoning conflict in the Middle East.

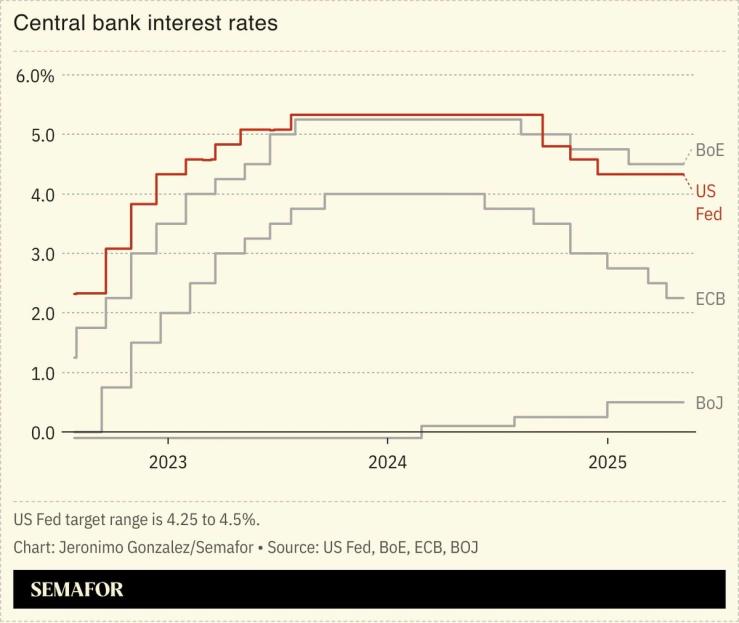

The central bank’s balancing act is a difficult one: Whereas many of its counterparts worldwide are embarking on a rate-cutting path to ward off slowing growth and rising prices as a result of American protectionism, economists expect US growth to slow but inflation to quicken, a combination that leaves no clear path for monetary policy.

Though price rises in the US have so far been mild, inflation expectations — simply, the belief that prices may increase — are a worry, and often cause real-world inflation, The Wall Street Journal’s chief economics correspondent noted.