The Scene

Traditional investors have yet to pour into cryptocurrencies six months after the US Securities and Exchange Commission approved bitcoin exchange-trade funds. Greg Tusar, who runs Coinbase’s trading business aimed at institutional investors, thinks he can get pensions and hedge funds there.

The View From Greg Tusar

Liz Hoffman: I understand the appeal of crypto to retail. Why would a pension fund or an endowment want it?

Greg Tusar: At the end of the first quarter, we had $170 billion of total institutional assets in our custodian. Thirty-three of the top 100 hedge funds are our clients and directly own crypto on our platform. The state of Wisconsin is one of the largest holders of [BlackRock’s Bitcoin ETF]. The next group that’s coming is the quant community. These assets can be traded in a way that looks and feels enough like prime brokerage at a traditional bank that it’s possible to bring over some of those quantitative strategies.

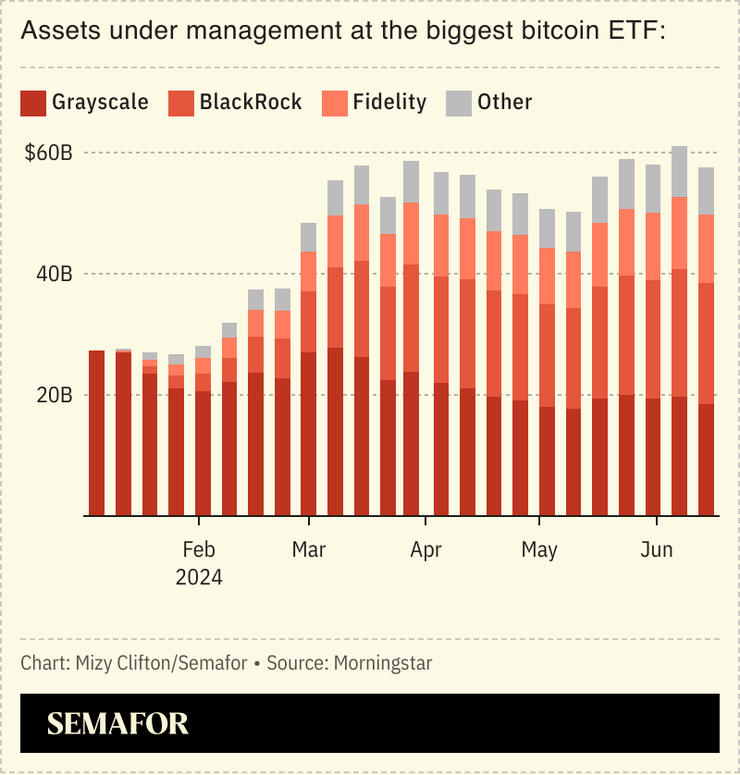

Six months after bitcoin ETFs got approved, where are we? After an initial rush, total assets haven’t grown meaningfully.

The ETF has been a great catalyst. It’s brought more interest into the space. Inflows did slow, and that’s probably a good thing, for the market to digest. But it has picked up again recently, and I think that’s due to the approval of ethereum ETFs.

We bought a small asset manager last year and the reason we’re excited about the asset management side of the business is that it feels very young today. It has largely meant venture or ETFs and we think there’s a lot of room for actively managed strategies, structured products with a floor, a cap, those sorts of things.

Can I borrow against my bitcoins to buy more bitcoins? That’s a pretty core feature of prime brokerage.

As a retail customer, no. For institutional investors, if somebody has bitcoin and wants to borrow dollars, we’ll do a collateralized loan. We’ve distinguished ourselves from a risk management perspective relative to some who have come and gone who didn’t do that.

And if you want to be long bitcoin and short ethereum, we have a risk model that suggests what the appropriate haircuts are in the same way that if you were long Pepsi and short Coca Cola.

What about indexes?

None have established themselves yet. I would put that in the watch-this-space category. You need good asset selection that filters out undesirable [tokens]. So if you just go purely based on market cap weighting, you would probably catch a lot of things that you might not want to include.

Doesn’t the fact that market cap is a bad indicator of quality suggest some real problems in the market? That the popular stuff is garbage?

There are going to be GameStops in crypto. There’s nothing we can do about it. People should have the ability to buy and sell things that they want. But with an index, you’re selecting those on behalf of the user. It’s really no different than having an S&P 500 index committee.

But I think the primary reason is we don’t have indexes today is regulatory clarity around what is or isn’t a security. That’s why we’re fighting so hard for regulatory clarity. The passage of FIT21 in the House, the approval of the Ethereum ETF, put together it’s an indication that as a country, we’re moving in the direction of embracing crypto.

Why is that a good thing? Bitcoin has turned out not to be a great store of value or useful in payments. If it’s just a commodity now, why is it better than, I don’t know, soybeans?

There are commodities use cases, there are stablecoin use cases, there are utility use cases and securities use cases. But none of those things can happen inside of the US without clear rules of the road.