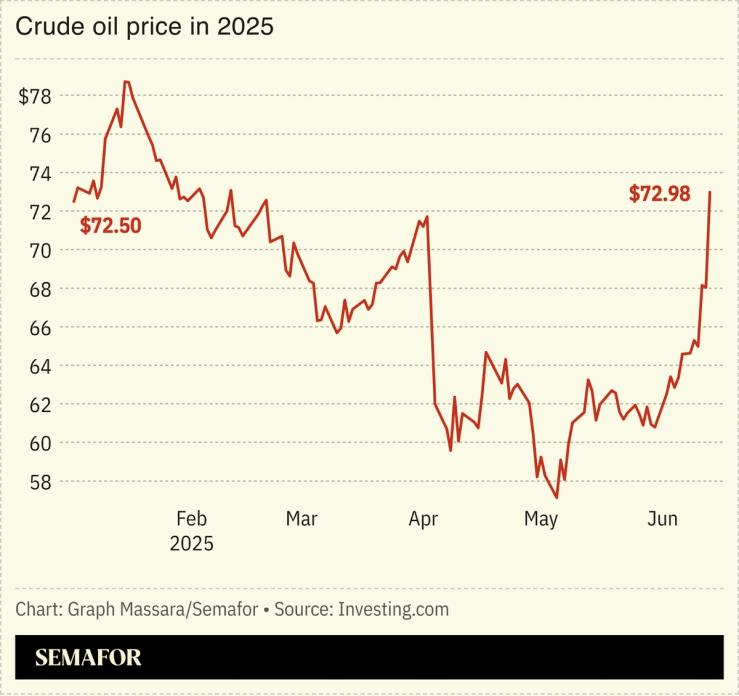

Oil prices surged along with safe-haven assets like gold and the US dollar, as markets reeled amid the Israel-Iran conflict.

Middle East stocks largely fell on Sunday, and analysts expect other world markets to slide Monday over fears that rising oil prices will cause global economic disruption and lead to stagflation.

A worst-case scenario is a complete disruption to the Iranian supply and the closure of the Strait of Hormuz.

Investors, already grappling with heightened geopolitical risk as traditional security and trade alliances falter, should brace for more uncertainty, experts told Bloomberg.

Volatility is here to stay and markets have not adjusted for the geopolitics question marks yet,” one analyst said.