The News

LAGOS — The move by British drinks maker Diageo to sell its majority stake in Guinness Nigeria this week renewed fears that more Western conglomerates will flee Africa’s most populous country as inflationary pressure continues to cut consumer spending power.

Diageo will sell its 58% stake in Guinness Nigeria to Singaporean group Tolaram for about $70 million but will retain ownership of the Guinness brand. The sale follows a need for “a flexible and asset-light beer operating model,” Diageo said on Tuesday.

It will continue to lead marketing strategy for Guinness Nigeria’s non-alcoholic malt drinks, alcoholic sodas, and beers including the flagship brand Guinness Stout, which has been sold in Nigeria for more than 70 years.

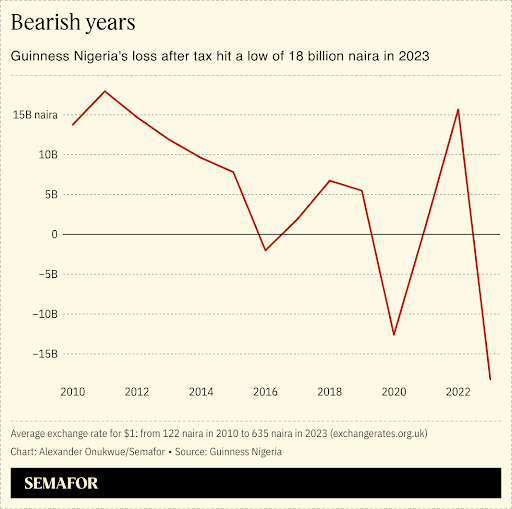

The deal comes on the back of the Nigerian company’s recent bumpy performance in the last decade as the naira weakened sharply against the dollar. Guinness Nigeria’s loss after tax exceeded 18 billion naira (about $28 million) last year. A decade ago, its profit of 9.5 billion naira was worth over $58 million.

An inflation rate jump from 22% to 33% in the past year has crushed Nigerian incomes as many struggle to keep up with the sharp rises in prices of food and medicines.

Beer makers have upped prices multiple times this year but still wrestle with rising costs. Nigerian Breweries, owned by Dutch beer maker Heineken, suspended production and laid off staff at two of its nine plants in April citing a “tough business landscape” following a $93 million loss last year.

In this article:

Alexander’s view

Diageo joins the list of foreign companies now fleeing Nigeria after riding past waves of uncertainty during their decades-long presence in the country. “Calling it quits now indicates the current situation is so challenging that investors would rather take a break,” Ikemesit Effiong, partner at the SBM Intelligence consultancy in Lagos, told me.

The roll call so far has featured British multinationals Unilever, and GSK; Ohio-based consumer goods major Procter & Gamble, and French pharmaceuticals company Sanofi. Kimberly-Clark, the American maker of Huggies diapers, shut down its $100 million production plant in Lagos and dismissed nearly all its staff this month, two years after it was reopened with the promise of creating 6,000 jobs.

These companies’ pullback reflects the Nigerian consumer’s struggles in a volatile economy. It also echoes a general low confidence in a country whose near term growth prospects, according to IMF and African Development Bank forecasts, is not among the most promising in Africa.

Nigeria’s attempts at stability have included interest rate hikes and weekly dollar sales to licensed vendors. But the inflation trajectory over the past year suggests that manufacturer’s sales efforts will continue to be undermined by the economy’s structural weaknesses — from a national insecurity crisis that hinders productive agriculture, to oil theft that constrains sufficient dollar earnings.

Beyond these, a program to upgrade port, power, road, rail and internet infrastructure in industrial clusters “will go a long way in helping multinationals manage their capital cost challenges,” Effiong said.

Know More

Diageo had been reviewing its Nigeria strategy over the past year before this sale.

It said last October that it would end a 2016 agreement that allowed Guinness Nigeria to import its spirits — notably Johnnie Walker, Baileys, and Singleton — into the country. The move was necessary to shore up against “the negative impacts of lingering foreign exchange scarcity and exchange rate volatility,” the company said at the time. Nigeria’s currency has depreciated more than 60% since last June when President Bola Tinubu effectively floated it.

Initially slated to happen this April, that separation will now happen in the 2025 financial year with Tolaram at the helm of Guinness Nigeria. Tolaram operates multiple joint ventures that produce noodles, milk and cooking oil amongst other consumer goods in Nigeria. A 90-hectare, $1.5 billion deep sea port in the Lekki area of Lagos that it co-owns with the state government opened in 2023.

The Guinness purchase furthers Tolaram’s diversification and interest in building a “strong presence and heritage” in Nigeria, group chief executive Sajen Aswani said.

Diageo’s business in Nigeria going forward will be through the import of its spirits by a new affiliate. Nigeria will be “one of the main operational hubs” of the company, Diageo said.

Room for Disagreement

Diageo’s Nigeria withdrawal mirrors its decisions in other African markets, said Bayo Onanuga, the Nigerian president’s special adviser on information and strategy.

The company is “merely following the business practice it has executed” in countries like Cameroon and Ethiopia where local operations have been sold to other companies, Onanuga said. Diageo sold Guinness Cameroon to French brewer Castel for £389m ($460 million) in 2022,

Tinubu praised Tolaram for “having absolute faith” in Nigeria’s economy, promising that his reforms will produce “enduring profitability” for the company and other investors in the country.