The Scene

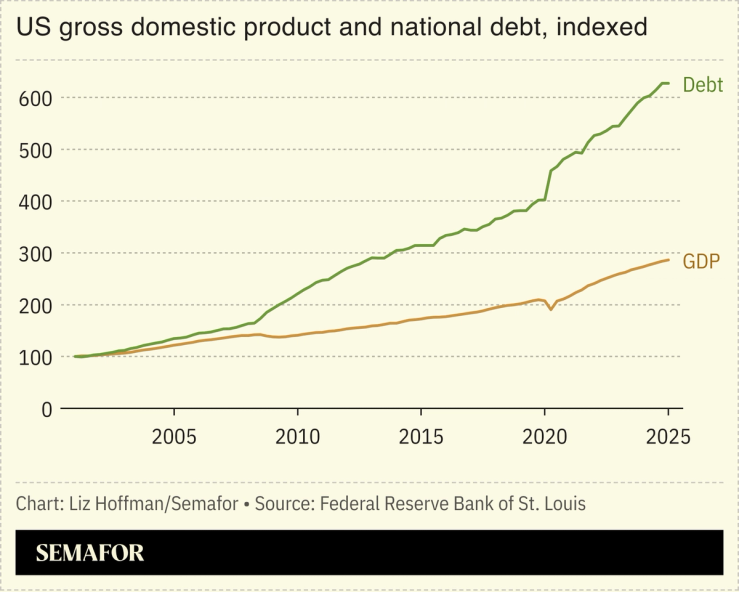

“There are five ways out,” David Rubenstein told me in Washington this week, ticking through America’s options to deal with its $37-trillion-and-rising national debt.

The Carlyle co-founder was a debt hawk before it was fashionable, sounding the alarm in the post-2008 days of free money and Barack Obama’s technocratic optimism. The political center has shifted Rubenstein’s way with startling speed over the past 18 months.

“One, you cut spending, but no one wants to do that. Two, you increase taxes, and we don’t like to do that. Three, you can go to the IMF for a bailout,” at which point I realize we’re entering strange territory. “Four, you can say [to your creditors] ‘Look, we’re sorry’ and default.” Uh oh.

The fifth option — and the only one that anyone seems to want to talk about — is for the economy to grow its way out of the hole. It’s a bet that a combination of AI, tax cuts, AI, energy independence, and AI will unleash productivity gains not seen since the 19th century and let America’s earnings catch up with its borrowings. It’s first-year business-school math: how much debt a company carries relative to how much money it makes. When that ratio gets too high, as America’s is now, you can either decrease the numerator or raise the denominator.

But big economies grow slowly. “We’re talking about a $28 trillion economy,” Rubenstein said. “Can you grow it at 5% or 6%?” Excluding the pandemic snapback, the US economy hasn’t strung together consecutive quarters of annualized 4% growth since 1999, when the economy was less than half the size it is now and deep into a stock market bubble.

The Trump administration economic advisers are annoyed at this line of reasoning. They say a 3% growth rate — one pillar of Treasury Secretary Scott Bessent’s 3-3-3 plan — is more than sufficient to shrink the debt over time. Maybe because of Silicon Valley’s influence on the White House, they’re more bullish on AI and more likely to see it ushering in a “fourth industrial revolution.”

In this article:

Liz’s view

I’m not an economist, or Semafor’s AI expert. I’m only pointing out that even Trump’s critics and allies seem to agree that the US’s best shot to defuse a debt bomb is what overleveraged private-equity portfolio companies will say this year when creditors come knocking: AI, trust us.

Notable

- Economists say prices haven’t yet risen because companies stockpiled inventories ahead of Trump’s tariffs. But those looking for evidence of a tariff-wrecked economy will have to keep waiting.