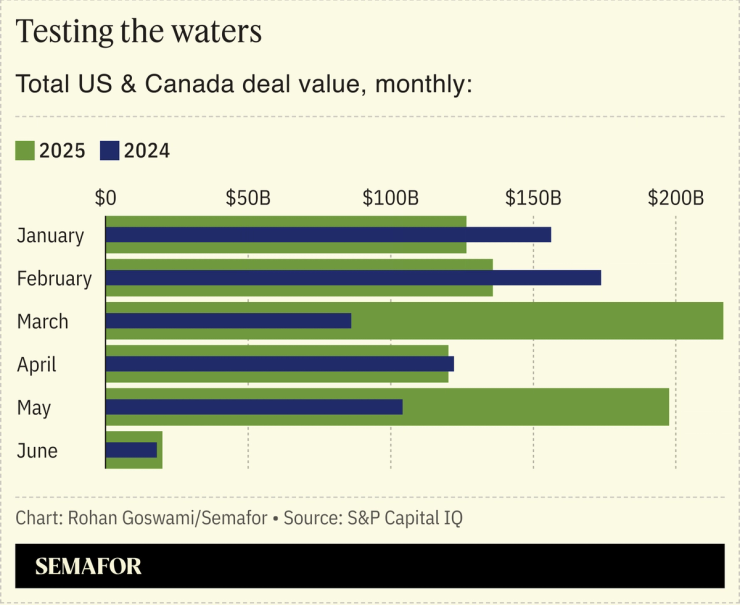

Wall Street’s animal spirits are poking their heads out, but not far.

A flurry of mergers have spurred cautious optimism among dealmakers who had been steeling for a dull year and slim bonuses. But recent transactions fall roughly into two camps, neither brimming with nerve: tuck-in deals where sellers are willing to swallow a valuation cut, and deals between counterparties that know each other well.

Salesforce is buying Informatica for $2 billion less than the two companies discussed last year, according to The Wall Street Journal, while ServiceNow struck a $2.9 billion deal for an AI assistant that was valued at $2.1 billion four years ago. One of the biggest deals this quarter was a $19 billion merger of equals between two industrial-process businesses, announced yesterday. We “have worked together for many years,” Flowserve CEO R. Scott Rowe said of the transaction. It’s a similar story at Dicks’, which struck a $2.4 billion deal for longtime competitor Foot Locker.

Several long-awaited IPOs have launched to warm receptions. Circle’s debut Thursday shows that bankers, if anything, are underestimating investor demand for the right kind of businesses: long-established and in favor with the government (Profitability helps, but isn’t crucial: CoreWeave shares are up 240% since IPO.)

Whether regulators will encourage these tentative steps is an open question. HPE’s $14 billion acquisition of Juniper remains up in the air, and the populist tendencies of the Trump administration are most visible in its skeptical approach to corporate power and consolidation.