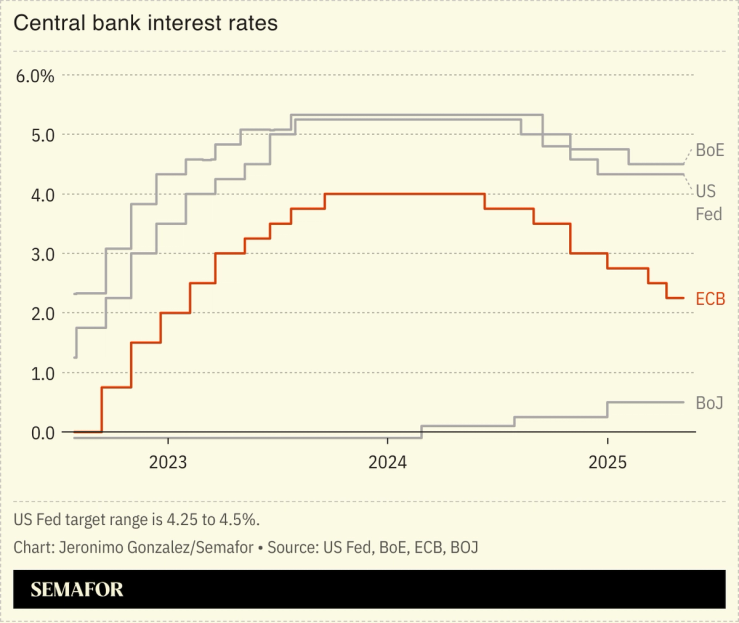

The European Central Bank cut interest rates for the eighth time in the past year on Thursday, lowering borrowing costs to 2%.

The quarter-percentage-point cut comes in response to slowing eurozone inflation, in part owing to US trade restrictions, but analysts are divided on whether the central bank will further reduce borrowing costs. The ECB’s growth forecast for 2025 remains unchanged, signaling expectations of steady if modest economic expansion.

Particularly intriguing is the future of its boss: ECB chief Christine Lagarde has discussed cutting her term short in order to replace Klaus Schwab as the head of the World Economic Forum, WEF’s founder told the Financial Times last week. “Any move by Lagarde to accelerate her departure… could trigger a succession race,” the FT noted.