The News

The overwhelming rejection of shareholder proposals urging ExxonMobil and Chevron to better report and reduce their carbon emissions capped off a dismal run for climate activists.

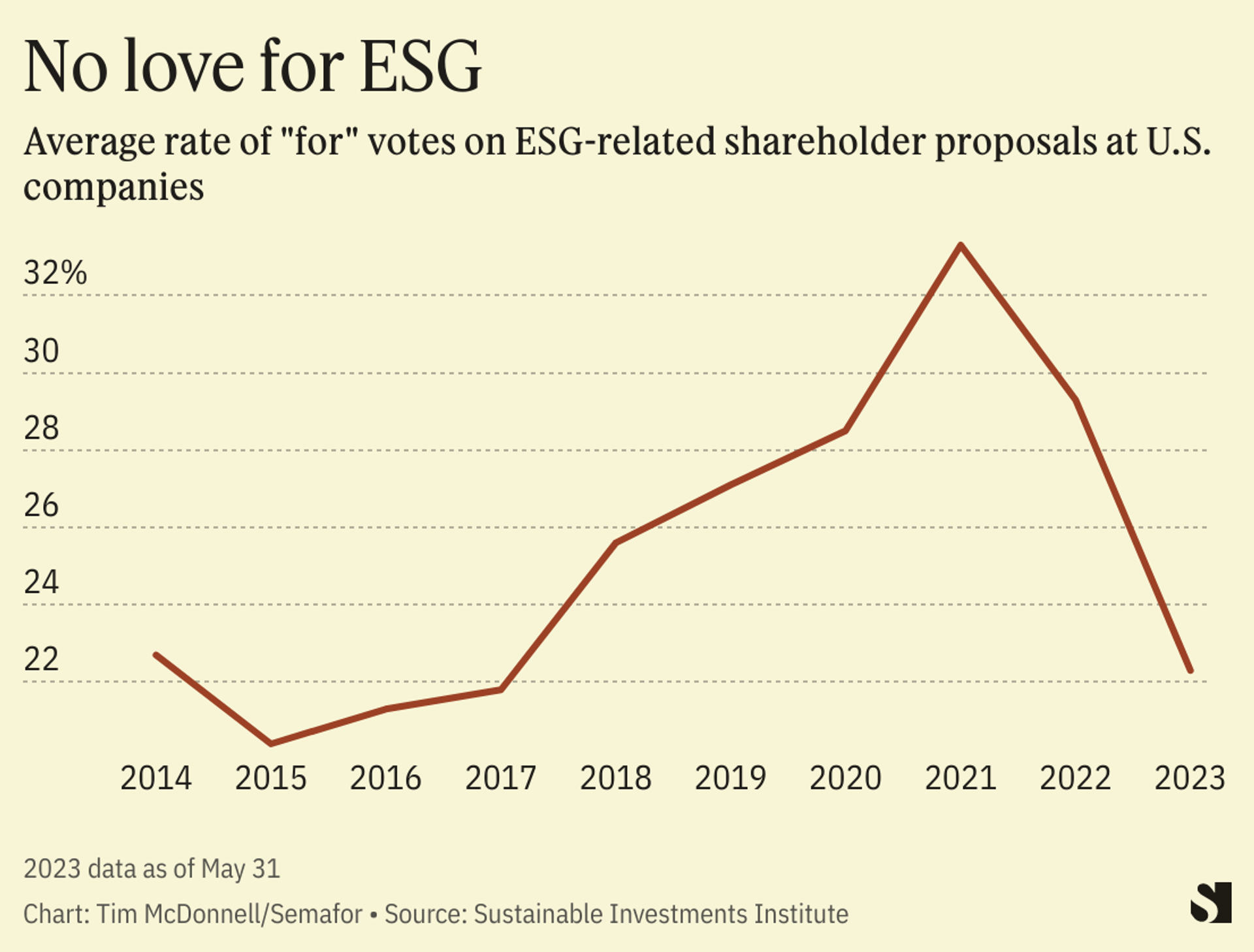

Of the dozens of proposals put forward at annual shareholder meetings of U.S. banks, insurers, and oil and gas companies over the last month, only one received majority support, the worst showing for ESG-related proposals since 2017.

Tim’s view

A few things went wrong for climate activist shareholders this year, and they point to possible paths toward future success.

First, energy market conditions are undermining the short-term business case for ditching fossil fuels. As the West shunned Russian oil and gas, last year was the most profitable ever for U.S. and European producers. The campaign in 2020 by activist hedge fund Engine No. 1 to replace some Exxon board members with more climate-friendly alternatives was successful largely because the company was in a poor financial state, making big asset managers like BlackRock more amenable to finding common cause with climate activists. That’s no longer the case — for now.

At the same time, many climate-related proposals are becoming more pointed in what they ask of companies, shifting from a focus on emissions disclosure to demanding more specific plans to phase out the production or financing of fossil fuels. Those calls are still alienating most investors. (Starting last year, the Securities and Exchange Commission narrowed the conditions under which companies can preemptively reject shareholder proposals. That means more of them are reaching a vote.)

Another factor is the push by legislators and attorneys general in Republican-controlled states to penalize what they perceive as “woke” ESG investment practices by asset managers. The anti-ESG movement has asset managers apprehensive about supporting climate resolutions, said Heidi Welsh, executive director of the Sustainable Investments Institute, a nonprofit research organization in Washington. It effectively forces them to weigh the reputational risk of a subpoena against the longer-term financial risks of climate change and the wishes of clients like New York City’s pension funds and others who are threatening to pull billions of dollars from their managers if they vote against ESG measures.

“What started last year and is in full bloom this year is that the anti-ESG contagion has infected the proxy voting season,” Welsh said.

Activists have a few options on how to revise their strategy, said Paul Rissman, who sits on the board of directors of the Sierra Club Foundation, which filed several resolutions at financial institutions. One is for pension funds or other investors to file lawsuits accusing asset managers of breaching their fiduciary duty to clients by ignoring climate risks. That strategy hasn’t been tried yet in the U.S., but was successful in a 2020 case in Australia. Another option is to quit bluffing and take money away from recalcitrant managers, like the U.K.’s largest pension fund did last year when it shifted $6.3 billion from BlackRock into a climate-focused fund managed by Legal & General.

A third strategy: Change nothing, and continue beating the same drum until it becomes too loud for companies to ignore.

Quotable

“There are some on the activist side who have now become discouraged and are saying, ‘Engagement doesn’t work, so let’s go back to gluing ourselves to things.’ But it’s a very fluid situation, and climate change is the one constant. This is not the end of shareholder engagement as a tactic.” — Paul Rissman

Room for Disagreement

If the news from the proxy voting season appears grim, it is unfolding in a context in which a rapidly rising number of companies are proactively setting net zero targets. Thomas Peterson, climate coordinator at the activist investor group As You Sow, said that when filing shareholder resolutions the group targets companies that are laggards in their sector. “Those companies are getting harder to find,” he said. “That’s a good thing. The low-hanging fruit is gone.”

The View From The Anti-ESG Movement

This year also saw a record number of anti-ESG proposals, which mostly aimed to roll back companies’ workplace diversity initiatives. The number of such proposals nearly doubled this year from last year, up to about 80, most filed by the National Center for Public Policy Research, a conservative think tank that counts Exxon as one of its top donors. Yet support for these measures was even lower than for climate resolutions, averaging less than 3% in favor, according to Welsh. The lesson is that while investors may be wary of standing up for ESG, they’re even less willing to attack it, given the reputation and financial risks.

Notable

- Climate resolutions fared better across the Atlantic. Compared to last year, shareholders of the top European oil and gas companies stepped up their support for measures at TotalEnergies, Shell, and BP asking the companies to cut emissions faster.