The News

Japanese automakers are betting on hybrid vehicles — not electric. The tactic is a contrast to China, which continues to build its EV output, and to the United States, which has seen falling EV sales despite investment and government backing.

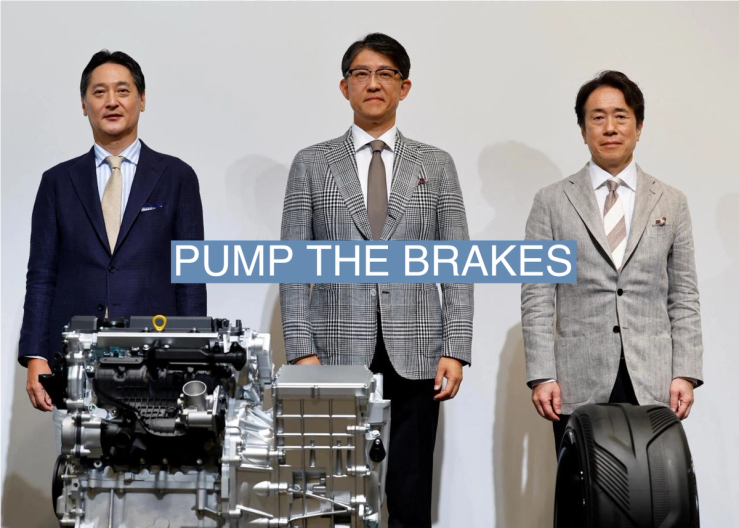

In a rare joint appearance, the heads of Toyota, Mazda, and Subaru pledged to invest in efficient combustion technology and unveiled new hybrid engine prototypes, including one that runs on hydrogen fuel cells. Toyota’s CEO Koji Sato said hybrids will have a “new role” for consumers who are dissatisfied with high EV prices and the lack of charging infrastructure.

Despite the growing interest in EVs as a green transport solution, hybrid vehicles are cheaper and easier to produce.

SIGNALS

Japanese automakers are resistant to electric transition

Traditional automakers have lobbied extensively against policies meant to boost EV sales, and Japanese automakers like Toyota are among the most vocally opposed to the EV transition, according to Influence Map, a climate and business think-tank. Aside from Tesla, only Mercedes-Benz and BMW are forecasted to produce enough EVs by 2030 to make a difference in global decarbonization efforts, while “Japanese automakers are the least prepared,” and “engaging the hardest against it,” the report found. The Japanese government, meanwhile, is investing heavily in next-generation EV batteries to compete with China, Semafor previously reported.

Washington’s protectionism could boost Japanese EVs

High US tariffs on Chinese EVs and parts essentially eliminate them from the American market, giving Japanese automakers an advantage to fill the gap, columnist Tim Culpan wrote for Bloomberg. Japanese automakers Subaru, Toyota, Nissan, and Mitsubishi already have extensive production facilities scattered across Mexico, the US, and Canada, giving them the infrastructure base they need to transition to producing EVs for the US. If European and American carmakers can’t keep up, then Japan’s automakers “will be poised and ready to jump on the opportunity.”

Toyota chases hydrogen-powered vehicles, but customers aren’t convinced (yet)

One of Toyota’s new engine prototypes relies on hydrogen fuel cells, and Toyota is seen as being at the forefront of the technology. But so far, there have been fewer than 20,000 hydrogen-powered vehicles sold in the United States, and drivers have complained that hydrogen fuel is more expensive than gas, according to the Autopian car blog. The infrastructure is also lacking, with only 59 refueling stations in the United States, mostly in California, according to TopSight. Toyota itself has acknowledged its Mirai hydrogen car’s lagging sales; chief technology officer Hiroki Nakajima last year said the company would prioritize hydrogen-fuel cells for trucks, and build charging infrastructure at rest stops and shipping ports.