The Scene

Nine days from the presumed X date, there is still no deal between the White House and House Republicans. A Moody’s executive told Politico that the U.S. is unlikely to actually miss a payment. But if there is no a deal to raise the debt ceiling, likely in return for some spending cuts, “some bills have to go unpaid,” Treasury Secretary Janet Yellen told NBC’s Meet The Press.

BlackRock’s Rick Rieder oversees $2.4 trillion in the credit market, where the law of gravity — and the basis for how assets are priced — is that Treasurys are risk-free. We talked about what happens on X plus one.

The View From Rick Rieder

Q: On a scale of 1 to “pack your bags,” where are you? And what are you buying?

A: I’m where the market is, which is that it’s going to be a bumpy road but we are not going to default. But if we can’t put a price on the risk-free rate, every other asset becomes impossible to value. So just look at the amount of money that’s sitting in cash. Investors are getting paid to sit on the sidelines. It’s extraordinary.

We’re buying a lot of corporate commercial paper. It pays you 5 to 6% from one-month to 10-month paper. The great irony is that the U.S. Treasury might default but big, stable companies won’t.

Q: If you’re a debt-ceiling optimist, there’s money to be made in T-bills maturing in the next few weeks because everyone is dumping them. That’s what Bill Gross is doing. Why hasn’t that been arbitraged out?

A: People who invest in very short-dated bills aren’t doing it to make money. They’re doing it to avoid risk. You just don’t make that much money in one-month paper, so it’s not worth it.

Q: Plus if you’re wrong, you have to explain to your boss why you were betting on politicians being rational… If we do default, what happens?

A: Nothing good. A ratings downgrade would be a big deal because of how international investors and other central banks would view our debt. Secondly, U.S. Treasury bonds are the most liquid and actively used collateral in the world.

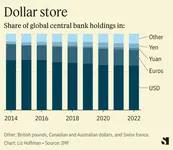

And a third thing, which is harder to decipher, is the impact on the dollar. Normally the flight to quality in the world is into dollars. But after sanctions and the dynamic around deglobalization [post-pandemic], international investors are inclined to diversify.

Q: Where are they going to go? The yuan market doesn’t seem deep enough and with the euro, you’re always kind of waiting for Greece to take the whole thing down.

A: That’s why when people ask whether the dollar is going to lose its reserve currency status, I think that’s dubious. But we keep chipping away at the impenetrable armor of the dollar. Yuan is being used more, euros, there is a part of the market that looks at crypto as an alternative. I’ve been watching gold have a good run [up 8% this year].

Q: As you said, Treasurys serve as collateral for trillions of dollars of investments. If there is a default, are we going to see a ton of margin calls?

A: I don’t think there’s a huge price [drop] because I don’t think anybody’s going to question that the U.S. will ultimately pay. But it will dilute people’s confidence in Treasurys as a form of collateral.

Q: Banks hold a lot of these. With the regional banking mess on a low simmer, it would seem to be a bad time to have that market go sideways.

A: Historically banks, particularly regional and small banks, were not huge holders of Treasurys. But over the last couple of years, you got this explosion of deposit inflows. Demand for loans didn’t grow fast enough so banks made this massive move into Treasurys. So [turmoil in the Treasury market] would be more acute today than in 2011.

Q: In fairness, the biggest banks turned around and gave those excess deposits to the Fed. They understood that it was more money than they could responsibly handle.

A: 100% right. But I don’t think anybody thought the Fed would raise rates nearly as much as they have. Rates staying too low for too long created artificial prices for these securities that got shocked lower because the Fed was behind the curve on inflation.

Q: You’re getting at a bigger theme that I suspect we’ll all be writing and talking about for the next couple of years, which is what happens in a world where money costs something?

A: It’s a huge deal. I think interest rates will come down next year, but they’re going to stay higher than they did historically. And markets are funny. They like to believe that things are going to go back to normal and then all of a sudden, they readjust fast. We’re witnessing that today. The rollover financing for leveraged loans, the rollover financing for commercial real estate, in housing, we haven’t seen this in years.