The News

A leading pan-African industrial park developer is betting that uncertainty around global trade will drive the continent’s most populous nation to support local manufacturers to replace imported goods and tap into “massive” local consumption.

Arise Integrated Industrial Platforms, which develops industrial zones in which companies process raw materials, has committed to investing $400 million in the development of a site in Nigeria’s southwestern Ogun state, which borders commercial hub Lagos, through a public-private partnership. The company’s founder and CEO Gagan Gupta said the site — which will host several industries and is under construction — will be operational by July.

The volatility caused by erratic US trade policies encourages African countries to be more independent, Gupta told a handful of reporters on the sidelines of the Africa CEO Forum in Abidjan last week. “This allows countries to say, ‘you know what, we put our national interest first’,” he said, citing the Nigeria First policy unveiled by the country’s government this month.

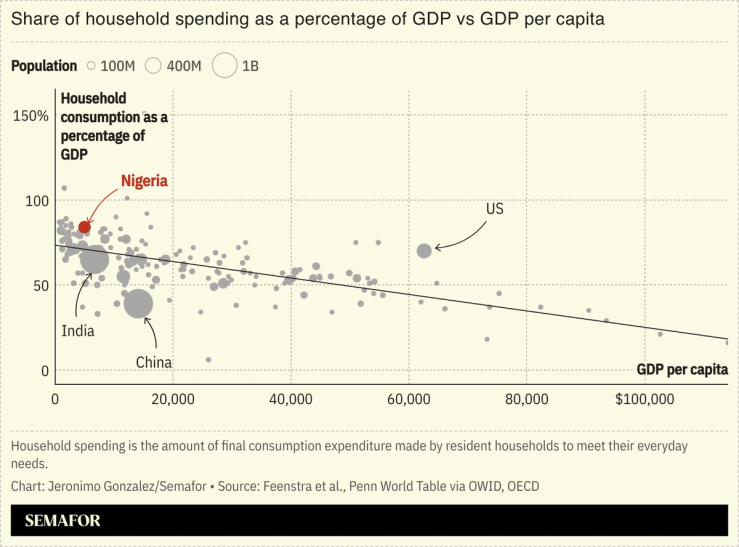

“Nigeria will be a domestic play with a lot of import replacement opportunities,” Gupta said of Nigeria, a country of around 220 million people that he referred to as a “massive country” with “massive consumption.”

He said one of the world’s largest textile plants was set to open in Ogun’s state’s Remo Economic Industrial Cluster, employing around 250,000 people and capable of producing 1,000 tons of garments each day. Gupta, when asked about the proportion of goods that were intended for export, stressed the strategy is overwhelmingly focused on the domestic market.

Know More

Arise designs, finances, builds, and operates industrial parks, leasing facilities to companies and providing a supply of raw materials. It operates in 11 African countries, including Benin, Chad, Côte d’Ivoire, Gabon, and Sierra Leone.

Gupta said the “key focus” for the Ogun state development was to ensure products are not exported in a disassembled or even partially assembled state. He said he wanted at least 70% of value addition to happen locally, which means building an “entire ecosystem” from the provision of raw materials to power. “You really bring manufacturing closer to where the consumption is,” he said. “It’s about focusing on a value chain that will work in that country.”

Step Back

Nigeria’s government this month announced the Nigeria First policy. Under the economic initiative, foreign goods or services that are available locally will not be procured without clear justification and a waiver from the Bureau of Public Procurement.

Government ministries and agencies will also conduct an immediate audit of procurement plans and submit revisions in line with the new policy.

Alexis’s view

Clad in a colourful kaftan, Gupta’s view of West Africa’s troubled giant was as bright as his attire when he met a small group of reporters for breakfast. But the Indian entrepreneur’s assessment that African governments are likely to rethink policies in the wake of the unpredictable approach to trade adopted by Donald Trump’s White House seems to be borne out in the case of Nigeria’s president.

African decision makers are now acutely aware that they’re on their own. They can no longer rely on the US in the way they did only six months ago, and the global trade architecture seems fluid. Imports are costly, using up precious foreign currency, and coming at the expense of local businesses that can create jobs and be taxed.

At first glance, the Nigeria First policy sounds like an empty slogan that echoes Trump’s America First protectionist stance. But the potential for it to be part of a broader shift is clear when it’s viewed alongside President Bola Tinubu’s push to overhaul the country’s tax system. His administration’s plans, contained in legislation passing through parliament, are a concerted effort to improve tax collection in a way that could radically boost public coffers. The approach mirrors Tinubu’s tax overhaul of Lagos when he was state governor from 1999 to 2003 — a move that is widely lauded and suggests he is serious about the changes at a national level.

It would make sense for Nigeria to encourage local production, particularly where it involves industrial developers like Arise that provide their own infrastructure. Catering to Nigeria’s “massive” market is a golden opportunity for businesses and could generate much-needed tax revenues.

Room for Disagreement

Gupta’s outlook on Nigeria stands in contrast to that of a number of multinational companies — including Procter & Gamble, GSK, and Unilever — that have in the last two years either severely cut back their presence or pulled out entirely. Companies have typically cited currency devaluations and skyrocketing inflation that have pushed up operating costs and hit consumer spending power.

The View From France

Gupta is not alone in expressing optimism about operating in Nigeria. French food giant Danone last week told Semafor it is doubling down on its plans to invest in the West African country. “We are convinced about the potential of Nigeria,” Christian Stammkoetter, Danone’s head of Asia, Middle East, and Africa, told Semafor on the sidelines of the Africa CEO Forum.

Danone has long operated in Nigeria, where it is best known for its Fan Milk brand, and recently invested in developing milk distribution capacity in the north of the country to help lower operational costs.

Notable

- Africa has around 15 years to seize the opportunity offered by manufacturing, British economist Paul Collier told The Africa Report.

- Tinubu’s tax overhaul, the “cornerstone” of the president’s fiscal strategy, involves “navigating the interests of federal, state, and local governments,” wrote Oluwadara Akingbohungbe in BusinessDay.