The Scoop

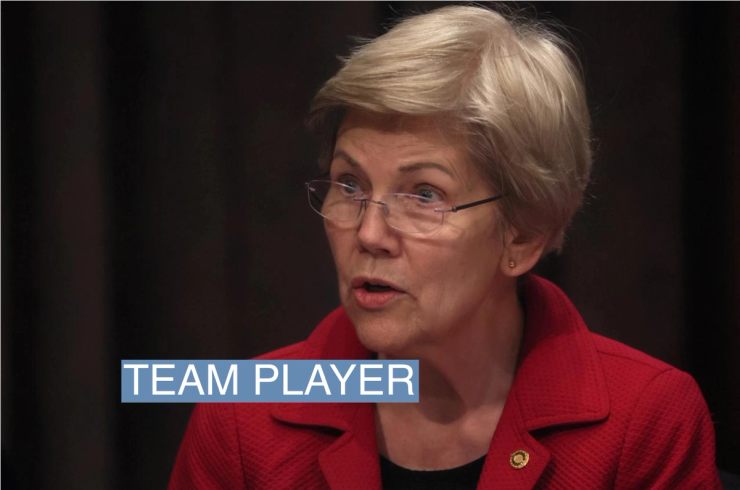

Sen. Elizabeth Warren, known for calling Wall Street executives to task for management failures, has been running a behind-the-scenes campaign to protect a top banking regulator from documented allegations that he presided over a toxic workplace.

Ex-top aides to the Massachusetts Democrat helped FDIC Chair Martin Gruenberg prepare for congressional hearings this week, when he was set to be grilled about a scathing report from an independent law firm that found widespread sexual harassment and bullying at the agency, which oversees thousands of US banks, people familiar with the matter said.

Gruenberg testified before the House yesterday, when he apologized and said he would take anger management classes, and will appear before a Senate committee at 10 a.m. today.

Rohit Chopra, a former Warren protege who now runs the Consumer Financial Protection Bureau, went to the FDIC’s headquarters last week to run Gruenberg through likely questions he would face and practice his answers, the people said. Chopra is a board member of the FDIC.

When that session went poorly, Warren’s former chief of staff tried again. Dan Geldon, who worked for Warren until 2020 and now runs a Washington consulting firm, went through a mock hearing with Gruenberg over the weekend, some of the people said.

Warren’s office and the CFPB declined to comment. The FDIC and Geldon didn’t immediately respond to requests for comment.

In this article:

Know More

An investigation by law firm Cleary Gottlieb found an agency rife with sexual harassment, bullying, and discrimination, where complaints were ignored and offenders went unpunished. The findings have put pressure on Gruenberg, who has been a fixture at the FDIC since 2005, in rotating stints as its chair and a board member. The report found that Gruenberg contributed to a culture of bullying and that underlings, scared of being berated, were reluctant to bring him bad information.

That information breakdown has led some critics to tie Gruenberg’s temper to lapses at the FDIC last spring, when three regional banks failed and the agency was slow to seize them, spurring worries about a contagion that forced the government to guarantee deposits at two of the banks. Republican members of Congress and at least one Democrat have called on him to resign.

But Gruenberg, a progressive who has pushed tougher rules on Wall Street throughout his career, is key to a financial-regulation agenda that includes forcing banks to hold more capital, reining in bonuses, and intensifying merger reviews. If he were to be forced out of his role, the FDIC would be paralyzed, split evenly between Democratic and Republican board members and at least temporarily run by a Republican, Travis Hill.

“There’s plenty of blame to go around,” said Dennis Kelleher, of the progressive think tank Better Markets. “This is outrageous, but to attack the Democrat only, which has the inevitable result of stalling this important work, is so clearly partisan politics.”

(In a bit of good news for Warren, the Supreme Court this morning rejected a constitutional challenge that would have dismantled or gutted the CFPB. Warren first proposed the idea of a consumer-focused financial regulator in 2007 when she was a professor at Harvard, and was appointed by former President Barack Obama to create the agency after the global financial crisis.)

Liz’s view

Neither Gruenberg nor Warren nor progressive allies in DC who have fallen into line now would let a bank CEO who fostered a workplace this toxic stay in the job. “Your definition of accountable is to push the blame to your low-level employees who don’t have the money for a fancy PR firm to defend themselves,” Warren told John Stumpf, the then-CEO of Wells Fargo during its fake-accounts scandal. “It’s gutless leadership.”

Their entire exchange, from 2016, is worth reading and comparing to Warren’s statement to the American Banker after the FDIC report was released: “Chair Gruenberg has accepted responsibility, and I support his work to implement the action plan to improve the FDIC’s culture.”

It’s a strange hill to die on. The agenda that Democrats are rallying around Gruenberg to protect isn’t particularly robust or likely to go anywhere. Proposed rules requiring banks to hold more capital are likely to be significantly watered down, and may not even be reworked before the election in November. Rules curbing banker bonuses were mandated by the Dodd-Frank law 14 years ago and still haven’t been finalized, and the latest version lacks the needed support of the Federal Reserve.

Room for Disagreement

At Wells Fargo, “you had people as a regular-way business practice breaking the law,” Kelleher told me. “I don’t think that’s anywhere near comparable to what we’re talking about here.”