The Scene

One of the longest, strangest, and most profitable activist campaigns in memory has come to a quiet end. Elliott Management partner Dave Miller quietly stepped off the board of Howmet Aerospace last week, closing the books on a corporate battle that captivated and bemused Wall Street and inspired a Succession subplot.

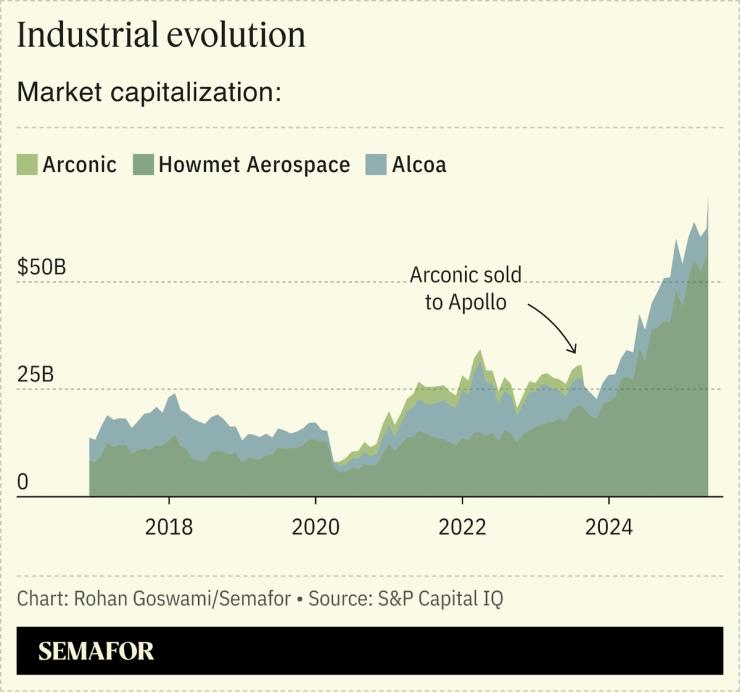

Howmet is one of three companies that emerged from Alcoa, the aluminum giant in which Elliott took a stake in 2015. The hedge fund pushed the company to split in two: Alcoa, which mined aluminum, and Arconic, which made things with it.

Arconic continued to struggle, prompting Elliott to launch an extremely memorable proxy fight in 2016 that involved the activist mailing video tablets to shareholders to watch its pitch — something HBO writers would later steal as a plot point for Waystar Royco’s own boardroom battle. Arconic’s CEO responded by couriering a letter to Elliott founder Paul Singer containing vague, and vaguely extortionate references about a fountain serenade during a World Cup trip. Arconic fired its CEO, gave Elliott board seats, spun off a division that was later sold to Apollo, and turned its remaining business into a $64 billion aerospace juggernaut, Howmet.

Miller’s departure from Howmet’s board caps a highly lucrative play for Elliott’s investors: the hedge fund’s stake was worth around $1 billion in 2017. Eight years later, that same position would be worth roughly $8.4 billion, based on Semafor’s calculations. A spokesperson for Elliott declined to comment on the matter.

In this article:

Rohan’s view

Arconic became one of Elliott’s most defining skirmishes, outdone only by a fight at Samsung C&T that indirectly felled South Korea’s president, or the time it seized an Argentinian naval ship. It earned Elliott a reputation for pugnacity and persistence — what Singer called “manual efforts” — that the activist has shed to a certain extent.

The hedge fund has only gone full-tilt once in the last 10 years — the current fight at another conglomerate, Phillips 66, which will head to a shareholder vote next week, barring a settlement — although it came close to going the distance at Southwest Airlines last year.

Most activist engagements today never become public. That reflects both the growing size of these funds, which now manage tens of billions of dollars and whose correspondingly larger prey requires careful engagement, but also the reality of boards and CEOs today. Companies opt to go activist on themselves through board refreshments, stock buybacks, and a willingness to hold underperforming executives to account.

Just as boards have shown a willingness to savage themselves, activists have borrowed from the corporate playbook as well. Most prefer to move quietly, negotiating behind the scenes — a method that saves them time and money.

Room for Disagreement

But they don’t shy away from a fight, either. Those relatively few fights that now make it to the public eye — Trian and Disney, Elliott and Southwest, Ancora and Norfolk Southern — remain marked by the old pugilism. And activists now have far more tools at their disposal: private investigators, jet trackers, social media monitoring, and things even we don’t know about.

Meanwhile, companies pay tens of thousands of dollars for sophisticated monitoring software that flags when known activists visit their websites. And when the fights get fierce, CEOs can call on their powerful friends: Jamie Dimon, George Lucas, and the Disney family itself all publicly backed management in Trian’s 2024 proxy fight at the House of Mouse.

Notable

- Elliott is inching closer to victory at Phillips 66. ISS endorsed all four of the activist’s board nominees, Semafor first reported last night, only the second time in the last 15 years that the advisory firm has backed an activist’s entire slate of nominees at a large company.