Aramco reported falling profits and slashed its dividend after oil prices plunged, cutting a key source of funds for Saudi Arabia as it pushes to diversify its economy away from fossil fuels.

The kingdom has made significant progress in growing its other sectors, with the non-oil economy accounting for 51% of GDP last year.

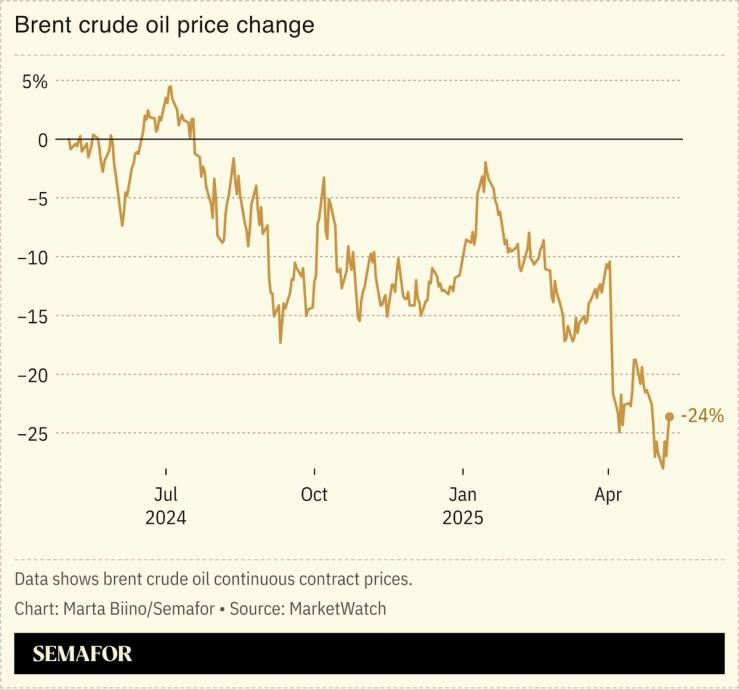

Yet the IMF estimates that Riyadh needs oil prices to be above $90 a barrel to balance its budget; prices are currently hovering near $62.

Worse may be to come, with Goldman Sachs projecting crude could drop to $56 next year and analysts warning that Aramco’s historic strategy of maintaining capital expenditure during downturns — unlike its publicly listed peers — could put further pressure on profits.