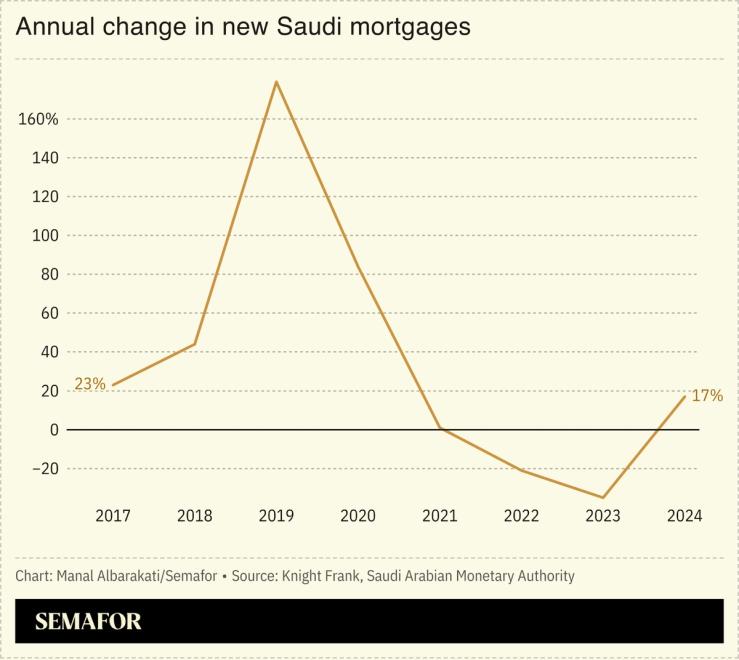

Saudi Arabia’s mortgage issuance surged after three years of contraction, a rise that masks cracks in the property market.

Banks issued 91 billion Saudi riyals ($24.3 billion) in new home loans last year, a 17% jump driven by lower interest rates and state guarantees aimed at boosting homeownership, according to S&P Global Ratings. The loans are helping the kingdom close on its target of 70% of Saudis owning their own home by 2030; it’s already at 65.4%. Saudi Arabia is the Gulf’s biggest economy and will soon be the world’s largest construction market.

But prices and rents are rising fast in Riyadh and Jeddah, and home buyers are borrowing to buy off-plan properties — homes that are still under construction — compounding risks for banks and raising concerns that buyers are being priced out of already built units, S&P said.