The News

British consumer goods company PZ Cussons may sell its Africa operations, citing adverse economic conditions on the continent, particularly in its largest market Nigeria.

PZ’s group revenue for the three months to March 2 — which it defines as the third quarter of its financial year — fell by 23.7% “primarily as a result of the devaluation of the Nigerian naira,” the company said last week. Its Africa business, despite raising product prices to account for inflation, saw its revenue halved during the period. It was a much steeper decline than was recorded in its other markets in Europe and Americas, and the Asia-Pacific, at -1.4% and -10.7% respectively.

The company said it has carried out “a strategic review of our brands and geographies” to focus on where it can be most competitive. In particular, PZ’s board described its Africa operations as “a complex group of assets” and is “evaluating the strategic options both to reduce risk and to maximise shareholder value.” It could lead to an outright sale, with CEO Jonathan Myers saying “nothing is ruled out.”

Last year, PZ said it would delist its Nigeria subsidiary from the stock exchange by paying £23 million ($29 million) to buy a 27% stake held by the public. But Nigeria’s securities and exchange regulator barred the buyout move this March, to the delight of Nigerian shareholders who wanted a higher offer for their stock.

Know More

PZ’s Africa operations include outposts in Ghana and East Africa, but Nigeria is its “largest and most diverse single market,” according to the company. Its products in Nigeria, where it has operated for over 120 years, range from skincare and sanitary products, like Imperial Leather and Morning Fresh dishwashing liquid, to food items such as Mamador cooking oil.

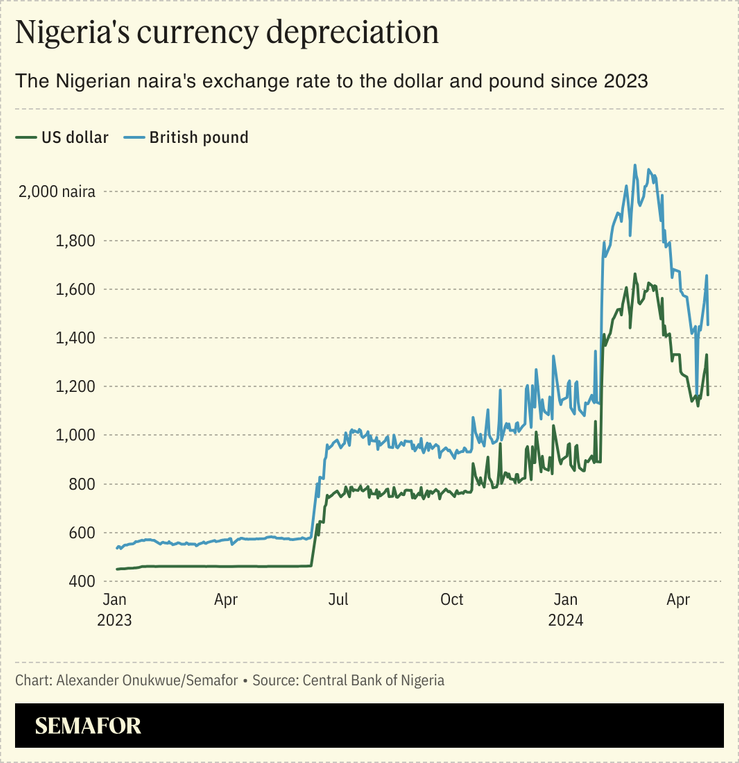

Rising inflation and currency devaluation over the past year have increased production costs in Nigeria. Inflation rose to 33.2% in March, a near-three-decade high. The Central Bank of Nigeria’s intervention in the foreign exchange market, through weekly sales of dollars to licensed traders, has created some stability for the naira’s value. But it remains significantly weaker than it was before Bola Tinubu became Nigeria’s president last May.

PZ’s exchange rates for calculating its accounts for the 2022, 2023 and 2024 financial years were 558, 536, and 1,400 naira to the British pound respectively. At over 60%, the Nigerian currency’s depreciation over the past year compares unfavorably with the Indonesian rupiah (5.7%) and the US dollar (4.1%).

These factors have led consumer goods companies — including Unilever, GSK, and Procter & Gamble — to consider shutting down or changing their strategy. Unilever’s naira revenue between January and March this year grew 59% on an annual basis, thanks to a 41% increase in prices. Yet, a 91% increase in operating costs have led analysts at Lagos-based CardinalStone to predict sustained pressures on Unilever’s margins this year.

PZ still plans to improve profitability, generate more cash, and stay competitive in Nigeria by finding a way through the naira’s volatility. “The macro-economic challenges and complexities associated with operating in Nigeria are significant and there is much more to do to unlock the full potential of the business,” PZ’s CEO Myers said in the company’s statement last week.

Notable

- Strategies for adapting to Nigeria’s economic struggles include Unilever’s use of Cassava, a local crop, as the source of a main ingredient in its toothpaste, instead of importing it from China.