The News

The Federal Reserve gave a damning assessment of its own oversight of Silicon Valley Bank, saying supervisors misjudged the lender’s problems and were too slow to act once they became clear.

The report released on Friday is part of the Fed’s review of the second-biggest bank failure in U.S. history. Led by Michael Barr, the Fed’s vice chair of supervision, the central bank signaled a coming overhaul of rules for medium-size lenders, plus changes to how the watchdog oversees the banks it regulates.

Barr called the review “a first step in that process” and “a self-assessment that takes an unflinching look at the conditions that led to the bank’s failure, including the role of Federal Reserve supervision and regulation.”

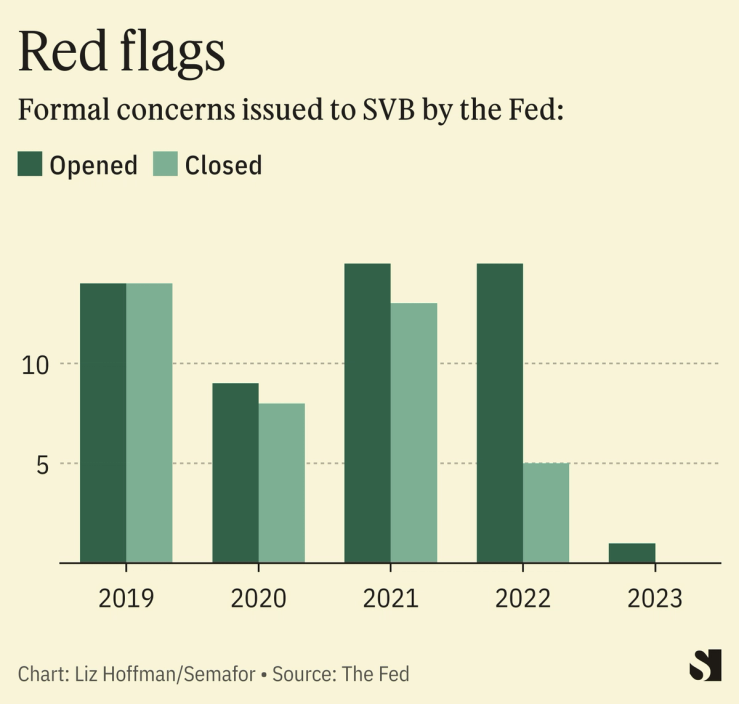

He noted that SVB’s balance sheet tripled in only two years but supervisors rated its governance as “satisfactory” from 2017 to 2021 despite “repeated observations of weakness in risk management.” Even though most of its deposits were uninsured — a clear flight risk — the Fed called the bank’s ability to fund itself “strong.” When it failed, SVB had 31 red flags from the Fed, three times the average bank, according to the report.

The Fed board staff in Washington also gave positive supervisory ratings to the San Francisco Fed, which has primary oversight of SVB.

“We need to develop a culture that empowers supervisors to act in the face of uncertainty,” Barr said. “Supervisors did not force SVB to fix its problems, even as those problems worsened.”

The Fed found that a 2019 change that relaxed rules for regional banks, part of the Trump administration’s broader deregulatory push, also contributed to the bank’s collapse.

In this article:

Liz’s view

As far as autopsies go, this is a thorough one, and the Fed doesn’t sidestep its own complicity, despite mountains of evidence that SVB’s management was willfully blind to risk. (One fact from the report that floored me: In April 2022 — right around the time its chief risk officer left, replaced almost a year later, and just as interest rates were starting to rise — the bank hired a consultant to produce a report deeming its deposits were safer than previously thought.)

But the problems go beyond SVB, which wasn’t the only bank to fail. Silvergate, mostly owing to its crypto exposure, failed two days before, and Signature Bank (supervised by New York watchdogs and the FDIC) a few days later. First Republic is on life support, trying to gin up a government rescue.

Questions remain about the government’s response to those situations, particularly First Republic. The emergency lending facility announced in March appears not to be designed to accept most of First Republic’s assets as collateral, even though regulators knew what the bank owned and roughly how much cash it needed.

And I’ve written about why a Fed-brokered private solution for First Republic makes sense for everyone, and is preferable, both commercially and psychologically, to another bank failure.

Room for Disagreement

The report spares one community that many have blamed for SVB’s demise: its clients.

Media entrepreneur Elizabeth Spiers wrote in the New York Times that she blamed venture capitalists who told startup founders to park their money at SVB and then in a panic urged them to pull it. She briefly lost access to her account there in March when outflows shut down SVB’s systems, though her company’s account was one of the few that was insured.

The VCs are “the reason the bank was so overloaded with risky clients, and they’re also the ones who panicked at the first rumors of trouble and advised their portfolio companies to flee, initiating the bank run that brought the whole thing tumbling down.”

Notable

- The Fed did an extensive deep dive into the lead up to SVB’s collapse. Read the full report here.