The News

A brisk new trade in the financial futures of millions of retirees is unnerving some US workers, regulators, and politicians who worry that private equity firms will invest corporate pensions recklessly.

Recent lawsuits challenging AT&T, Lockheed, and Alcoa’s plans to turn their pensions over to Athene, which is owned by Apollo, casts a broader spotlight on private equity’s push into new corners of finance. Sen. Sherrod Brown has held hearings, cheered on by the Teamsters, and the Labor Department is weighing whether to require companies to at least consider whether an insurance business is owned by private equity before turning over their pensions.

Companies like AT&T and IBM don’t want to be in the retirement business. So they’ve been offloading their pension plans to insurance companies. The 773 deals last year broke 2022’s record of 568, according to Aon.

For years, the business of taking over those pensions was dominated by a handful of century-old insurance mainstays like Prudential and MetLife. But private-equity firms have barrelled in. Apollo, KKR, Brookfield, and Blackstone have all bought insurance companies since 2019, and have been bidding aggressively to acquire pension plans.

Over the past three years, about $135 billion of corporate pension liabilities have moved from America’s biggest companies to insurers. They are converted from corporate promises, vestiges of an era of generous paternalism, into an annuity, a type of insurance contract that has become the hottest product on Wall Street.

In the process, they lose the backing of the Pension Benefit Guaranty Corp., a government entity that guarantees workers’ retirement benefits if their pension plans fail. Instead, any insolvency would be resolved by state insurance funds, which operate similarly to the FDIC’s fund for bank depositors and try to make as many people whole as possible from what’s left.

“Nothing comes free in the investment world. With higher returns come higher risks,” said Jerry Schlichter, who filed the lawsuits contesting the Athene transactions. “You can say insurance companies are stodgy but there’s good reason for that.”

An Athene spokeswoman called the lawsuits “baseless complaints instigated by class action attorneys who are attempting to enrich themselves at the expense of retirees… Insurers like Athene have deep expertise in managing annuity obligations, are subject to robust regulation, and hold regulatory capital to protect policyholders.”

In this article:

Step Back

Higher interest rates are driving this boom.

Typically companies looking to transfer their pensions have to come up with cash to close any shortfall. But because higher-yielding bonds generate enough cash, long into the future, to meet their obligations to retirees, corporate pensions are in good shape. The largest of them are fully funded for the first time since 2007, according to Willis Towers Watson. That means companies don’t have to pony up cash.

Companies aren’t currently required to care whether an insurance company is owned by a private-equity firm, so long as it meets all the other fiduciary standards. Last summer, the Labor Department convened an advisory council made up of unions, accountants, insurers, and companies to reexamine the question, and the result was a split vote. Regulators are four months late issuing new guidance, which suggests it’s a close-run thing.

“Let me set the record straight. Yes, we own assets that Apollo originates,” Bill Wheeler, Athene’s vice chair, testified at the hearing. “We’d rather have Apollo assets than assets from some third party.”

Liz’s view

AT&T’s 96,000 retirees are clearly better off with Athene, an A-rated and well-capitalized money manager that reports to financial regulators, than with AT&T, a BBB-rated telecom company that left its pension underfunded for 11 of the past 12 years.

The question is whether they would have been better off with MetLife than with Athene.

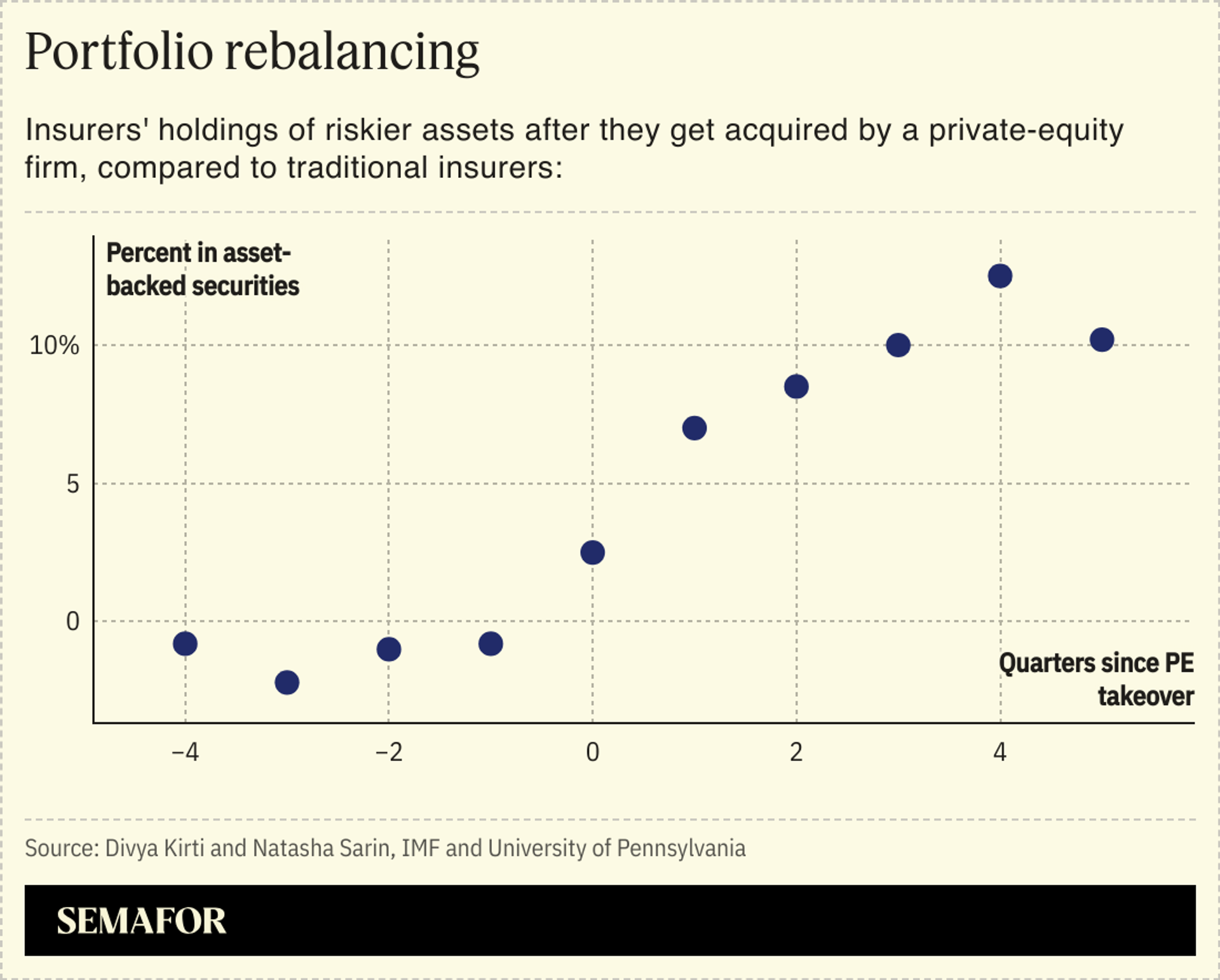

Insurers owned by alternative asset managers invest more of policyholders’ money in things like bundled car loans or aircraft financing payments, and less in safer government bonds. They split from traditional players last year in opposing a rule that would increase capital requirements for those riskier and more complex investments.

They also eat a lot of their owners’ cooking: Dig out Athene’s holdings and you’ll see a lot of loans originated by Apollo. The same is true of American National, which is owned by Brookfield, or Corebridge, which is part-owned by Blackstone.

I’m not saying those are bad investments. But the average private equity-backed insurance company’s portfolio yields 0.62% more than that of a traditional firm, according to AM Best, a ratings firm for insurers. They say they can deliver that extra yield without any additional risk, which is, generally speaking, not how finance works.

Those insurers insist they’re no different than traditional players. “It’s not true that we’re ‘private-equity’ backed,” Wheeler, the Athene executive, said in his testimony. “We look a lot like Prudential, or MassMutual, or MetLife.”

He’s right, in that they’re subject to the same capital standards as MetLife or Prudential, and their portfolios need to pass the same safety checks.

But they’re different animals, with different priorities and DNA. KKR and Brookfield are dealmakers. They are good at finding investments like corporate loans and data centers and wind farms that produce profits down the road. For them, owning insurance policies and pension plans, which need profits down the road, is a way to pay for their deals. They are asset managers that play a little liability on the side.

State insurance regulators are pretty good at their jobs; about 30 insurers have failed this century, compared to 566 banks. “The regulators have the same toolbox, and an incredible amount of transparency … to feel confident about these transactions” involving PE-backed insurers, Mariana Gomez-Vock, of the American Council of Life Insurers, told me.

But mismanagement does sometimes get by them, and when it does, everyone wonders how.

Room for Disagreement

In a worst-case scenario — the failure of an annuities provider —retirees might still be better off.

“In the last 30 years, there hasn’t been a single [retiree] under a group annuity contract that’s missed a payment or had a benefit cut,” said Preston Rutledge, a former assistant Labor secretary for employee benefits.

In comparison, a study of 500 corporate pensions taken over by the federal Pension Benefit Guaranty Corp. found that 16% of retirees saw their benefits cut. The average retiree lost $222,000.

“A lot of folks have a very strong belief that money is safest sitting with an employer,” the ACLI’s Howard Bard told me, “despite every piece of evidence being to the contrary.”

Notable

- Citigroup CEO Jane Fraser is sounding the alarm on “an arbitrage between banking and insurance,” which she’ll raise at an upcoming board committee meeting.