The News

Brazilian President Luiz Inácio Lula da Silva called for an end to the dollar’s dominance in international trade during his state visit to China, lending his support to Beijing’s efforts to boost the yuan’s role.

However, despite a recent rise in its use, the yuan — or any other currency for that matter — remains far from threatening the dollar’s dominance in international markets.

Know More

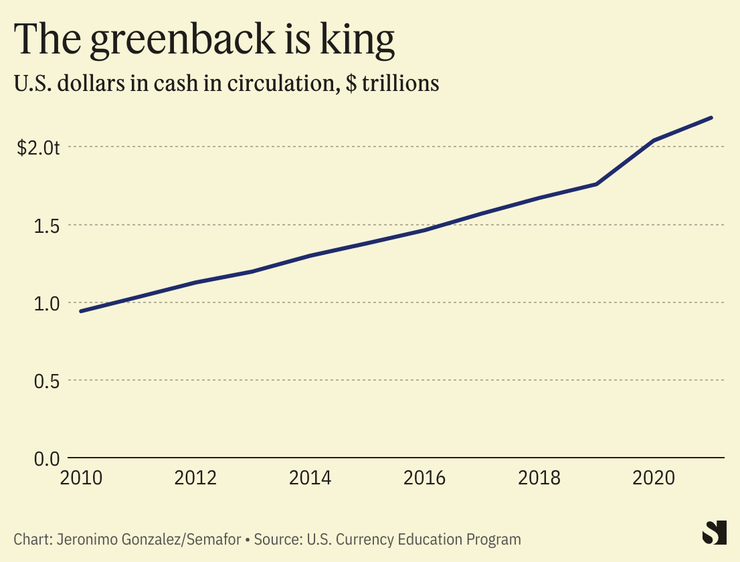

The cash value of dollars in circulation more than doubled in the last decade to over $2 trillion, with as much as half of that estimated to be circulating abroad. Besides the U.S., seven other nations now use the dollar as their official currency: Ecuador, El Salvador, Zimbabwe, Timor-Leste, Micronesia, Palau, and Panama.

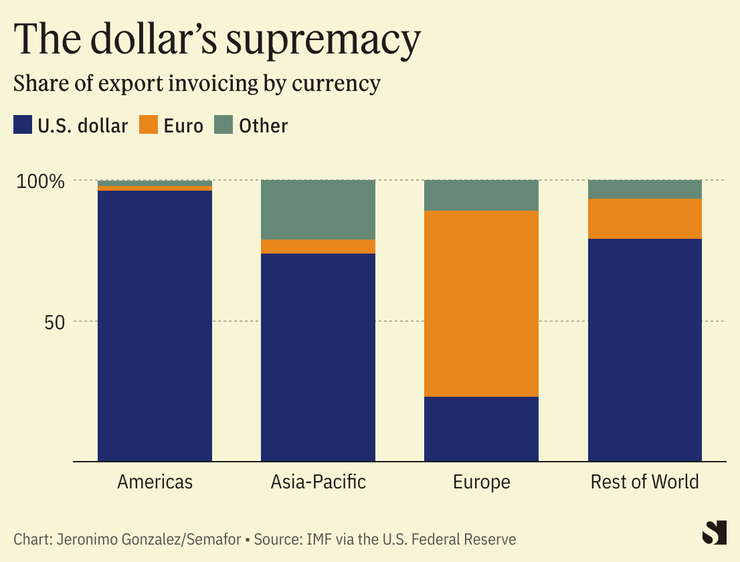

Between 1999 and 2019, the dollar accounted for 96% of trade within the Americas, 74% in the Asia-Pacific region, and 79% in the rest of the world. The only region where the dollar isn’t dominant is in Europe, where the euro leads.

According to Nobel-winning economist Paul Krugman, the ease with which dollars can be used in transactions works as a moat around its dominance of international markets.

“It’s easier to do transactions in dollars than in other currencies because so many other people use dollars,” Krugman wrote in The New York Times. “And the ease of transactions is one reason so many people use dollars.”

However, the dollar’s dominance stems from more than just ease of use.

As Krugman pointed out, the dollar’s dominance lies on economic fundamentals, too: America’s huge economy, sophisticated capital markets, and a lack of capital controls that restrict people’s ability to move money around.

China, on the other hand, does impose capital controls, and often acts arbitrarily against investors, spooking foreign capital. “These fundamentals immediately rule out the yuan as an alternative to the dollar,” Krugman wrote.

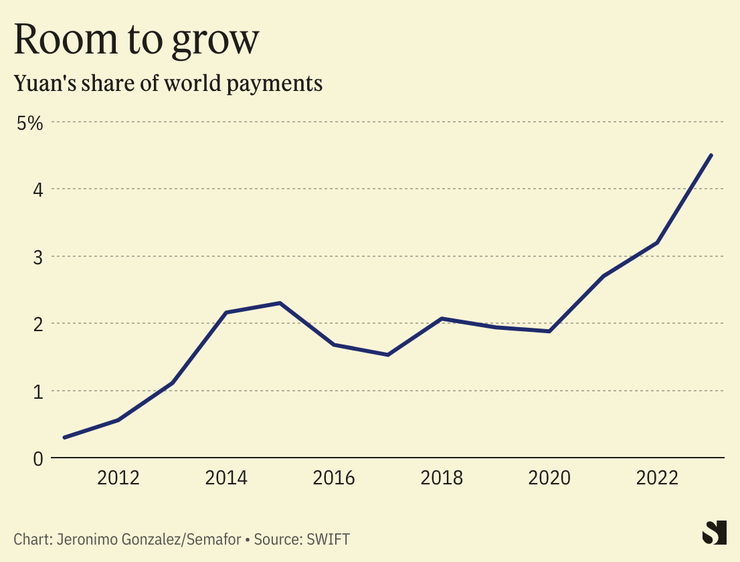

However, the role of the Chinese yuan in international markets has increased, more than doubling in the last year. The rise is largely driven by China’s increased demand for Russian oil and gas.

“It’s likely that a lot of this, given the timing, represents Russian trade [with China] which is done through intermediaries,” the head of a China-focused research group told the Financial Times.

China’s continuing purchases of Russian oil and gas, shunned by the U.S. and Europe, have driven the value of international transactions made with the yuan up to 4.5%, still far below the dollar. In February and March, the yuan replaced the dollar as the most-traded foreign currency in Russia, Bloomberg reported.