The News

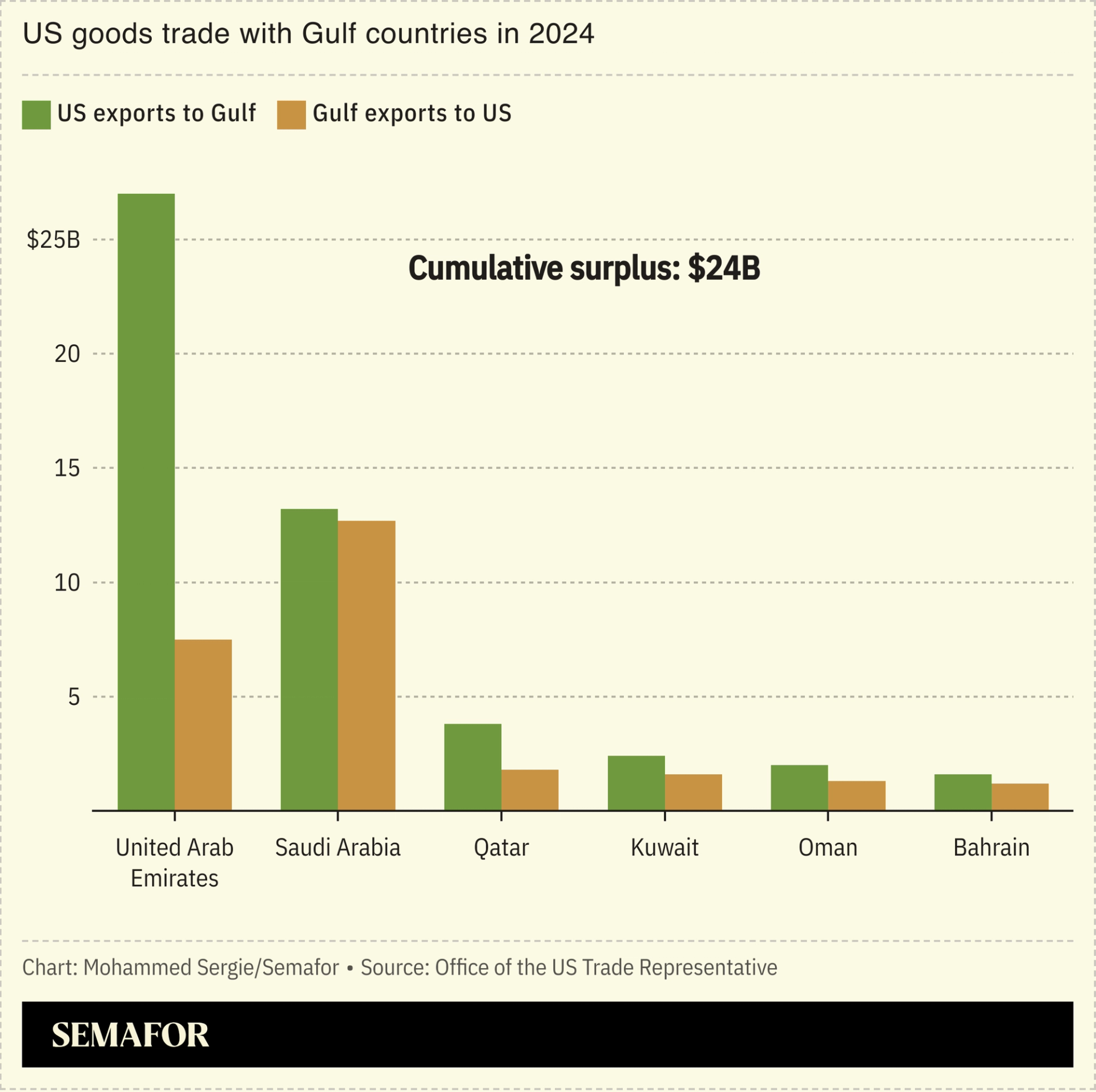

The Gulf appears likely to have escaped the direct impact of US President Donald Trump’s blanket tariffs this week. Oil, gas, and refined products — the bulk of Gulf exports — are exempt, and the US is no longer a key market for Gulf crude. That’s why regional countries were hit with the blanket 10% tariff. There’s also little chance of retaliation: Gulf states import high-value goods from the US, like advanced tech and weapons systems, and aren’t expected to haggle with Trump for additional exemptions.

But the secondary effects of “Liberation Day” and growing US protectionism are hitting hard. Projections of slower global growth may crimp oil demand, a weaker US currency will erode the purchasing power of the dollar-pegged Gulf currencies, and slumping assets are denting sovereign wealth portfolios. Even countries hit with minimal US tariffs can’t escape the havoc of a global trade war.

Here’s what Justin Alexander, director of consultancy Khalij Economics, thinks about the levies: