The Scene

U.S. Steelworkers are fighting a takeover by Japan’s Nippon. Railroad unions have rallied around Norfolk Southern’s CEO in opposing a hedge fund trying to take over its board of directors. Regulators are trying to block the biggest grocery-store merger in U.S. history because it would undercut unionized workers’ ability to successfully strike.

The power that unions won last year on the picket line is now being wielded in the boardroom, with support from President Joe Biden, a proud union man who has aimed his corporate regulators toward labor practices he views as unfair.

“We saw the collective bargaining wins last year, but now we’re seeing the other playing fields where having a strong labor union can make a difference,” said Sharon Block, a former Biden adviser who now teaches at Harvard.

Union membership remains on a 40-year wane but has seen a string of successful strikes and contract negotiations. Airline pilots, Hollywood screenwriters, UPS delivery drivers, and Detroit auto workers all won significant wage and benefit increases.

Now labor has emerged as a force in several corporate deals. Plenty of forces can disrupt or seal a merger — antitrust regulators, fickle debt markets, unruly shareholders — but it’s been years since unions were credibly on that list outside of major corporate crises, like the auto bailout in 2008 or airline bankruptcies in the 2000s, when unions made major concessions to save their companies.

“One reason why I believe that this deal is not going to go through is because U.S. Steel completely disrespected the wishes of the union,” said Lourenco Goncalves, the chief executive of Cleveland-Cliffs, which is trying to break up U.S. Steel’s sale to Japan’s Nippon Steel.

Goncalves said in an interview that he approached the union before he launched his own takeover bid for U.S. Steel, whose management “took offense to that, because it was very important to U.S. Steel to break the back of the USW. And that’s where the problem started.”

The United Steelworkers have come out against the sale to Nippon, calling the Japanese company’s commitment to honor the union contract “a meaningless piece of paper.” Biden has also hinted he might block the deal on national security grounds, saying last month that U.S. Steel, which has military contracts, should remain American-owned.

When the Federal Trade Commission sued to block the Krogers-Albertsons deal, it made many of the expected arguments about how the merger would raise prices for consumers, and an unusual one, too. It defined unionized grocery-store workers as a market that Krogers and Albertsons compete in, right alongside selling food. Most of their combined 700,000 workers are unionized.

Regulators say the deal would prevent unionized workers from being able to play the two companies off each other during collective bargaining negotiations and undermine the effectiveness of any strikes. That strategy was key to United Auto Workers’ win last year, when it strategically walked out at competing factories and used an agreement with Ford to strong arm General Motors and Jeep maker Stellantis into big wage bumps.

The FTC pointed to a 2022 Kroger’s walkout in Denver, when striking workers encouraged shoppers to go to Albertsons instead, and hinted in a redacted court filing that management of the two companies had discussed ways to end the strike.

In this article:

Liz’s view

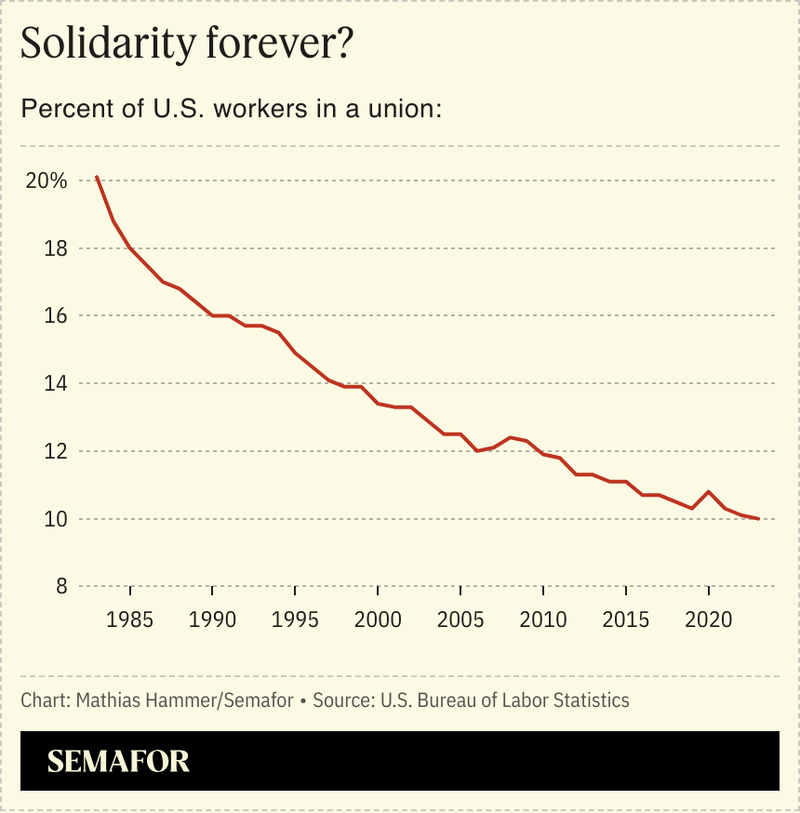

Unions’ power is likely temporary, a product of an historically tight labor market. They remain in long-term decline — the share of U.S. workers who belong to a union has fallen from 20% in 1983 to 10% last year — and are increasingly concentrated among government workers.

Younger generations care less about salary or corporate paternalism, and expect to have more jobs, even more careers, than their parents did. Workers in their 40s and 50s are three times more likely to be in a union than those under 25, government data shows.

It’s easy for progressives to get excited about collective bargaining wins. Starbucks’ caving to its union, which put up a surprisingly credible slate of qualified board candidates, may end up being the high-water mark for labor’s boardroom incursion.

Room for Disagreement

Fresh off its win in Detroit, the UAW announced organizing drives at the 13 nonunion carmakers in the U.S., including Tesla and Toyota. “The money is there. The time is right,” union president Shawn Fain said.

Notable

- Why Norfolk Southern’s unions are backing its embattled CEO, a year after a deadly crash in Ohio.