The News

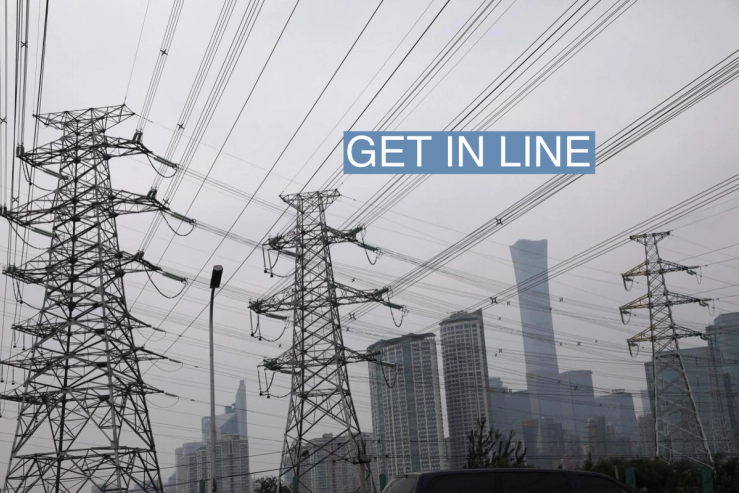

The biggest obstacle to a lower-carbon electric grid used to be the high cost of wind and solar hardware. Now it’s the outdated, byzantine bureaucracy of the grid itself: the process for deciding what transmission lines, substations, and other infrastructure are needed and where — and who should pay for them.

Around the world, a huge backlog is accumulating of prospective renewable energy installations that would be profitable but for one reason or another can’t connect to the grid. In the U.S., that backlog, known as the interconnection queue, amounts to 1,300 gigawatts worth of wind, solar, and batteries. That’s 30% more than the country’s current total installed electricity generation capacity, meaning grid delays are preventing the U.S. from potentially doubling its electricity supply, with renewables. If everything in the queue was built, the U.S. would be able to get 80% of its power from zero-carbon sources by 2030, even as total demand rises because of EVs and home electrification.

Tim’s view

In the U.S., the Inflation Reduction Act, while a powerful tool for lowering the cost of renewables, does little to solve the interconnection queue.

Federal funding in the bill could help utilities adapt some existing grid infrastructure to serve renewables instead of fossil fuels. But the most needed solution is for federal regulators to force the companies that operate the nation’s grids to be more proactive in their planning and find a better way to distribute the costs of new infrastructure. The Federal Energy Regulatory Commission (FERC) is weighing a new rule that would do just that. But its ability to pass transmission reform is being held up by Senate squabbling over nominations to fill an empty commissioner seat (the other four commissioners are split between Republicans and Democrats).

A report last Friday by PJM, the country’s largest grid operator that serves much of the Midwest and Southeast, illustrates the risks. PJM expects one-fifth of its existing coal and natural gas plants to retire by 2030 as a result of age, competition from cheaper sources, and climate policy. But the process for approving, financing, and building infrastructure to accommodate the new renewable sources in the queue is so slow that it could lead to power shortages.

That mismatch was avoidable, given that the trajectory of the energy transition has been visible for years, said Rob Gramlich, president of the consulting firm Grid Strategies: “It’s annoying when system operators say these things, when they weren’t considering reliability five or ten years ago like they should have been.”

Know More

The problem stems from the historic design of the electricity market, in which the grid was fed by a small number of big fossil fuel power plants. Centralized power production makes transmission planning easier and removes ambiguity about who should bear the costs. When a new power plant got built, the developer would pay the connection costs to expand transmission infrastructure so that the additional power could be distributed, and pass those costs to ratepayers.

In a system that is fed by innumerable small installations and thus more widely distributed, transmission is trickier to plan, but even more important so that electrons can travel from sunny and windy places into cities or factories. And the payment question gets muddled: Why should any one developer have to shell out for upgrades to transmission capacity that benefit everyone?

In fact, inequitable cost distribution is one reason the queue is so crowded: Developers often apply for projects speculatively, hoping another developer will get stuck with the upgrade tab and withdrawing their application if it falls to them. Instead, experts say, grid operators should anticipate where new transmission infrastructure will be needed and spread that cost evenly across all generators. But the owners of existing fossil fuel plants have little incentive to support reforms that would put them into more direct competition with lower-cost renewables.

Another solution is the policy used in Texas, which doesn’t require the grid to have enough transmission capacity to handle every incoming new electron (PJM, by contrast, does). That means at times of high transmission traffic, some facilities may get shut out. But many wind and solar developers are willing to take that risk and build anyway, betting they will be able to offer a lower price than fossil fuel plants and therefore not be the ones shut out.

Ideally, transmission planning would happen at a national level, to spread costs more widely and link up far-flung sources of electricity supply and demand — delivering Midwest wind power to New York City, for example.

Quotable

“Right now it’s nobody’s job to plan the transmission we need. The U.S. is the only country that doesn’t have a national grid plan.”

— Chaz Teplin, a grid expert at the Rocky Mountain Institute.

The View From China

No country does grid planning better than China. That’s part of how it’s able to add about as much renewable energy to its grid every year as the rest of the world combined. China has almost 100 times more long-distance transmission capacity than the U.S. Because this process is managed by a small number of state entities, there’s little debate about who will pay for grid upgrades.

A drawback of this top-down system is that most of China’s electricity production is tied up in preset delivery contracts, rather than responding in real time to supply and demand. If production suddenly falls off in one area, there’s no market mechanism to redirect electrons from elsewhere and fill the gap — that’s why a drought-related crash in hydropower in Sichuan last summer caused blackouts, contributing to Chinese provinces upping their coal capacity.

The View From Europe

In a report Monday, the U.K.’s National Audit Office warned that it faces similar problems to the U.S., with billions of pounds worth of approved solar and wind projects unable to connect to the grid. In 2022, the report found, the country’s utilities paid an average of £62 million per day for power the grid was contracted to buy but wasn’t able to actually accommodate. And on Tuesday, officials in Germany said they will push four major grid companies into a merger, in order to better facilitate transmission upgrades.

The View From Nigeria

For developing countries without widespread existing grids, a short-term solution to more and cleaner power may be fragmentation, rather than central consolidation. In Nigeria, a growing number of towns are investing in solar microgrids, local systems that can serve a few dozen households or an industrial facility. They’re much cheaper than big transmission lines, and can be set up without involving utilities.

Across the continent, many African utilities are facing what experts call a “death spiral” toward bankruptcy, in which their inability to finance grid upgrades (because of crippling debt burdens and high borrowing costs) leads to lower-quality service, driving away the commercial customers that are their most important source of income. Microgrids can bypass that problem, for now, but eventually much more conventional transmission will be needed to increase electricity access and support industrial economic development.

Room for Disagreement

One bright spot in the U.S. grid is that 2022 was a record-breaking year for the installation of utility-scale batteries. Batteries also get stuck in interconnection queues. But once connected they make it easier for the grid operator to manage the flow of power from different sources with less need for new transmission lines.

Notable

- Another holdup on the U.S. renewables rollout is a labor shortage, The Wall Street Journal reports. Electricians to install EV chargers and heat pumps are booked solid months in advance, and solar developers can’t seem to hire fast enough.