The News

The GOP battle over Congress’s $78 billion tax bill is turning nastier.

That much was clear after Sen. Thom Tillis, R-N.C., thrashed House Republicans who backed the deal in a Wednesday evening Wall Street Journal op-ed, accusing them of getting “played by Senate Democrats doing the bidding of the Biden administration.”

The legislation, which would pair business tax deductions with an expansion of the Child Tax Credit, passed the House last month in a blowout 357-70 bipartisan vote. But it has met strong resistance from Tillis and some other Republican members of the Senate Finance Committee, who are seeking a chance to make their own changes — a demand supporters worry would slow the deal’s path to package with tax season already in swing, or possibly sink it entirely.

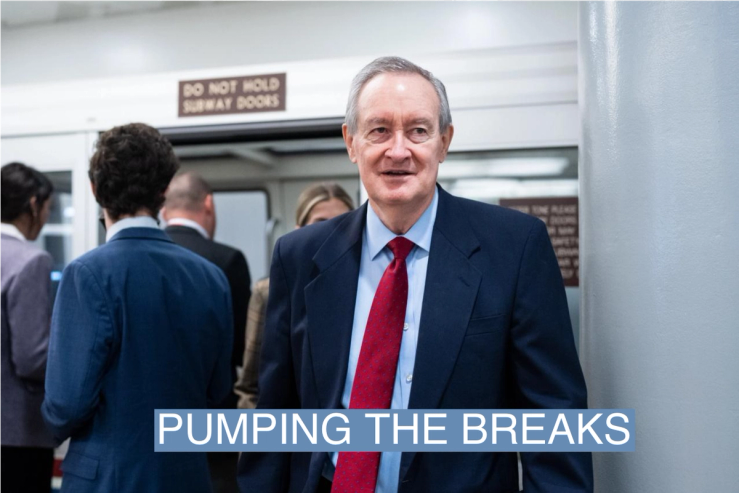

Senate Finance Republicans led by ranking member Sen. Mike Crapo, R-Idaho, met late Wednesday to discuss the legislation. Crapo also released a statement in which he castigated “efforts to pressure Senate Republicans to rubber stamp” the tax deal, calling them “counterproductive.”

Republicans on the panel appear to be split, however, after Sens. Todd Young, R-Ind., and Steve Daines, R-Mont. said recently they’d vote for the bill. Notably, Daines chairs the political arm that elects Senate Republicans.

Though Tillis acknowledged there “may be” divides on the committee, he told Semafor “there’s no question a majority of Republican members have concerns with moving forward based on the current package.”

In this article:

Know More

Some Democratic aides privately believe Crapo is slow-walking the tax package in order to kill it. Senate Finance Chair Ron Wyden, D-Ore. has pressed for speedy passage as tax filing season revs up. He seemed hesitant to entertain ideas for sweeping changes after lengthy negotiations that already involved Crapo.

“A lot of the issues that have been mentioned, we dug into them in considerable detail over seven months of negotiations,” Wyden, who co-authored the bill with House Ways and Means Committee Chair Jason Smith, R-Mo., told reporters on Thursday morning.

The bill’s Republican detractors have focused much of their criticism on a change to the Child Tax Credit known as the “lookback provision.” The reform is designed to help parents whose earnings suddenly drop in circumstances like a job loss, by letting them claim a larger benefit based on a previous year’s income. Conservatives have argued the change would disincentivize work.

“The fundamental problem with the bill is that Republicans made a major concession to Democrats—allowing the child tax credit to begin to transition into a de facto welfare program—in return for something Democrats already wanted: research-and-development tax breaks for businesses,” Tillis wrote in his op-ed Wednesday.

The lookback provision has been one of Crapo’s chief targets, as well. But in an interview with Semafor, he declined to say whether removing it would be enough to secure his support. “I’m not gonna speculate on that right now,” he said.

Crapo told Politico he’d be interested in adding other tax extenders, and further tweak the child tax credit so more of the benefit flows to working parents who pay taxes. The latter change though might cost Democratic votes.

There has been some chatter on Capitol Hill about potentially bringing the bill to the floor without Crapo’s support, but it’s unclear whether it would be able to attract enough Republican votes to pass in those circumstances. Crapo has said he’d vote it down in that scenario.

Crapo has said he himself will only bless the bill if a majority of Senate Republicans back it. “I never put deadlines,” he told Semafor when asked how soon he might be ready to reach a deal. “My timeline is I’m trying to get to the point where a majority of my caucus is supportive as quickly as we can, but I can’t tell you how fast that is.”

The View From GOP senators

Crapo also appears to be assessing the pulse of GOP senators outside of the Finance Committee. Sen. Mike Rounds, R-S.D., met with Crapo on Wednesday about the tax legislation. Asked if he supports the bill, Rounds demurred and said he will keep providing Crapo with space to negotiate.

“We had a good meeting,” Rounds told Semafor. “He’s explained what his thoughts are on it and kind of a path forward, which I thought was very reasonable. He’s doing his best to express concerns that have been given to him by members of the committee, and he wants to work through those. We’ll let him continue to negotiate.”

Others, though, are already enthusiastically onboard. Sen. Markwayne Mullin, R-Okla., said he’s close to Smith, the Ways and Means chair, and sees a benefit to getting ahead of next year’s enormous tax cliff, when Congress will need to negotiate over whether to extend expiring portions of the 2017 tax cuts signed by Donald Trump.

“I think too often we’ve decided we’re going to wait till better timing because the roses are gonna be cleaner and prettier down the road,” he told reporters. “The fact is, we’re still dealing with the same divided Congress. So we’re still gonna have a short majority.”

The View From K ST

Rohit Kumar, the Washington National Tax Services co-leader at PwC, said he believes Crapo is negotiating in good faith to assemble a bill that can pass the Senate. He added there’s been a lobbying blitz in support.

“I’ve been told that there’s been a lot of executive outreach to senators, sort of across the board — Democrats and Republicans,” Kumar, who once served as a senior aide to Senate Minority Leader Mitch McConnell, told Semafor. “I’ve also been told that there’s been a significant quasi-organized small business effort because small businesses, pass-throughs have a March 15 payment deadline for estimated taxes.”

“For them, getting it done before March 15 is really important because it changes the size of the check that they have to write to the federal government,” Kumar said.