The News

Japan’s Nikkei index closed at a record high on Monday, after hitting a milestone last week that shows years of corporate reforms are finally paying off.

Under pressure from shareholders and regulators trying to jumpstart economic growth, Japan’s sleepy corporate giants have adopted a Western-style embrace of profits. They added independent board members and began to unwind their stakes in each other, which had insulated managers from outside pressure. They bought back a record $65 billion in stock in 2023 after the Tokyo stock exchange required underperformers to “comply or explain” depressed stock prices.

International investors noticed: Foreign flows into Japanese stocks hit a 10-year high in 2023.

“Traditionally Japan worried more about employment stability and workers than shareholders,” said Bruce Aronson, a senior advisor at the Japan Center of the U.S.-Asia Law Institute. “But there’s a realization that there’s a cost to having companies that don’t take risks, that protect management. There’s a cost to innovation and economic dynamism.”

Hedge funds like Elliott Management and Third Point tried Western-style activism at Japanese companies including Toshiba and Sony with little sustained success, but are starting to rack up wins. Last year, industrial conglomerate Dai Nippon Printing announced a record stock buyback under pressure from the fund, which is now pressing its ideas at Japan’s biggest property group.

“The last piece of the puzzle: Can a foreign firm come and do a hostile takeover, or go around management that is dug-in?” Aronson said. “Sounds plausible, maybe feasible, but it hasn’t happened yet.”

In this article:

Liz’s view

In 2013, then-Japanese Prime Minister Shinzo Abe took the podium at the New York Stock Exchange, the seat of global profit-seeking, and made a plaintive pitch. “Buy my Abenomics,” he begged, and invoked, naturally, Gordon Gekko. Japan’s stock market had featured in the 1987 classic Wall Street, but in the recently released remake, it was China that beckoned Shia LaBeouf. The speech presaged a series of reforms meant to make Japan not only economically competitive but financially vibrant, and to drag its clubby, conservative trading houses into the new Wall Street age. “Japan will once again be a country where there is money to be made,” he said.

It took a decade, and Abe, who was assassinated in 2022, didn’t see the results. The Nikkei passed its 1989 peak for the first time last week. And unlike Western markets, its gains aren’t powered by startup froth or AI mania, but rather by underlying profits from the country’s blue-chip firms — the targets of Abe’s years of whip-cracking. The earnings of Tokyo-listed companies are expected to hit a record for the third straight year, according to SMBC Nikko Securities.

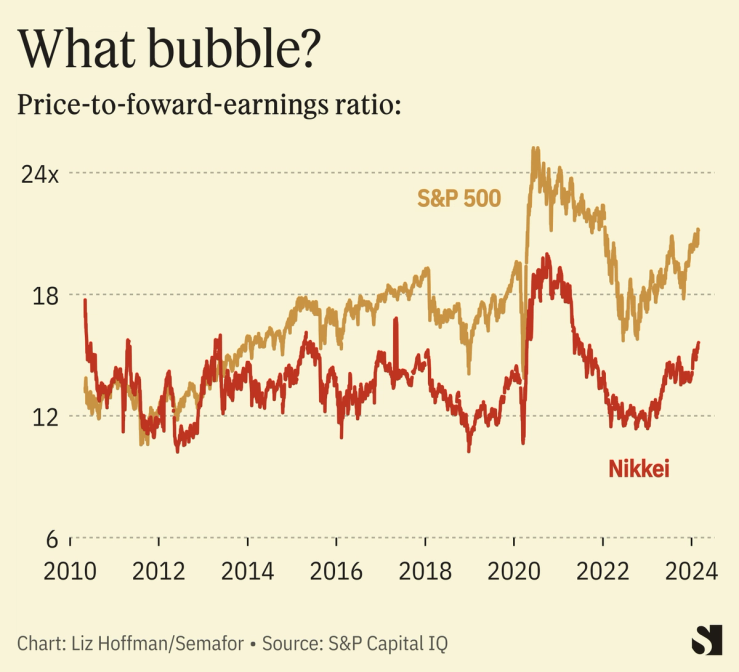

By one measure, Japan’s stocks still look cheap, meaning there could be more gains ahead. The Nikkei is trading around 15 times the annual profits of its component stocks, versus about 20 times for the S&P 500.

The View from Warren Buffett

Japanese companies’ shareholder-friendly practices are now “much superior” to those common in the U.S., Warren Buffett wrote in his annual letter last weekend. The billionaire had been an early believer and in 2020 bought sizable stakes in five Japanese trading houses. Buffett said he was up $8 billion on the investments.

Notable

- Hoping to follow in its neighbor’s footsteps, South Korea’s main financial regulator on Monday unveiled details of its program to push companies to prioritizes shareholder returns. Its effort to close the “Korea discount” underwhelmed investors who had hoped for a heavier hand, the Korea Times reports.