The News

An unusual deal announced this week between two French companies in the U.S. signals a path to more aggressively utilizing the tools of the Inflation Reduction Act — and drastically expanding renewable-energy project development in the United States.

Schneider Electric and ENGIE agreed an $80 million tax-credit transfer deal in which Schneider will partly fund four ENGIE solar and battery-storage projects in Texas. Schneider will then use the resulting tax savings to purchase 110,000 megawatt hours of renewable energy credits from ENGIE projects over the coming decade, credits that will reduce its Scope 2 carbon emissions.

“The purpose of these tax credits is to drive investment in the clean-energy economy in the U.S.,” John Powers, who leads Schneider’s renewables and carbon consulting division, said in an interview. “It’s very coherent to take the savings on those taxes and further your own decarbonization journey.”

Know More

Along with offering vast financing to goose investment in clean-tech in the U.S., the Inflation Reduction Act tweaked longstanding tax rules to help finance renewables projects. Green power developers had for years used tax-equity deals to get their projects off the ground, selling an equity stake in their project in exchange for discounted tax credits. But these tax-equity deals had largely been the province of major U.S. banks. The IRA has allowed developers to sell tax credits independently of an equity stake changing hands.

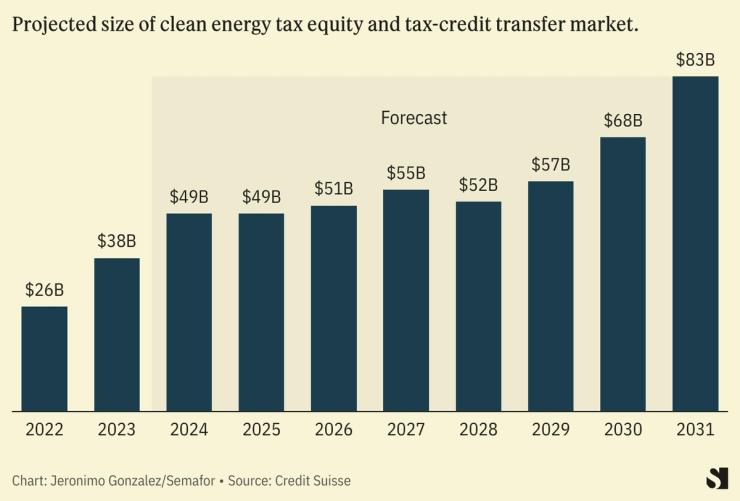

The change was meant to open up the market for tax-credit transfers, widening the available pool of potential investors to corporates as well as financial institutions and growing the overall clean-energy tax trading market, potentially to more than $80 billion by 2031 from around $20 billion now, according to a Credit Suisse analysis. So far, tax-credit transfers remain a small portion of the overall market: Senior bankers at Bank of America and JPMorgan estimated it amounted to $4 billion last year, though that figure is itself remarkable given U.S. authorities only gave detailed guidance on the new system in June. Bank of America’s head of tax equity origination said he expects “to see significant growth in the tax credit transfer market this year.”

Prashant’s view

In the context of the broader tax-equity market, the Schneider-ENGIE deal is big — some 80% of tax-credit transfers so far have been for less than $50 million, according to Crux, a marketplace for such transactions — but far from enormous, and the tax-credit transfer portion of the deal is not the first of its kind.

Its structure is, however, unusual both from a sustainability and a financial perspective. And it spotlights a fast-growing market’s broader potential.

Tax credit transfers are typically agreed with a built-in discount to account for the various risks associated with the project — that it may not develop to plan, for example. The most notable risk is that if the project fails within five years, the credit can be clawed back. Schneider did not disclose how much of a discount it received from ENGIE in their deal, but said it reinvested that sum into purchasing the renewable energy credits.

The credits can be offset against Schneider’s Scope 2 operational carbon emissions, which it publicly reports. As these disclosures become more prevalent and, in some cases, mandatory, such a transaction may become more attractive: In effect, for taxes a company is going to pay anyway, it can reduce emissions tied to its operations.

From a financial point of view, the deal also has positives. By effectively signing a power-purchase agreement with ENGIE, Schneider has helped “de-risk” its partner’s overall projects by providing a guaranteed “offtaker.” That helps ENGIE win financing for its various projects, making it less likely the various projects will fail and thus be subject to the five-year clawback.

The deal offers an example of how tax-credit trades can help finance new renewables projects, while providing a way for corporate emitters to reduce their direct emissions in the process and get a better deal on clean power.

Room for Disagreement

Tax-credit transfers are in some cases still a poorer deal for developers than traditional tax equity: Though the ultimate market for the latter may be smaller, mostly restricted to large U.S. banks, tax equity offers various financial advantages — particularly when it comes to asset depreciation — over tax-credit transfers that can be lucrative for renewables developers.

That advantage may, for the moment, be dulled by prospective regulatory changes. U.S. officials are mulling new rules that aim to increase financial stability but require banks to hold more cash for certain types of transactions, including tax equity. That, banks and renewables developers say, would destroy the current tax equity market.

Yet even if the rules do not come into force or are watered down — as many in the industry expect — the growth of tax-credit transfers offers a new financing option for the U.S. clean-energy market that did not exist previously. As Powers put it to me, banks “only have so much tax capacity, and when they’re done, they’re done.” In recent years, that capacity has been about $20 billion annually and, “if you’re the 21st billion, you’re going to have to wait until next year.”

The View From Wall Street

Assuming the proposed new banking rules carve out exemptions for tax equity, Wall Street banks see the possibility of perhaps doubling the volume of transactions they can process by partnering with corporates: In a potential $100 million transaction, a bank could take on half of the deal in tax equity, and work with a company willing to take on the rest in tax-credit transfers. The bank in that scenario would be able to maintain its tax equity capacity, but also pocket advisory fees on tax-credit transfers.

Notable

- My colleague Liz Hoffman scooped last month that big Wall Street banks are thinking the unthinkable: suing the Fed over the proposed new banking rules.