The Scoop

A bipartisan Senate bill is taking gentle aim at setups popular among tech companies that give insiders voting control, pouncing on the building mistrust over how AI is being wielded.

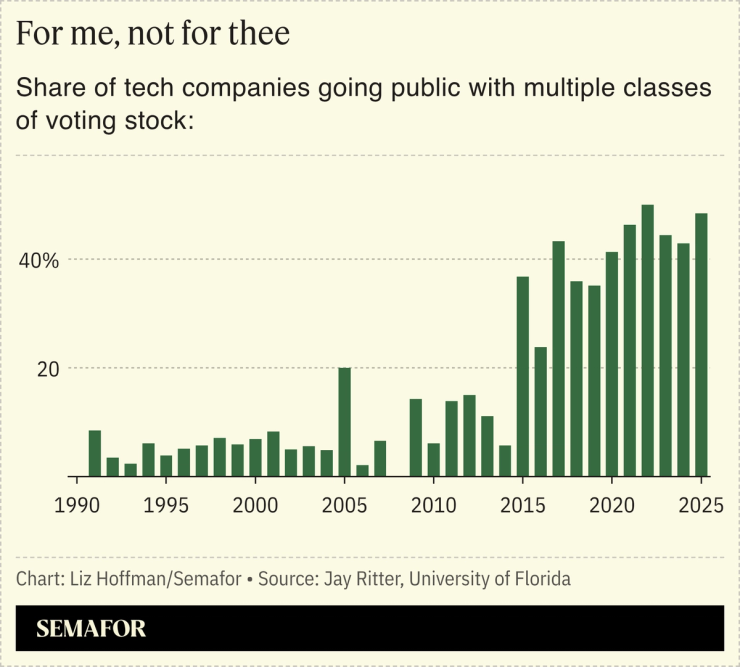

The bill, introduced by Sens. Ruben Gallego, D-Ariz., and Mike Rounds, R-S.D., would require companies to give shareholders more information about separate classes of stock that carry extra votes in corporate elections. A record 41% of companies that went public last year carried such dual-class setups, according to data compiled by Jay Ritter, a professor at the University of Florida.

Though they aren’t legally required to — a loophole the Senate bill seeks to close — most big companies disclose the voting control of insiders, which can often be far higher than their economic ownership. Mark Zuckerberg, for example, controls 61% of Meta’s voting power despite owning 13% of its shares (a fact clearly stated for shareholders.)

In 2018, a panel of investors that advises the Securities and Exchange Commission recommended more transparency, calling out Nike, Snap, and other companies for leaving shareholders guessing about how much power they had.

Know More

A similar bill passed the House of Representatives in 2023, but later stalled. Now, the presence of a Republican cosponsor on the Senate bill is notable — Rounds has been pretty critical of big tech companies. Exchanges can regulate dual-class stock but have largely abandoned their listing standards in the face of competition for IPO fees: NYSE scrapped its “one share, one vote” policy in the 1980s, and Hong Kong, Singapore, and London have abandoned their prohibitions over the past decade.

One obstacle to more regulation, Ritter said, is that dual-class stocks outperform their more democratic rivals. “If investors had gotten burned, they would demand a big discount” to hold shares with less voting power, he told Semafor. “But it’s worked out great for everyone.”