10 Minute Text

Allbirds’ CEO on his stock price, San Francisco, and why ESG ratings are “broken”

Allbirds charmed techies with its wool and eucalyptus sneakers and went public in the frothy market of 2021 banging the sustainability drum. Now it’s caught up in the tech-stock selloff and headquartered in a San Francisco that’s bordering on ghost town.

CEO Joey Zwillinger, who spent five years at a startup that programmed algae to turn sugars into oil before co-founding Allbirds, answered my questions on all of the above.

Liz Hoffman said:

L: Hi Joey – thanks for doing this. First off, can you send a selfie and tell me where you are?

Joey Zwillinger said:

Oh, sorry. Did you mean my face?

Joey Zwillinger said:

I’m in my backyard escaping my kids.

Liz Hoffman said:

L: Very on brand

Joey Zwillinger said:

J: Always...

Liz Hoffman said:

L: So this is a rough chart. You’re trading like a tech stock. But you make shoes. What’s going on?

Joey Zwillinger said:

J: Been a very tough year in the capital markets, particularly for companies that went public in late 2021. That said, if we measured ourselves with short term stock market results, we’d both go crazy and lose sight of the once in a generation opportunity this brand has.

Liz Hoffman said:

L: Any regrets about going public?

Joey Zwillinger said:

J: Nope. I regret not sleeping as much, but we’re increasing our discipline after only six years of life (5 before IPO) and we have a lot of cash to help build the brand.

Liz Hoffman said:

L: We’ve seen a bunch of direct-to-consumer brands opening physical stores — Warby Parker, Everlane… I think you have ~50 stores now. Does that say something about the limits of e-commerce?

Joey Zwillinger said:

J: So different by category.

---

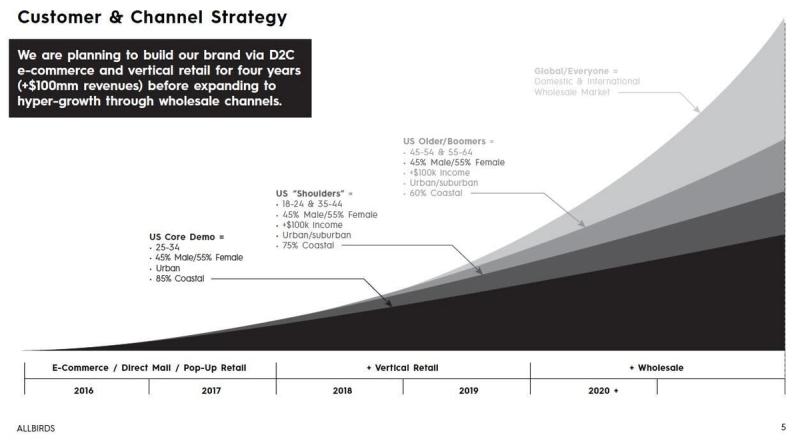

Let me find this chart I gave one of our first investors back in 2016… hang on…

Joey Zwillinger said:

Liz Hoffman said:

L: Coming with receipts... So are stores for you more transactional like a bank branch or experiential like Apple stores?

Joey Zwillinger said:

J: We have always been a brand. A distribution channel does NOT define our company.

Joey Zwillinger said:

J: What I tried to share in that chart back in 2016 was that to reach a broader audience, we would need to have stores and wholesale partners… with +80% of shoes being bought in physical stores, there’s no way around it really.

--

(I’ve never shared that chart before btw 😊)

Liz Hoffman said:

L: That’s what we at Semafor call a scoop.

Liz Hoffman said:

L: Allbirds has been leaning into performance footwear. Are you going to be signing up athletes for endorsements and making signature shoes?

Joey Zwillinger said:

J: We have incredible performance products, but it takes a long time to crack the psyche of the runner. Our sweet spot has always been, and remains lifestyle footwear!

Liz Hoffman said:

L: You did a small layoff in August, ahead of the wave we’re seeing now. Were you just early or is there more to come?

Joey Zwillinger said:

J: Being primarily a direct retailer (digital + ~50 stores), we see what’s happening in the economy immediately… no one between us and the consumer, and I think we simply saw the trends and acted quickly.

Liz Hoffman said:

L: Here’s a headline from an NYT story today that paints a pretty bleak picture of downtown San Francisco, where you’re based. Is it that grim?

Joey Zwillinger said:

J: It’s still very slow downtown for sure. But I’m an optimist. The tech sector seems to be getting hit the hardest here, and SF is the epicenter of tech. I think there will be a shift to other industries — it’s beautiful and multi-cultural, and I hope the next chapter can be even more dynamic, if a bit less concentrated with people in tech.

Liz Hoffman said:

L: OK one last one (I stopped the clock while you were digging up that deck. It’s like soccer.)

--

You guys tried to go public via an “SPO,” an eco-friendly spin on the IPO. You ran into some SEC pushback on the marketing, but you’ve been very vocal about those principles.

--

a) what are you doing on that front and b) do you think the current public-co framework is flexible enough for this moment in corporate ESG?

Joey Zwillinger said:

J: We did use the SPO! Just agreed to a little name change with the SEC. Our commitments that we’re tracking to well make us best-in-class in ESG. Anyone investing in our stock can be assured that they are putting capital to work in a way that takes a balanced view for multiple stakeholders (like the environment!), and not just one penny more of profit at all costs.

Joey Zwillinger said:

J: The blowback is coming from how ESG is rated, which I agree with the critics, is totally broken. If Exxon is an A+ on a top ratings agency, you don’t need to do too much more research than that.

Liz Hoffman said:

L: All right that’ll do it. Thanks for the time.

Joey Zwillinger said:

J: Thank you, Liz!