The News

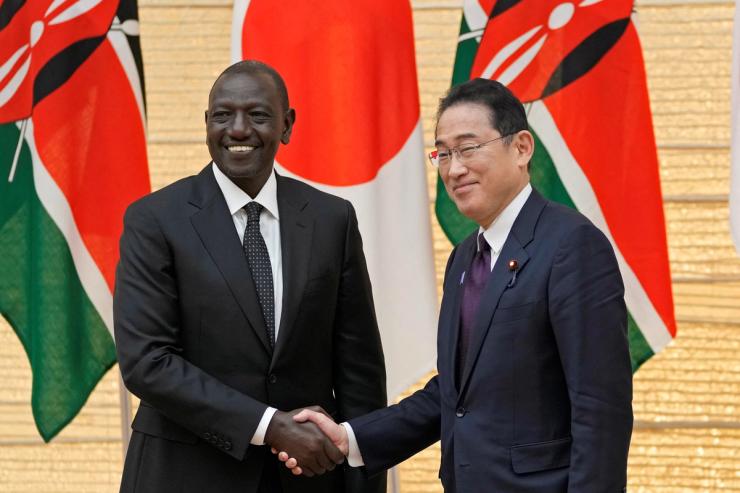

Kenya secured more than $2 billion in financial commitments from Japanese investors during President William Ruto’s visit to Tokyo this week, officials said.

Most of the investments will fund infrastructure and energy projects across the country, turning it away from Chinese investment that has historically helped fund these sectors. China’s struggling economy has dried up its financing in Kenya in recent years, and Nairobi is struggling to repay the debt Beijing has left behind.

SIGNALS

Japan sees Kenya as EV production hub

With Kenya heavily reliant on expensive oil imports, electric vehicles are becoming a more popular option in the country. The total number of EVs in the country remains small, according to the Japan External Trade Organisation , but the last two years have seen several startups focusing on electric bus production that could address the problem of one of its most popular, yet highly polluting forms of public transportation — private minibuses. Kenya, like other African governments, is also hoping to replace the high number of used vehicles in the country with new, locally-produced cars, according to African Business Partners, a Japanese advisory firm. Japan’s deal with Ruto devotes $470 million to EV production and geothermal initiatives, according to Zawya finance news, with Toyota investing another $5 million into vehicle manufacturing.

Chinese investment is devaluing Kenya’s currency

Chinese investment has helped Kenya’s economy grow, but it has not translated to local cash flow, one economist told the Kenyans newspaper. “Money never arrives in Kenya,” he said, because both the financier and contractor for infrastructure projects are Chinese, so the investment never directly involves local businesses. Still, Kenya ultimately must pay the loan after the maturity period, which requires Nairobi to buy more dollars because of its already shallow foreign reserves, devaluing the Kenyan shilling. The devaluation means it is becoming more expensive to pay off foreign debt, according to the China Global South Project.

China risks losing global influence as Belt and Road initiative buckles

Many of Beijing’s Belt and Road Infrastructure (BRI) projects have failed to earn the returns analysts predicted, leaving several underdeveloped countries in a “debt trap.” But this predatory lender scheme is reminiscent of when Western multinational corporations sought to collect on bad debts throughout the 20th century, antagonizing much of the Global South, according to Foreign Affairs. “Beijing risks alienating the very countries it set out to woo,” the magazine wrote. This debt is also putting strain on lenders, notably the International Monetary Fund, as developing countries ask for money to repay Chinese debt. Rather than dissuading these nations from accepting Chinese loans, Western lenders should play a more active role in BRI deals to ensure transparency and prevent the IMF from having to step in, Foreign Affairs argued.