Wild gyrations in commodities prices are having huge impacts on economies the world over.

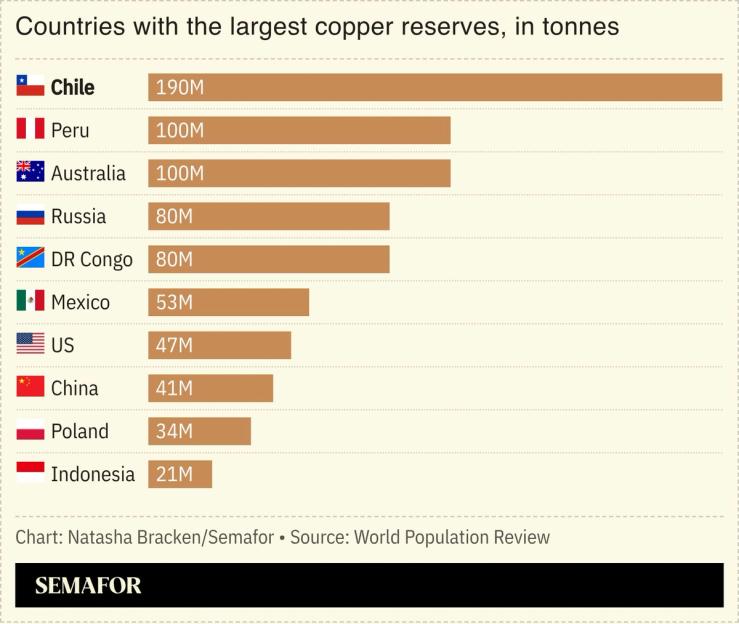

Though copper prices have dipped recently, the metal’s months-long surge has been a boon for Chile, where it accounts for around a tenth of GDP: The country’s incoming finance minister intends to eliminate a fiscal deficit while slashing corporate taxes, and Goldman Sachs upgraded its forecast for Chile’s economic growth this year and next.

Yet exposure to commodity prices also means governments are vulnerable to swings in global markets. African stocks, bonds, and currencies all came under pressure this week as gold and silver plummeted, Bloomberg noted, warning that “windfalls can vanish just as fast as they appear.”