The Scene

Saudi fintech Hakbah is pushing to formalize one of the region’s oldest financial habits, jameya savings circle, as the kingdom prepares a new National Savings Strategy aimed at bringing more household money into the banking system.

Founder Naif Almutairi told Semafor the platform, which digitizes traditional group savings, now has more than 2 million registered users. Hakbah has been operating since 2020 under the Saudi central bank’s regulatory sandbox while awaiting dedicated rules for savings products.

Those rules are expected this year and will include initiatives like retail savings bonds, creating a clearer framework for platforms like Hakbah. “We need regulation for savings, not just for jameya,” said Almutairi.

Know More

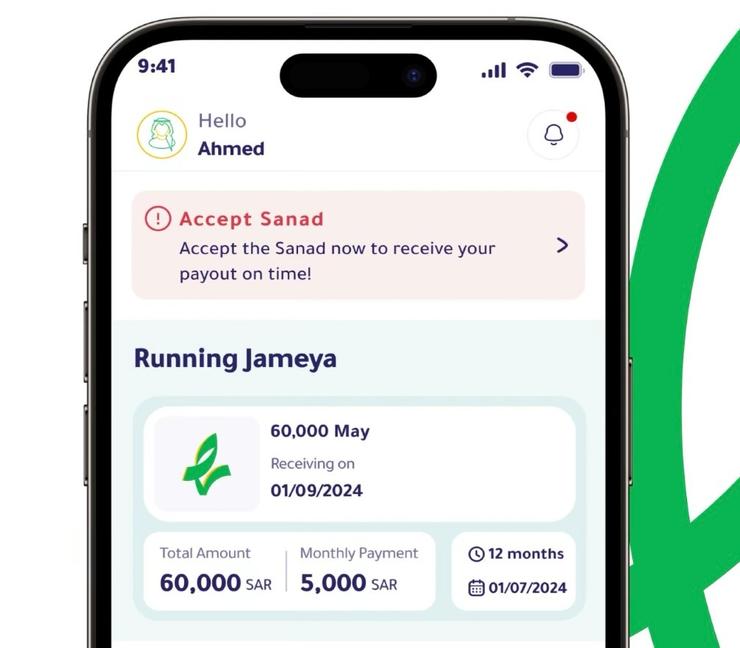

Traditionally, individuals involved in a jameya circle pool together their monthly contributions, with members taking turns to receive a lump sum. Hakbah recreated the system digitally, matching users with cycles of different amounts and durations: Shorter ones spike before Ramadan and Eid, while demand for education-focused cycles surges in September. Others cover weddings, travel, or big household expenses.

Hakbah’s bet is that Saudis’ saving behavior doesn’t look like that of their Western peers. “In the West, people save for retirement,” Almutairi said. “Here, we save for living.”

The company’s user base reflects that reality. Around 70% of customers are between 23 and 37, and some are as young as 18, saving a few hundred riyals a month for a phone, tuition, or a computer. “That’s saving to spend, but it builds the habit,” he said.

Almutairi said the potential market goes far beyond traditional bank customers, from housewives with informal income, to university students, freelancers, and employees at small businesses who lack access to credit.

Notable

- Saudi Arabia is making a fresh bid to become the region’s fintech hub, targeting 500 licensed firms by 2030, up from under 300 today, as it opens up digital asset licensing and draws funding.