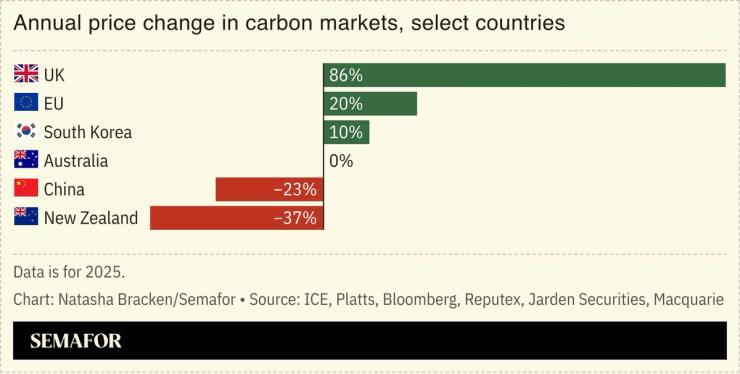

Carbon markets are increasingly reflecting regional policy decisions rather than global changes in emissions, new research showed. In Europe, for example, that shift translated into higher prices: EU carbon prices rose by around 20% over the course of 2025, driven by forecasts of tighter permit supply and slower-than-expected decarbonization, according to investment bank Macquarie. The UK’s carbon market was also a strong performer, with traders anticipating a future link to the EU system that would allow permits to trade interchangeably across both markets.

Policies in New Zealand, by contrast, pushed carbon prices way down after the government moved to de-link its system from international climate commitments, reducing confidence that carbon permits there would become scarcer over time. Australia’s market showed a similar outcome through different mechanics, with the market there weighed down by strong issuance of carbon credits.