The News

Goldman Sachs’ 450 partners are heading to Miami next week for a four-day offsite that will test CEO David Solomon’s hold on the firm amid a swirl of bad headlines and growing angst.

The annual gathering is, in good years, a chance to brief partners on strategy and reinforce camaraderie. Goldmanologists read tea leaves on which executives are given which speaking slots, and guest speakers share their views (Marketing professor and commentator Scott Galloway came last time.)

This year, Solomon will face a partnership as restive as at any point in the past decade, maybe ever. Despite its second-best ever revenue year and unchallenged dominance in its core businesses of dealmaking and trading, profits and pay were down sharply.

The firm is retreating from its expensive push into consumer banking, a business now being investigated by regulators. Deep layoffs have rattled managers. An Economist cover story — headline: “Goldman Sags” — has been widely shared internally since it came out last week, an unsparing look at a firm “trapped by its own mythology” of untouchability.

“Goldman Sachs’ partnership is the fabric of our franchise, and will continue to be at the center of the firm’s history and culture for the next 153 years and beyond,” Ericka Leslie, who co-chairs Goldman’s partnership committee, said in a statement.

In this article:

Liz’s view

Goldman went public in 1999 and basically pretended it hadn’t.

It issued bare-bones earnings reports — it made heaps of money, and how it did so was hardly shareholders’ concern — and did little of the long-term strategic planning, budgeting, and public narrative-setting that is basic grown-up public company stuff. And it ran itself as a kind of Marxist collective for the benefits of its partners, even as it replaced their capital with that of public shareholders.

Solomon has moved to change that. He’s held investor-day presentations and tilted profits toward shareholders, trying to close a widening gap between Goldman’s share price and that of its closest peers.

He trimmed the partnership, which had swelled to more than 500, padded by compliance and control staff promoted in a round of post-2008 virtue-signaling. And he moved to professionalize Goldman, which once ran as a loose collection of fiefdoms, in other ways, setting strategy from the top and treating the partnership less as a sounding board and check on his power than a powerful recruitment tool.

So it’s worth questioning why it exists at all, especially now as its mood is tense and its loyalty feels fragile.

The partnership is a carry-over from Goldman’s past, when top employees risked their own money to finance trades and underwrite securities. When a new class is selected every two years, the inevitable headlines declare them the happiest people on Wall Street.

At its best, the partnership is a cultural glue that reinforces a surprisingly collaborative ethos, and a tantalizing reward that keeps employees hustling. “Don’t tell my wife this, but being made partner was the greatest moment of my life,” is a quote widely attributed to former CEO Lloyd Blankfein that he almost definitely never said, though others have. (More from him below.)

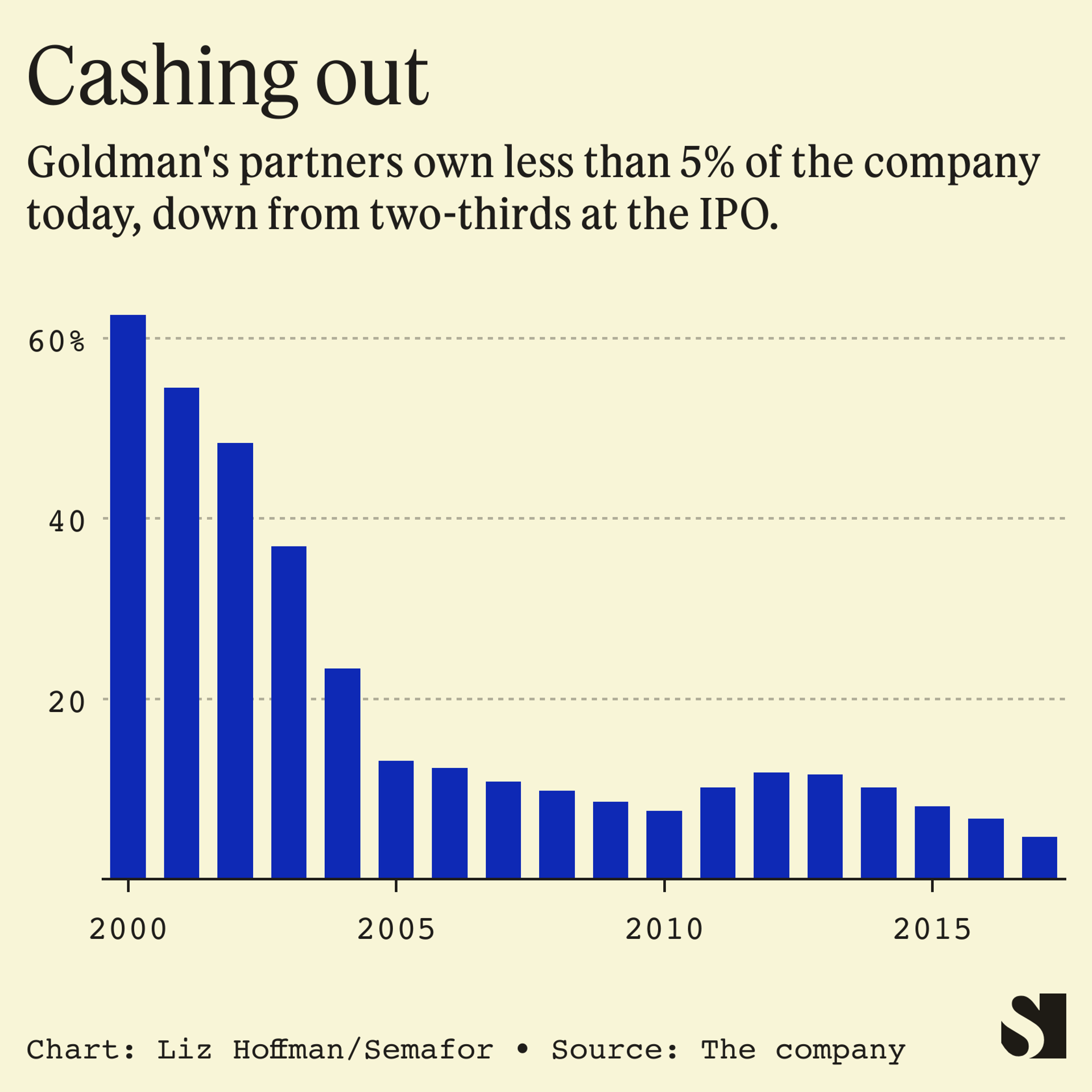

But that glue is starting to flake. Partners today own just a token slice of the firm, whose shareholder registry is now topped, like most other public companies, by BlackRock and Vanguard. Solomon’s overdue push to make Goldman into the Fortune 50 company it is makes sense in today’s corporate world, but has contributed to a dwindling sense of cohesion.

Falling compensation hasn’t helped, and a series of executive reshuffling — the latest will see the co-head of its asset-management arm leave the post, according to people familiar with the matter — has contributed to a feeling of chaotic musical chairs and drifting strategy.

Even as he reined in the partnership, Solomon has tried to make it more special, for example by offering access to exclusive funds. And he has reinforced the firm’s alumni network, an enviable list of financial and business elite.

But more recent attempts to shine up the brass ring have clanged off the rim. A wider group of partners were given stakes in Goldman’s private funds this year, but have groused about its long-dated — they’ll start getting profits in eight years — and uncertain value. Many would rather have the cash.

Room for Disagreement

There’s a reason Goldman maintains its recruiting edge and cache on Wall Street, and it’s not its profitability or stock price, both of which have lagged competitors in recent years. Blankfein points to the partnership, which he says has helped Goldman keep its identity and edge in a Wall Street that’s changed dramatically since 1999.

“I could lay it all out for you, how it’s been maintained for almost a quarter century post-IPO, but it would take a book,” he told me. “The benefits are confirmed by the firm’s ability to attract and develop talent, and the success of its alumni and the pride they take in their history and continued relationship with the firm.”