The News

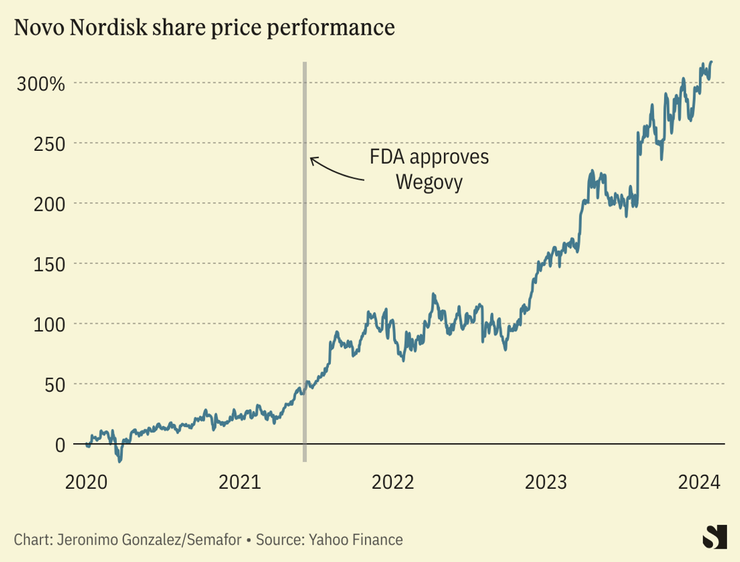

Danish pharma giant Novo Nordisk reported its highest annual profit in decades last year — a 51% jump from the year prior — driven by sales of its blockbuster weight-loss drug. Wegovy, also sold as a diabetes treatment under the name Ozempic, has become highly sought-after, securing Novo Nordisk’s place as Europe’s biggest drug company with a more than $500 billion market capitalization. Ozempic alone accounted for 41% of Novo’s total sales in 2023.

The drug has become so popular that the U.S. is experiencing a shortage of its main ingredient, semaglutide, and Novo restricted starting doses for new patients last May to make sure existing patients could continue treatment. Novo executives announced Wednesday that they plan to ramp up production through the year, hoping to alleviate supply pressures.

The medications use compounds known as GLP-1 drugs to signal fullness to the patient’s brain and suppress their appetite. Some Wall Street analysts predict GLP-1 drugs are on track to become the best-selling class of drugs of all time.

SIGNALS

Doctors worry about Ozempic’s reputation as ‘vanity’ drug instead of diabetes treatment

Ozempic and Wegovy are so coveted for off-label use, or prescribing the drugs for a non-FDA-approved purpose, that doctors say it’s getting difficult for patients who need the drugs to access them. “It’s been really, really terrible — patients don’t know where to turn,” one endocrinologist told The New York Times, expressing concerns that the drug will be associated more with “vanity” than a critical medication for diabetes patients.

Ozempic is approved for people with Type 2 diabetes, and Wegovy is for adults with obesity or excess weight with at least one “weight-related condition” such as high blood pressure or high cholesterol. It’s also expensive — a 28-day supply of Wegovy costs more than $1,300 without insurance — and the results might not last after a patient stops taking the drug.

Fake Ozempic could be putting patients at risk

As Ozempic’s popularity skyrockets, copycat drugs have flooded the marketplace. These knockoffs, called compounded drugs, aren’t approved by the Food And Drug Administration, but can be legally manufactured during an official drug shortage. Doctors warn that the untested drugs could be mixed with unsafe ingredients, and the FDA cautioned people against using compounded versions of Ozempic, Wegovy, and similar drugs in May.

“Compounding medicines with this particular type of medication is literally the wild wild west, there’s a lot of anything goes,” one doctor told a San Antonio TV station. Novo filed two lawsuits last year against compounding companies accusing them of copying its patented semaglutide formula, and warning that their drugs are “potentially unsafe and ineffective.”

Ozempic maker welcomes competition in weight-loss drugs market

Treating obesity effectively is going to take more than one company, Novo Nordisk CEO Lars Fruergaard Jørgensen told CNBC, saying he welcomes healthy competition that’s “a win-win for not only the two companies, but also for society.”

Other drug companies are entering the weightloss market, which could help push down the cost of Ozempic. Eli Lilly’s Zepbound is already available, while a new drug by Danish biotech firm Zealand is in late trials, and pharma giants Roche and AstraZeneca have both reached agreements with companies developing new treatments for weight loss and diabetes. Since these medications have to be injected, the race is on to develop a pill version. Pfizer recently abandoned its efforts to produce a weight-loss pill after trials showed significant side effects.