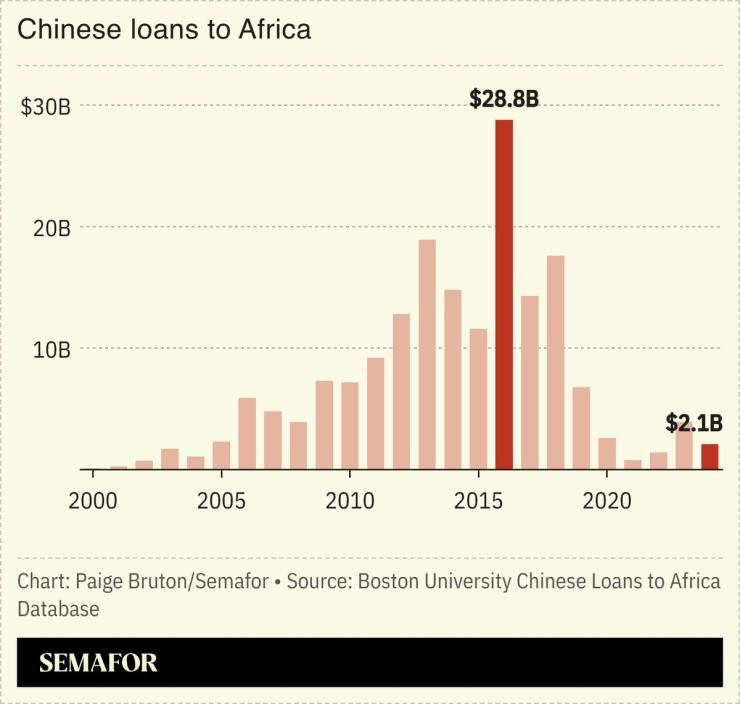

African nations now send more money to China in the form of loan repayments than they receive in new borrowing from the world’s second-biggest economy, signaling the stark shift in Beijing’s strategy on the continent.

China began accelerating lending to African nations two decades ago, with annual loans peaking at almost $30 billion in 2016. However, under-performing projects and economic mismanagement led several countries to default on their loans, with China pulling financing in response.

Yet Beijing remains keen on expanding its footprint in Africa as competition with the US for access to critical resources heats up: Chinese foreign direct investment in the region has boomed, growing almost tenfold in the two decades to 2024.