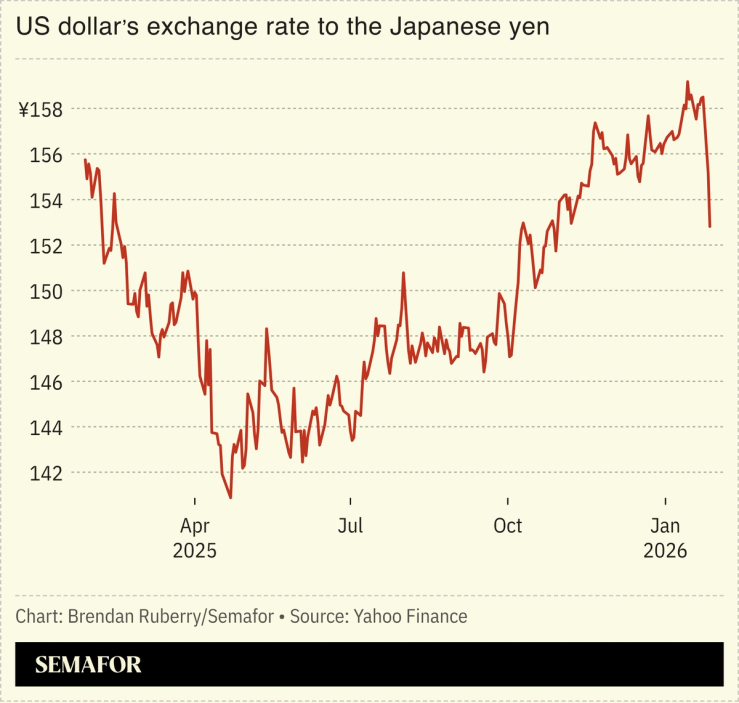

Japan’s currency strengthened Tuesday as speculation simmered that Japanese and US authorities could intervene after a sharp slide in the yen.

Such a coordinated step — which could involve the US buying Japanese assets — is rare and remains unlikely, analysts said. Unilateral moves by Tokyo are more likely: Last week’s sharp yen selloff was fueled by concerns over Prime Minister Sanae Takaichi’s spending and tax cut proposals, and she is eager to get through a Feb. 8 snap election “without markets blowing up,” Bloomberg wrote.

A Brookings economist, though, argued that the yen’s best hope is for the Japanese government to sell assets to pay down its debt, which is the highest among the world’s major economies: “The only way to get there… is for things to get worse before they can get better.”