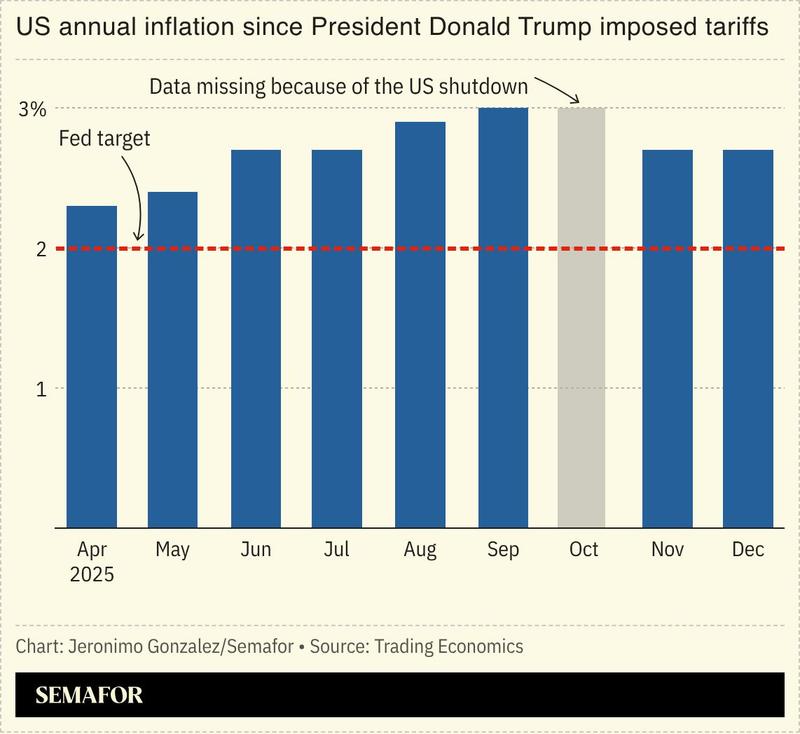

A growing number of experts warned of the risks of inflation accelerating in the US, even as markets bet that policymakers will lower borrowing costs.

Traders are pricing in at least two cuts this year, believing the Federal Reserve will prioritize a soft labor market. But inflation could yet worsen, two leading economists warned in a LinkedIn post, projecting it could top 4% in 2026, while Germany’s Kiel Institute projected that the Trump administration’s tariffs meant “US companies will be confronted with shrinking margins and consumers with higher prices in the long run.”

In a note to clients, the investment firm Bridgewater warned that rising protectionism and the race to build out AI infrastructure were both likely to drive inflation.