The Scoop

The Biden administration dramatically curtailed meetings with corporate executives, a retreat that helps explain CEOs’ embrace of Donald Trump and deepened a rift between Democrats and key centrist donors, according to a Semafor analysis of government data.

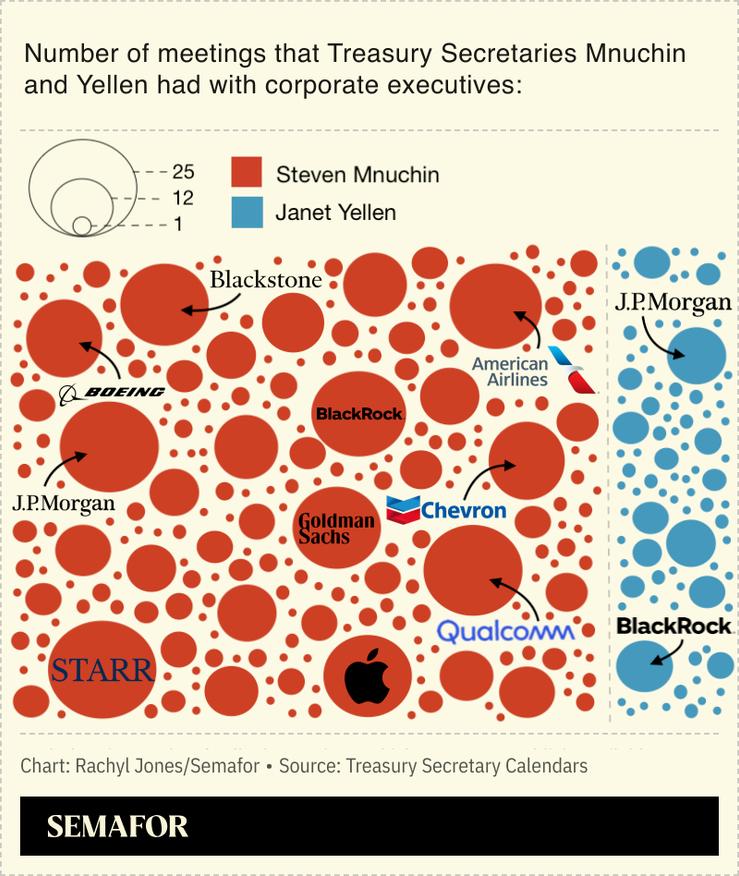

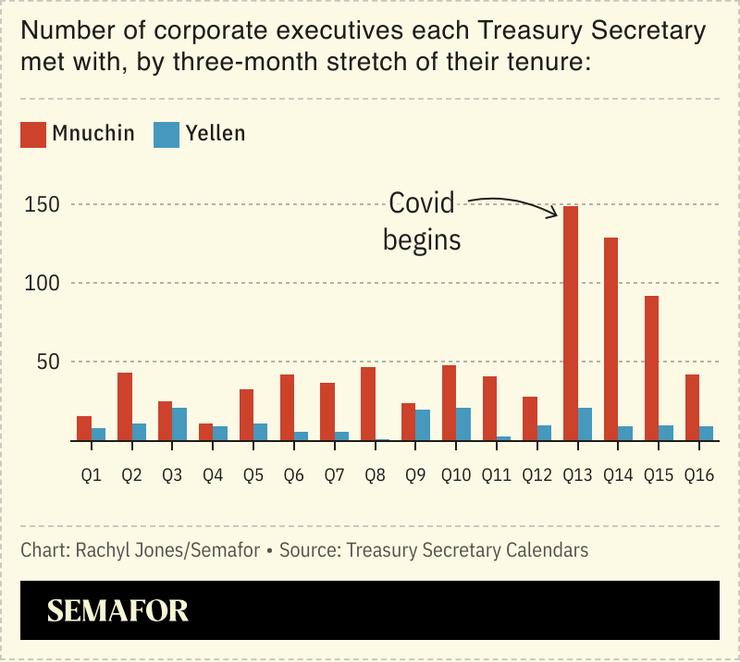

Former Treasury Secretary Janet Yellen met with executives far less frequently than her predecessor, Trump appointee Steven Mnuchin, a review of public calendars shows. Excluding the final year of their respective tenures, when the pandemic saw Mnuchin in frequent touch with airline and bank CEOs, he logged three times as many meetings and official conversations with corporate executives as Yellen.

The numbers undergird a deep tension between the business community and Biden administration that — even by Democratic standards — had relatively little interest in their input. And it helps explain the reception Trump has received from CEOs trekking to Mar-a-Lago and the White House, bankrolling inauguration parades, and praising his economic agenda.

Trump understands that business “has a dynamism that can overcome mountains,” Pfizer CEO Albert Bourla told Semafor. “He said, ‘I’ll put my money on you…on the private sector.’”

Biden called Bourla a “good friend” in 2021 and championed the Covid vaccine that made Pfizer billions of dollars and helped cement Bourla’s legacy. But the CEO is now unsparing in his criticism of the former administration.

“They were vicious to business. They were ideologically committed to hurt business,” he says. Among his list of complaints were terms in the Inflation Reduction Act that capped the prices of certain prescriptions and an “unacceptably” hostile antitrust regime.

Treasury’s public schedules are an imperfect but telling measure of an administration’s priorities. The secretary is a conduit to the private sector, whose market intelligence and investment plans can signal the direction of the economy.

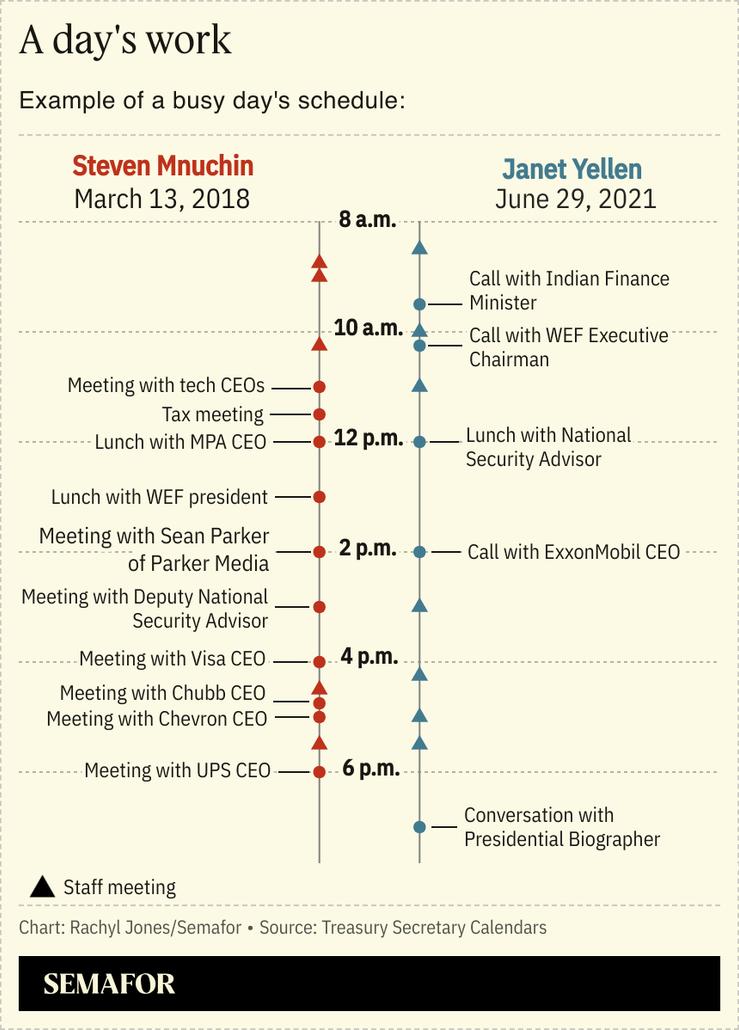

In all, Mnuchin logged 808 meetings with corporate executives, averaging one every other day, his calendar shows. A typical week, in March 2018, included sit-downs with the CEOs of Apple, Boeing, Visa, Chevron, UPS, and insurer Chubb, along with Hollywood superagent Ari Emanuel. When the stock market turned volatile that December, he spent the Sunday before Christmas on the phone with the CEOs of the six biggest US banks.

Yellen averaged less than one formal interaction with corporate executives per week, 176 in total. She spoke most frequently with JPMorgan Chase’s Jamie Dimon and BlackRock’s Larry Fink, though Mnuchin still spoke to both men more frequently.

In this article:

Know More

Democrats’ relationship with big business never recovered from the aftermath of the 2008 crisis, which coincided with Barack Obama’s presidency and riled up anti-corporate sentiments. While popular personally among the centrist set, Obama’s charged rhetoric and ban on lobbyists deepened the rift.

“There was a bit of a hangover from the Obama administration where they had pretty strict rules around meeting with people who were lobbying,” said Zach Butterworth, who served as Biden’s liaison to the private sector from 2021 to 2023. “We didn’t have that rule, but people assumed their meetings wouldn’t be granted, creating some friction there.”

Soaring inflation and accusations of price gouging flamed those tensions, as did the Biden administration’s crackdown on corporate mergers. “A lot of the antitrust work that we did left folks both in the cross-hairs and out of the cross-hairs feeling attacked,” Butterworth said.

As Silicon Valley Bank collapsed in March 2023, Yellen didn’t speak with any bank CEOs. She spent the day before her “Face the Nation” appearance, which did little to calm the panic, talking with senior White House officials and Democratic Congressional leadership. (She did meet the following week with several financial CEOs and helped broker a private-sector rescue of First Republic.)

CEOs have cheered the appointment of Scott Bessent as Trump’s Treasury secretary, confirmed by the Senate today. Wall Street sees the former hedge fund manager as a tempering voice on some of Trump’s less market-friendly positions and hope he will work to narrow the federal deficit.

“The breadth and depth of our capital markets, along with predictable pro-growth tax policy, and smart, updated regulation will continue to make America the most popular destination in the world for starting, growing and taking public a business,” he said earlier this month during his confirmation hearing with the Senate Finance Committee.

Methodology

Semafor reviewed more than 1,200 pages of Secretary Mnuchin’s and Secretary Yellen’s publicly available calendars, which include official meetings and discussions. The data captures one-on-one engagements as well as those with a few executives present. It doesn’t include events where the Secretaries addressed large groups of executives, such as trade association meetings, and may not capture sporadic encounters that aren’t retroactively added to the schedule.

Liz’s view

The private sector was wary of Trump on the way in, but grew to like his commercial approach to governing. The president would float something, CEOs would call up Mnuchin at Treasury or Gary Cohn at the White House or Jay Clayton at the Securities and Exchange Commission and explain why that idea was unworkable and offer some fixes. The final product would land somewhere in the middle of that bid-ask spread. It was governing by “hoot ’n holler.”

Those channels of communication went quiet under Biden, who appointed mostly academics and tenured government officials with limited private-sector experience. As the Democratic Party lurched leftward, contact with CEOs was seen as a political liability.

They look to be crackling back to life, which helps explain the genuine enthusiasm among the corporate set. (So, of course, does the promise of deregulation.) My guess is that a look back, in a few years, at Scott Bessent’s calendar will bear that out.

Room for Disagreement

Yellen was able to marshall the private sector when it mattered, helping to broker an industry rescue of First Republic that put a stop to the regional-banking crisis in 2023, the most critical market test of her tenure.