The News

Chinese lending to Africa has plummeted, new data showed, reflecting a shift in focus to strategic investments on the continent and a lower risk appetite for financing infrastructure projects.

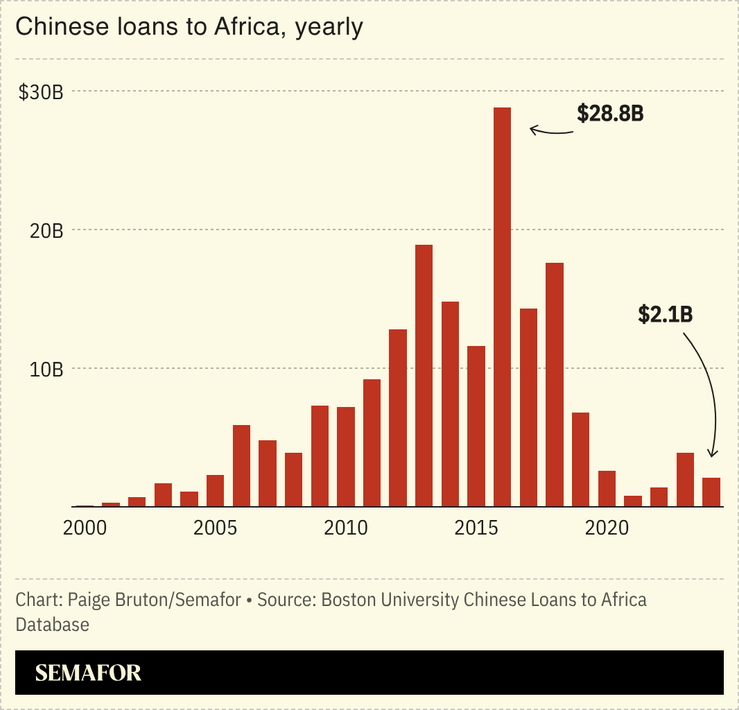

Beijing’s total lending in 2024 amounted to $2.1 billion, down by more than 90% from its 2016 peak, a report by Boston University’s Global Development Policy Center showed. And Chinese loans to Africa fell by nearly half in 2024 compared to the previous year.

The downward trend began when Chinese loans to Africa fell sharply by more than 60% to $6.8 billion in 2019, around the onset of the COVID-19 pandemic.

Chinese loans to Africa have averaged just above $2 billion since 2020, having reached $10 billion or more between 2012 and 2018, Boston University’s database showed. The decline stems from more restraint by Chinese lenders, and borrowing constraints in Africa tied to continued post-pandemic shocks, debt restructuring efforts, and an increasingly volatile international order, said Mengdi Yue, a researcher at Boston University’s Global Development Policy Center.

“Chinese banks lent so much in the past decade but are becoming more risk-averse because not every sum has been repaid,” Yue told Semafor. The lenders are feeling increased “pressure on their balance sheets and do not want so many non-performing or unpaid loans,” she said.

In this article:

Know More

Angola received nearly 70% of total Chinese loans to Africa in 2024. Most of it was a $690 million commitment from the Export-Import Bank of China for a decade-old coastal road project to transform the capital, Luanda.

The southern African oil producer has been the biggest beneficiary of Chinese loans to Africa, having received more than a quarter of the $180 billion lent to the continent since 2000. Most Chinese loans to Angola are for energy projects, as has been the case with the overall Chinese lending to Africa.

But Chinese energy lending to Africa has stayed flat for years now, according to Boston University’s database, with just one loan commitment to the sector in 2024. And beyond the fall in funding amounts, a mark of the evolution in Chinese-Africa lending is that lenders are increasingly denominating loans in yuan instead of the US dollars. Yue and her colleagues noted that all of Kenya’s infrastructure loans in 2024 were in yuan, a change from the East African country’s dollar-denominated borrowing in the 2010s.

While lending in yuan may reduce African countries’ exposure to dollar volatility and lower interest rates, the shift may pose new risks for countries that have not built up reserves in the Chinese currency, said the Boston University researchers.

The View From Abuja

A decline in Chinese lending for African infrastructure could increase interest from the United Arab Emirates or the Islamic Development Bank, said Ovigwe Eguegu, an analyst at policy consultancy Development Reimagined. It also could revive attention to a possibly larger role for the US in African infrastructure financing.

“Governments across the continent always looked to US and US-led institutions like the World Bank and IMF. But whatever was achieved with those organizations was far below what the continent needed, and their conditionalities made their financing unattractive,” Eguegu told Semafor.

The International Development Finance Corporation was launched in US President Donald Trump’s first term, as Chinese infrastructure investment in Africa was increasingly framed as a resource grab. But while spurring expectation that the US would be inspired to match China’s commitment to Africa infrastructure development, “what has become obvious is that substance hasn’t matched rhetoric,” Eguegu said.

Notable

- China’s trade surplus with Africa grew 65% last year to a record $102 billion, according to Chinese customs figures, driven by a 26% surge in exports to the continent to $225 billion. African exports to China grew 5.4%.