The Scoop

Ukrainian energy companies are running short of funds to recover from attacks, and are concerned that crises over Venezuela and Greenland are drawing political oxygen away from their country as they try to hammer out big new energy deals with the US.

Several of the country’s top political and private-sector energy leaders met for breakfast this morning in Davos, while the latest massive attack by Russia against energy infrastructure in Kyiv and elsewhere was still ongoing. If relentless power and heating cuts are meant to break Ukrainians’ resolve, they aren’t working, Sergii Koretskyi, CEO of the state-owned gas company Naftogaz, told Semafor: “We are staying strong, and will not give up.”

But Ukraine still needs far more Western financial support to rebuild and to buy more imported gas, especially from the US, he said. And although US President Donald Trump and his Ukrainian counterpart Volodymyr Zelenskyy are due to meet here this week and possibly sign a new deal for Ukraine’s recovery, the mood behind closed doors among energy industry leaders isn’t optimistic, Koretskyi said. In a Monday night dinner of global oil and gas executives — which, according to a participant list seen by Semafor, included most of the European and Gulf majors but none from the US — “I saw that now Ukraine is not number one, or even number five, on the agenda,” he said.

In this article:

Tim’s view

In the stop-and-start peace talks between Ukraine, Russia, and the US, Moscow has repeatedly dangled its oil and gas reserves as an enticement to the US to accept its version of an acceptable deal. That strategy was undercut by the US intervention in Venezuela, which gave US oil and gas companies plenty of risk and opportunity — Venezuela has the world’s largest stated crude reserves — to chew over without packing their bags for Siberia. And in the meantime, talks between Kyiv and the White House have continued to move slowly forward on what could be a more practical and lucrative opportunity for US exporters: Selling more LNG to Ukraine. But that effort faces some major unresolved headwinds.

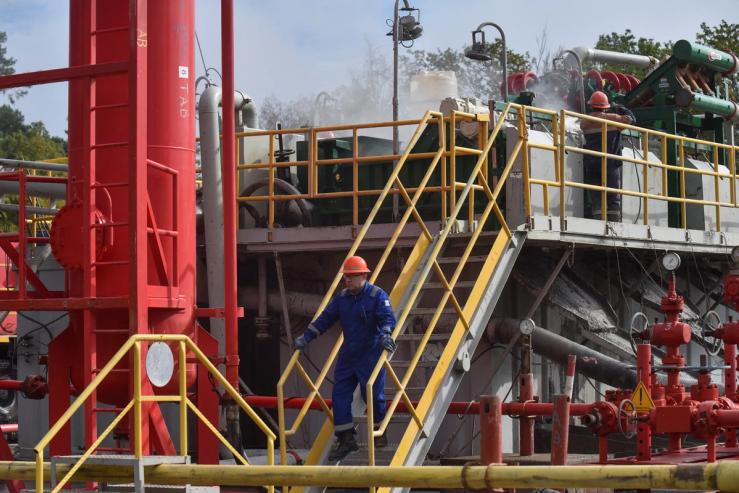

Koretskyi said that as more than half of Ukraine’s domestic gas production capacity was smashed by drones and rockets in the fall, he was able to piggyback on LNG deliveries organized via other European energy companies, including some cargoes from the US. But his goal is to sign a long-term consistent supply agreement with US exporters, which he said is close to being concluded. That would be not just a commercial victory for the US, but a geopolitical one, essentially replacing the gas trade relationship that Ukraine and Europe used to have with Russia with one controlled by the US.

There are a couple of problems. The first is money: Ukraine is short by at least $100 million for its anticipated gas import needs in the coming year, according to Economy Minister Oleksii Sobolev, a subset of the estimated $60 billion the country needs to rebuild its energy system. European development banks and other financial institutions have stepped up with billions of dollars in energy assistance since the full-scale invasion started, but US energy assistance has stalled. Negotiations are dragging on between Naftogaz and other Ukrainian companies and US institutions like the Export-Import Bank and the Development Finance Corporation. Another is logistics: Delivering LNG to Ukraine currently requires a convoluted and expensive series of transfers from ports in Greece or Poland. Talks are underway between the US and Ukrainian officials for a potential new LNG terminal on the Black Sea, but it would require the approval of Turkey for tankers to pass through the Bosphorus, which many experts view as a nonstarter, as well as additional security guarantees to prevent Russian attacks on those ships.

The first step is for the Trump administration to finally decide how to spend about $250 million in emergency energy assistance funding that is already available, said Geoff Pyatt, a former senior energy official in the US State Department. “If we don’t get the emergency support right,” Pyatt said, “we won’t have the opportunity to build the longer-term commercial partnerships we want to achieve.”

Know More

Where the US may be falling short, private Ukrainian investors are stepping in to fill some of the gap for the energy sector. On Tuesday Horizon Capital, the country’s largest private equity firm, said it raised $150 million for a new fund to focus on infrastructure projects, predominantly in the energy sector, and that the fund’s first project will be a new 124-megawatt wind power plant in southern Ukraine. “We’re not waiting for the war to end,” the firm’s CEO Lenna Koszarny told Semafor. “We’re looking for those who want to put a stake in the ground now.”

Notable

- Energy ministers from Northern Europe will meet later this month with NATO Secretary-General Mark Rutte. Among the topics of discussion will be a proposal to divert a portion of European defense spending to new offshore wind projects.