The News

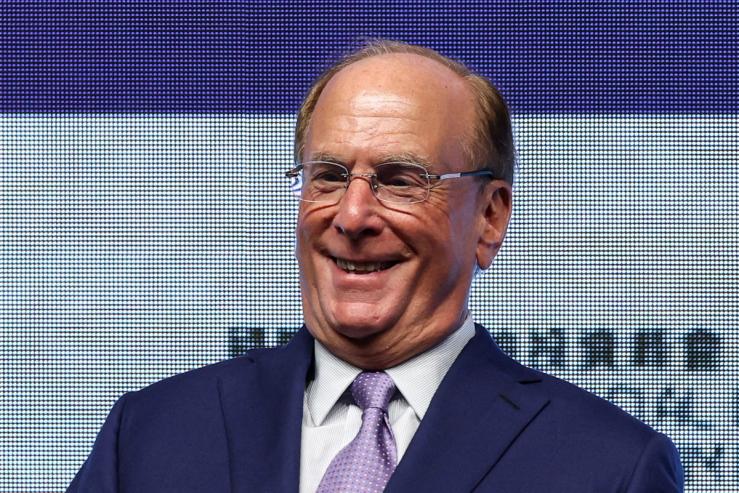

The World Economic Forum has become a cloistered and self-congratulatory body out of touch with economic realities, its new leader, BlackRock CEO Larry Fink said on the opening evening of the 2026 conference.

“For many people, this meeting feels out of step with the moment: elites in an age of populism, an established institution in an era of deep institutional distrust,” he said. “And there’s truth in that critique.

“If WEF is going to be useful going forward, it has to regain that trust,” he said. He hinted that the forum, which holds occasional offshoots in China and the Middle East, will add new events “in the places where the modern world is actually built,” naming Detroit, Dublin, Jakarta, and Buenos Aires.

Fink, who runs the world’s largest money manager, took over the World Economic Forum last year after its founder and longtime frontman, Klaus Schwab, stepped down following an internal investigation into his spending and workplace behavior.

It’s “obvious that the world now places far less trust in us to help shape what comes next,” he said, but noted that he wouldn’t be leading the forum if he didn’t believe in it.

Despite this year’s record attendance of 850 CEOs and 65 heads of state, Davos faces a growing perception as an echo chamber for elites whose global standing has waned, seen as both unpopular and toothless. The 20th century multilateralism that Davos advanced is crumbling under US President Donald Trump, who is set to arrive Wednesday, bringing his brand of populism and militarism. “Mini-lateralism” is quickly emerging as the buzzword of the week here in the Alps.

Know More

Fink’s strongest criticism of Davos past is that it mistook big-picture growth for lived reality — a mismatch that has toppled governments around the world over the past two years. Income inequality soared, and much of that wealth was created in financial markets unavailable to the masses.

“Now AI threatens to replay the same pattern,” he said, adding that the technology threatens to put millions of people out of work as its gains flow “to the owners of models, data, and infrastructure.” (It’s worth noting that BlackRock is a major infrastructure investor that has aggressively backed AI data centers.)